It’s not uncommon for financial concerns to weigh on people’s minds, and a recent study by Capital One reinforces just how prevalent these worries are.

The study found that over three in four (77%) Americans are worried about their finances and the lack of savings in their bank accounts.

This can be attributed to a variety of factors – from rising living costs to unexpected expenses – and it’s a reminder of the importance of financial planning and budgeting.

However, with the right strategies and tools, it’s possible to alleviate some of these concerns and take control of your financial future.

So if you’re an average joe and are wondering how to double 10k quickly then you’re in luck!

In this post, I’ll explore some of the most effective methods for achieving this goal, from high-risk high-reward investments to more conservative approaches – and everything in between.

Let’s dive in.

Contents

- How to Double $10k Quickly- 10 Different Ways to Potentially Double Your Savings

- Create an AI SaaS Business

- Invest In Blue Chip Art

- Flip Items For Cash

- Find A Side Hustle

- Build Your Own Business Online

- Get Into ETFs, Swing Trading, And Stock Market Investments

- Buy And Sell Domains For A Profit

- Find Profitable Real Estate Investments Using PeerStreet

- Give Out P2P Loans

- Make Money With Initial Public Offerings

How to Double $10k Quickly- 10 Different Ways to Potentially Double Your Savings

Lets be honest – saving $10k is no easy feat. But, if you have $10,000 and are looking for ways to quickly double your money, there are several methods to generate extra income that you can consider.

Here are 10 of tried and tested methods to help you achieve this goal:

Create an AI SaaS Business

Creating an AI SaaS business can be a lucrative and rewarding endeavor – especially now as the cost of building custom AI solutions is becoming much more affordable.

According to the experts at WebFX, a simple AI tool can cost anywhere from $6,000 to $300,000 depending on your scope and budget – and $0 if you have the technical know-how and are able to do everything yourself.

But – like any business – it also requires careful planning, research, and execution.

Here’s a story of one Reddit user who decided to make an AI excel formula help bot – excelformulabot.com – in his spare time (with a small investment) to help boost his productivity on excel at work.

And it’s safe to say, they’ve made more than double their investment considering even Google has officially launched the excel formula bot add-on on their Sheets platform.

This is a strong example of how an AI SaaS business can be created to solve a specific problem or address a particular need.

Character.AI is another great example of an AI SaaS business that leverages machine learning technology to solve a specific problem.

Character.AI is a platform that allows game developers to create non-player characters (NPCs) with human-like behavior and personality.

- By using machine learning algorithms, Character.AI’s platform can create NPCs that can interact with players in a more natural and engaging way, enhancing the overall gaming experience.

- This is a great example of how AI technology can be used to create more immersive and realistic gaming environments and quest dialogues.

- Plus, Character.AI’s platform is also scalable, allowing game developers to create NPCs dialogues for games of any size and complexity.

This is a key advantage for game developers who need to create large numbers of NPCs quickly and efficiently, something that wouldn’t be possible with traditional manual methods.

All-in-all, building a successful AI SaaS business requires a combination of:

- Technical expertise

- Business acumen

- A deep understanding of customer needs and pain points

However, since it’s an industry that is set to surpass $300 billion in 2026, it’s definitely one that’s going to pay dividends going forward and can easily help double your initial 10k quickly.

Take the success stories of hot AI SaaS companies like Scribie, Choicely, and PropertyData for example. They’re all highly ranked and make as much as $14.4 million per year.

Top Tip: If you’re looking to see if there’s an opportunity or gap in the AI SaaS market you can create an AI SaaS product for, consider searching on FutureTools.com.

The platform offers a database of emerging technologies and startups – as well as market research and analysis on various industries and technologies.

Invest In Blue Chip Art

In the art market, blue chip art typically refers to pieces by well-established artists that have the recognition, name, and sales to prove their worth.

And it comes as no surprise that investing in such valuable pieces of art has always been a safe and profitable investment.

In fact, according to CNBC, investing in blue chip art has shown to be just as profitable as other investment opportunities like bonds, if not more in terms of long-term returns.

