I want to share with you the secret to my budgeting success. It’s less of a tool or trick and more of a framework that will help you make budgeting decisions- a way to approach budgeting that will get you the most results with little effort. This return on effort (ROE) trick will help you make some significant budgeting wins.

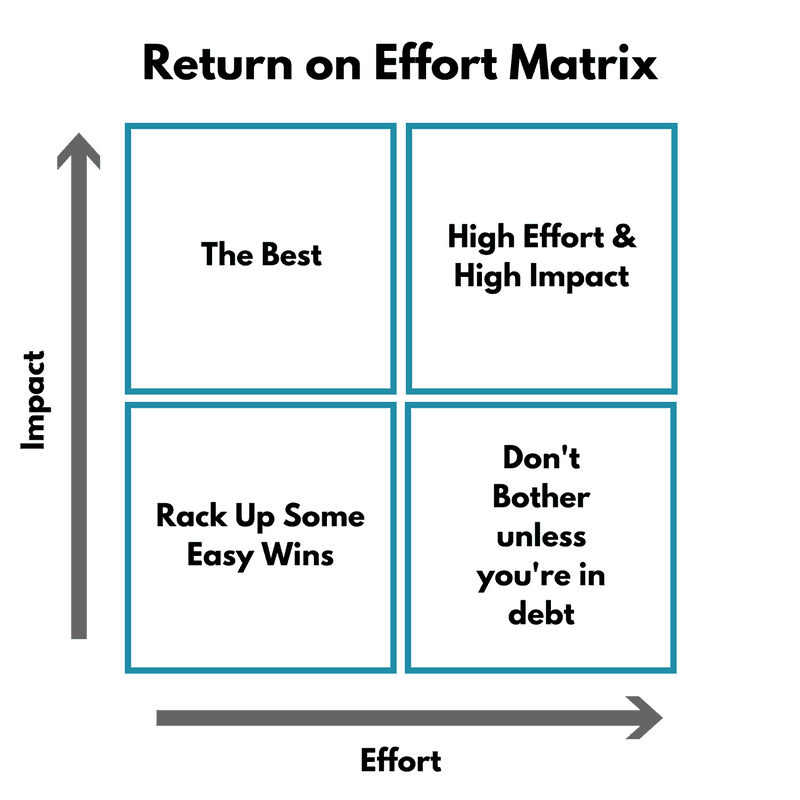

Introducing the Return on Effort Matrix

This return on effort matrix is simple. The return on effort matrix can reduce your monthly/yearly expenses in hundreds of ways. If you want to budget smarter, you just need to make decisions that will get you more bang for your buck.

The most significant consideration in the return on effort framework is your income.

If you make $100,000 a year, paying $9 a month for Netflix and buying coffee a couple of times a week from a local coffee shop won’t break the bank. For the effort to be worth it for higher income earners, either the impact will need to be higher, or the effort they put in would be less.

Those with lower income or debt to their name should have a lower return on effort threshold for “what is worth the effort.”

Don’t get me wrong. People who live on a higher income should still avoid letting their lifestyle creep up with their income. They can afford a few more small luxuries than the rest. At the end of the day, inflation should be fought with.

The Four Zones

Low Effort – High Impact

This is obviously the return on effort sweet spot. Doing less work and getting more results! Wouldn’t it be nice if every budget cut made was easy and greatly impacted the ability to save more money?

If you want to save money without trying, you definitely need to max out these easy wins. I’d also be willing to say that if you aren’t willing to put in the effort for these easy changes, you don’t care about saving money.

The things in my life that have had a significant return on effort usually fall into one of two categories:

1. Budget cuts that have a recurring benefit

These are one-time changes that can kick back savings month after month. They usually either require you to cancel a recurring expense entirely or to find a way to lower them.

- Cut your phone bill in half by switching to Republic Wireless, Project FI, or Mint Sim

- Cancel cable and save $125 a month

- Save money on insurance by qualifying for discounts

- Negotiate your bills

- Negotiating all of your current bills is a great way to save a few extra bucks every month. It may surprise you, but nearly every bill you pay can be lowered.

- If you don’t want to do this yourself, get the experts at Billcutterz to do it for you. It is entirely free to sign up! They negotiate your bills for you to save as much money as possible. The only catch is that they split the savings with you 50/50. The significant part is they only make money IF they can save you money. You’ve got nothing to lose.