Here are a few other reasons why investing in blue-chip art is always a great idea – and how it can help you double 10k quickly:

- Investing in blue-chip art can be a great way to diversify your investment portfolio, especially if you’re passionate about art.

- Art is an investment with the potential for lucrative returns on investment. In fact, blue chip art has beaten the S&P records by over 250% in the market.

- It’s also a stable and reliable investment. For instance – the Mei Moses World All Art Index, which tracks the value of blue-chip art, has compounded an annual return of 5.3% vs the 8.3% of the S&P 500 in the last two decades.

- Art is a tangible asset that you can physically own or buy shares of – which makes it a solid investment compared to other alternatives like cryptocurrency and NFTs.

- New platforms like Masterworks make it super easy and convenient to invest in shares of blue-chip art pieces from famous artists like Banksy, Picasso, and Basquiat.

- Artworks have a historical significance which makes them highly valued by museums and collectors alike.

Flip Items For Cash

Flipping items for cash can be a great way to double $10k quickly – and it’s one of my favorite methods here.

Just look at how this 26-year-old med school student was able to buy a house by flipping thrift store clothes online.

If you’re looking to do something similar or double your 10k, here are some tips to get started:

- Identify profitable items: Look for items that are in high demand and can be purchased for a low price. This may include items like clothing, electronics, furniture, memorabilia or other collectibles, and even domain names.

- Source items: Once you’ve identified profitable items, look for sources where you can purchase them at a low price. This may include thrift stores, garage sales, online marketplaces, or clearance sections of retail stores.

- Set competitive prices: Do some research to see what similar items are selling for, and price your items competitively to attract buyers.

- Advertise your items: List your items for sale on online marketplaces like eBay, Craigslist, Facebook Marketplace, or apps like Poshmark. Make sure to include clear photos and detailed descriptions of the items.

- Build a brand: As you start to build a following of buyers, consider creating a brand or social media presence to showcase your items and build a loyal customer base.

Top Tip: Look at retail arbitrage flipping masters like The Book Flipper and the Flea Market Flippers to inspire you to get started today.

Find A Side Hustle

Arguably, the best and safest way to make some residual income and double your savings outside of your regular job is by having a side hustle.

This is why more than 45% of U.S. workers actually had a side hustle on the side in 2022. But I know that finding the right one can be a bit of a challenge, so here are some examples to get you inspired:

- Become a mock online juror: Becoming a mock online juror can be an interesting side gig for those interested in the legal system. Mock jurors are used by lawyers to provide feedback on the strengths and weaknesses of their case before they go to trial. Try visiting websites like eJury and OnlineVerdict and sign up to be a mock juror on their platform. You can expect to get paid anywhere from $20-60 when getting started.

- E-commerce: Start an online e-commerce business that specializes in a specific niche. With over 218 million US consumers estimated to shop online in 2023, it’s definitely something you should capitalize on.

- Affiliate marketing: Promoting and selling products using an affiliate link for a commission on each sale isn’t something new, but it is relatively easy to implement. The market has an estimated value of $17 billion as of today.

Read about Jared Bauman’s $9,000 per month success for some incentive to try this side of entrepreneurship.

And consider taking Chase Reiner’s ChatGPT Short Form Riches course, which is designed to help you earn money online through affiliate marketing by utilizing advanced artificial intelligence tools.

- Delivery driver: Services like Uber Eats, DoorDash, and Instacart offer opportunities to earn money by delivering food and groceries.

- Offer online services: If you have a marketable skill, such as copywriting, and graphic design, consider offering your services as a freelancer through well-known platforms like Fiverr and Upwork.

- Sell DIY products: If you’re DIY savvy, consider starting an online business by selling handmade products such as pottery, jewelry, and clothing. DIY items usually sell with a large profit margin since they are handmade with low overall material and startup costs.

- Sell digital products: Sell digital products such as courses and stock photos online.

- E-commerce coaching: If you’ve already handled your fair share of online businesses, you can also offer your expertise in e-commerce and help others start their own online businesses by coaching other up-and-coming entrepreneurs.

- Rent out a spare room: If you have a spare room in your home, consider renting it out on a platform like AirBnB.

Additionally: look at these unusual but successful side hustles to double your $10k quickly:

- Earn over $3,000 a month from deleting Tweets? Yes – it’s possible.

- Use Chat GPT to help you build a successful app. This Twitter thread is pretty crazy and shows you the power of this AI tool.

And this is a big AI side hustle to try – especially if you have a passion for new technology:

Consider building a Chat GPT course and selling it on Udemy.

It’s an exploding market right now with over 570 course so far (and a lot more by the time I publish this).

Top Tip: Don’t see what you’d like to pursue as a side business? The Ebiz website has tons of side hustle ideas that have a high potential for success, consider browsing it to see if anything piques your interest and inspires you.

Build Your Own Business Online

If you play your cards right, building your own business online can be a lucrative side hustle or even a full-time gig!

Here are some reasons why having an online business is such a good idea:

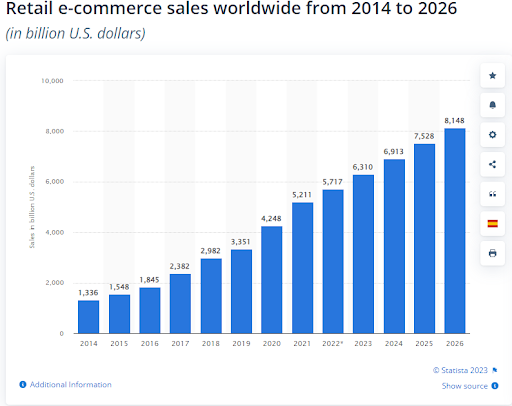

- In 2021 e-commerce sales reached north of $5.2 trillion dollars and the market is expected to grow a whopping 56% over the next few years.

- An online business allows for greater flexibility and scalability, as you can work from anywhere with minimal overhead costs.

- An online business can also help you reach a global audience and let you explore international markets.

- With the rise of social media and digital marketing, it’s easier than ever to promote your business and reach potential customers. You can leverage platforms like Facebook, Instagram, and TikTok to build brand awareness and drive traffic to your website.

- Starting an online business allows you to pursue your passion and turn it into a profitable venture. Whether it’s blogging, creating digital products, or offering services, you can build a business around what you love and make a living doing it

Get Into ETFs, Swing Trading, And Stock Market Investments

Exchange-traded funds (ETFs), swing trading, and traditional stock market investments are all ways to invest in the financial markets – and to double $10k quickly.

- An ETF is a type of investment fund that comes with shares that are tradeable on a stock exchange.

- ETFs track a basket of assets such as bonds and stocks like an index fund.

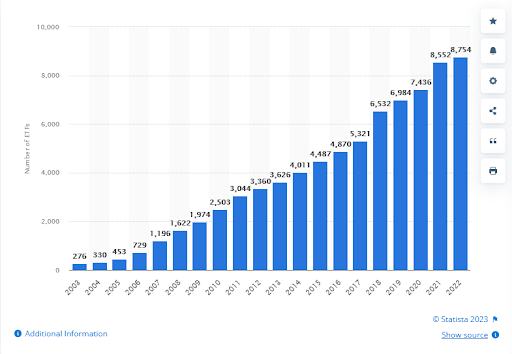

- They offer a diversified way to invest in a specific market or sector and the number of ETFs has grown immensely during the last 20 years.

According to Statista, investors can now choose from more than 8,754 ETFs while there were only a limited 276 options in 2003.

The advantages of ETFs include:

- Diversification: ETFs allow you to invest in a variety of assets with a single trade, which can help spread out your risk.

- Low fees: ETFs typically have lower fees than mutual funds, which can help you keep more of your investment returns.

- Transparency: ETFs disclose their holdings daily, so you know exactly what you are investing in.

Swing trading is a rather short-term strategy compared to stock market investment in which an investor usually holds a position for a few days or weeks, in order to profit from price swings and fluctuations. Swing traders benefit from both up and down price movements.

Some perks of swing trading include:

- Flexibility: Swing trading allows you to take advantage of short-term market trends without committing to long-term investment.

- Potentially lower risk: Because swing trades are short-term, you are exposed to less risk than if you were to hold a stock for a long period of time and can even use stop-loss orders to limit losses.