2. Small frequent return on effort wins that add up

No question that saving small amounts of money daily can add up quickly, especially in daily habits and expenses. I’ve started selling old furniture and have seen the power of small victories.

- Bringing your own lunch: $8 daily savings

- Making your own coffee in the morning: $4 daily savings

- Cut your own hair and save $25 every 4-6 weeks.

I want to share two more return-on-effort changes that can make a substantial long-term impact on your saving ability that don’t take much effort upfront.

- Move your investments into a fund with a lower expense ratio, increase return on investment and save $400,000. Check out the guide on this!

- Put your emergency fund into a higher interest-earning bank like Ally and earn 125 times as much as most major banks.

Another tremendous easy win is using cashback apps like ibotta, Rakuten, and Swagbucks! I’ve written a super thorough ibotta review that will help you save money on groceries and other shopping!

High Effort – High Impact

While sticking to a budget isn’t always easy, it should at least be worth it. This quadrant is where you can save serious money. It won’t be easy. It may require a sacrifice in your lifestyle or some week-to-week discipline.

These tend to focus on the three significant areas of spending: Housing, Transportation, and Food. Limit your spending in these 3 categories, and you will be on the fast track to your financial goals.

Housing

- Live in a smaller apartment or house

- Get a roommate

- House hack

- When buying a house, put 20% down to avoid PMI

Transportation

- Buy used to avoid significant depreciation

- Ride a bike and save money on gas, insurance, and vehicle maintenance

Food

- Meal Prepping can save you $215,000 over the next 30 years

- Become a couponing champion

Low Effort – Low Impact

The budget cuts that fall into this category obviously won’t save you a ton of money, but fortunately, they can be easy life adjustments that don’t take much effort on your part. These have a pretty low return on effort. Hopefully, you can find some that you can weave into your life without thinking about.

- Slow down your driving. Driving over 65mph increases your gas usage by 15%.

- Use Amazon’s Subscribe and Save function to save a little money on your regular spending. This will save you anywhere from 5-20% time, gas money, and stress.

- Avoid buying bottled water and instead use a refillable bottle.

- When you eat out at restaurants, find places with discounts that apply to you! This is great for teachers, veterans, students, kids, the elderly, and first responders.

- Raise/lower your thermostat by 3 degrees in Summer/Winter months

- Google for promo codes or discounts before you buy anything

High Effort – Low Impact

Sometimes the time and effort required to save a few bucks isn’t worth it. This is obviously the least optimal of the 4 quadrants. If you spend a lot of time trying to save money on things that barely reduce your expenses, you might be better off going for a walk or getting extra sleep.

I wouldn’t even bother with things that fall into this category unless you are in severe debt or actually enjoy it and see it as a hobby!

- Buying cheap beer. It just isn’t worth it.

- Making your yogurt and cheese. A few weeks back, I read a blog post detailing one lady’s process of making her yogurt. It was tedious to read, and I can’t imagine spending hours trying to save 10-15 cents a serving. I’d instead take a nap.

- Planting your garden. While this might catch me some flak, yet unless you are serious about it, you probably won’t save much money. If you enjoy gardening, then treat it as a fun hobby!

Related Questions

Is There a Difference Between Impact and Effort?

The value of your solution is based on the impact it will have on your problem. Effort refers to how many hours it will take to solve a problem and its feasibility.

What Is Your Method for Categorizing Effort Levels?

Prioritizing a task may require more effort to accomplish. A helpful method for estimating effort is to sort tasks into predetermined categories, such as low, low-mid, mid, high, and highest priority.

What Is the Best Way to Create a Matrix of Effort Impact?

Draw a diagram and divide it into four quadrants using the horizontal axis to represent the effort required to implement the solution and the vertical axis to represent the solution’s impact. Use this diagram to evaluate the effort and impact of each solution.

Wrapping up

At the end of the day, budgeting is not easy, and it might be painful. But if you want to be able to save for retirement, buy a house, or pay off your debt, then you have to do it. You’ll have to put in the effort. Hopefully, you can now maximize the impact your decisions will have.

Focus on the activities and budget cuts that are the main drivers for financial success and will get you the most return on effort.

This was very clever. The tips will definitely take discipline as long as we are looking at the bigger picture and staying focused. Love this information. Pinned it!

Thanks Anissa! Glad you found it useful.

Like the matrix. So simple, but effective with budget decisions.

Thanks Jumpstart! Glad you enjoyed it.