- Chances for high returns: If you are able to time your trades correctly, swing trading can potentially generate high returns.

On the other hand, investing in the stock market involves buying and holding stocks for longer periods of time. The aim is to benefit from the stocks in the long run as the company’s stock price increases.

The advantages of traditional stock market investments include:

- Potential for high returns with low risk: If you are able to pick the right assets, stock market investments can potentially generate high returns and are a stable means of income. Especially if you invest in stable and high-performing stocks like Apple, Johnson & Johnson, and Coca-Cola.

- Long-term growth and passive income: By holding stocks over a long period of time, you can benefit from the company’s growth and potentially generate significant wealth.

- Diversification: By investing in a variety of stocks, you can spread out your risk and protect your portfolio from market downturns.

Just remember, before investing in any of these options, it’s important to do your research, understand the risks and potential rewards, and make sure you have a solid investment strategy in place.

Top Tip: If you’re new to stock market trading and want to minimize your risk. Then consider investing in stable “blue chip” assets like these blue chip stocks. Just make sure to consult with a financial professional before putting all your eggs in one basket.

Buy And Sell Domains For A Profit

Since the advent of the internet, domain names have been bought and sold for ludicrous amounts of money as a commodity online.

For instance, in 2019 the Voice.com domain name was sold for a whopping $30 million – one of the most expensive domain purchases of all time.

The best part about this unique investment opportunity is that anyone can get into buying and selling domain names for a profit.

Sean Markey is a great example of someone who has successfully mastered the art of buying expired domain names and selling them to make a decent amount of money online.

He has also launched an online marketplace where you can buy and sell domains if you’re looking to get started. Sean was bought out by market giant ODYS in September 2022 – so his expertise certainly paid off.

And – if you want to add more value and increase your potential earnings – building up and flipping websites is also another thing you can consider:

Flip Websites: Buy and Sell Websites

Flipping websites refers to the buying, improving, and selling of websites for a profit. Typically the underlying website’s design, traffic, and content are improved and then they are sold to buyers who are looking to expand their businesses.

Here’s why you should consider flipping websites to double $10k quickly:

- It’s a great way to make money online. For example, Rob Boirun made $178,000 from selling a website he bought for $52,000 last year by boosting its SEO ranking.

- It helps you learn new and valuable skills such as content creation, marketing, and website UI design.

- Low investment and start-up costs.

- Monetizing the website or making it your own can be an additional source of income.

Mushfiq Sarker is the prime example of someone who has found great success at flipping websites as a side hustle.

After profiting from and selling over 180 websites, the flipping genius has formulated a database of things that need to be looked at before purchasing a website. His website “The Website Flip” allows users to buy, sell, and grow my websites on the platform.

Just remember Mushfiq’s 5-step process for website flipping success:

- Acquire

- Stabilize

- Grow

- Optimize

- Exit

Top Tip: To make sure you bag a potentially profitable domain name, try looking for expired or expiring domain names that are still valuable. Use tools like GoDaddy Auctions or expireddomains.net to find domain names that are set to expire or have already expired but still have a high search volume, backlinks, or other valuable factors.

Find Profitable Real Estate Investments Using PeerStreet

Getting into real estate is perhaps the most common popular and tried-and-tested form of investment out there. Unfortunately, buying a physical property with just $10,000 in hand is nigh impossible in today’s economy.

However, there are several options to invest in real estate to double your hard earned $10k quickly:

- Real Estate Investment Trusts (REITs)

- Real Estate Crowdfunding:

- Real Estate ETFs

Additionally, you can also choose to invest in platforms like PeerStreet which allows people to invest in high-quality real estate loans.

Here’s how it works:

- PeerStreet partners with top-tier private lenders who specialize in financing high-quality real estate loans. These lenders originate loans and then offer them to PeerStreet investors to invest in.

- As an investor on the platform, you can browse through a variety of loan offerings and choose the ones that match your investment criteria.

- You can then choose to invest in a portion of a loan and receive monthly interest payments, or you can invest in the entire loan and receive the full amount of interest.

One of the advantages of investing with PeerStreet is that the platform performs extensive due diligence on each loan offer, which includes an analysis of the property, borrower, investor, and loan terms.

This can give investors more confidence in their investment decisions as well as save borrowers from unfairly high interest debt ratest.

Give Out P2P Loans

Peer-to-peer loans are a type of lending that happens between individuals instead of financial institutions such as banks.

They can be a great good way to double $10k quickly as an investor, as the interest rates offered to investors are typically higher than those offered by traditional savings accounts like CIT Bank savings accounts or bonds.

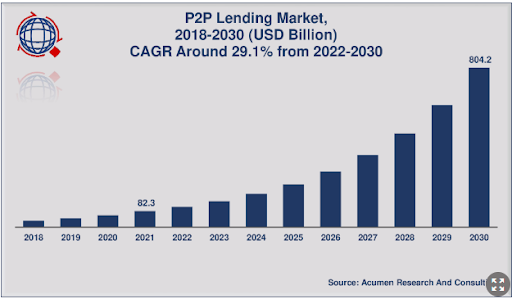

Plus, the P2P lending market seems to be on a stable upward trajectory and is estimated to cross $804.2 billion by 2030.

- Some popular P2P lending platforms include LendingClub, Prosper, and Upstart.

- These lending platforms bring together borrowers who are looking for loans and investors who are willing to give loans.

- They do this by letting investors browse loan listings and choose which loans to invest in based on factors such as the interest rate, duration, and the borrower’s credit score/loan purpose.

However, P2P lending does come with its share of risks, such as the possibility of borrower default, so it’s important to thoroughly research and understand the risks before investing.

Make Money With Initial Public Offerings

Making money with Initial Public Offerings (IPOs) involves investing in companies that are going public for the first time. IPOs can be a lucrative investment opportunity, but they can also be high-risk.

However, with most forms of investments, it has its advantages and disadvantages so be sure to think it through before considering it to double $10k quickly:

Advantages:

- Potential for high returns: Investing in an IPO can offer the potential for high returns if the company does well after going public.

- Access to early-stage companies: IPOs give investors the opportunity to invest in early-stage companies that may not be available on the stock market yet.

- Pre-market discounts: Some IPOs offer discounts to pre-market investors, which can lead to potential gains if the stock price increases after it goes public.

Disadvantages:

- High risk: Investing in IPOs can be risky as there is often little information available about the company’s financial long-term prospects.

- Volatility: Newly public companies can experience volatility in their stock prices, which can result in significant losses for investors.

- Limited availability: IPOs are typically only available to institutional investors or high-net-worth individuals, so they may not be accessible to all investors.

Key Takeaways:

- A recent study by Capital One found that over three in four Americans (77%) are worried about their finances and the lack of savings in their bank accounts, highlighting the importance of financial planning and budgeting.

- There are many different methods that people can consider to quickly double their money, including creating an AI SaaS business, investing in blue chip art, flipping items for cash, investing in stocks, trading cryptocurrencies, investing in real estate, buying and holding bonds, investing in peer-to-peer lending, investing in dividend stocks, and becoming a YouTube content creator.

- Building a successful AI SaaS business requires technical expertise, business acumen – and a deep understanding of customer needs and pain points, but it’s a profitable industry set to surpass $300 billion in 2026.

- Investing in blue-chip art can be a great way to diversify your investment portfolio and has beaten the S&P records by over 250% in the market.

- Real estate, starting a business, and investing in dividend-paying stocks are some other potential ways to save more money.

- You should also consider: website flipping, buying and selling domain names at a profit, IPOs, and using PeerStreet for real estate investments.

- Embrace AI technology like Chat GPT and learn how to make money from it.

If you’re looking to double your $10k savings quickly, there are many strategies you can employ.

It’s essential to: keep in mind that these options come with different levels of risk, to do your research and consider your unique circumstances before making any investments.

With the right tools, knowledge, and strategies, it’s possible to take control of your financial future, alleviate some of the worries associated with financial concerns and double your hard earned $10k quickly.

Now that you’ve strong tips to double $10k quickly, consider reading How to Save $20,000 in a Year [Chart Included] next and best of luck!