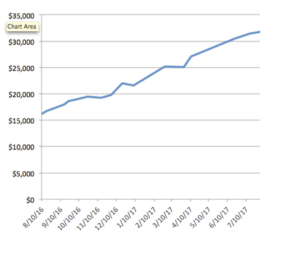

For the past couple of years I’ve been casually using excel to keep track of my finances. A couple of months ago, I realized that I had doubled my savings in just one year.

8/10/2016: $16,178

8/1/2017: $31,178

Over the course of just 12 months, I managed to increase my savings by 96%!

As I mentioned in my introduction post, my first year of marriage was a financial failure. I saved a whopping $4,500 which ended up being less than 6% of my combined income. Heading into my second year of marriage, I was determined to make some changes.

Today on the blog, I want to take a more personal approach to share how I doubled my savings in just one year.

Contents

How I Doubled My Savings

I Lowered My Expenses

The first thing I had to do was get my spending under control. I thought I had been living frugally and not spending much, but when it came time to look at my credit card statement, the truth was staring me in the face. I was overspending all over the place.

This isn’t an exhaustive list of all the ways I cut and trim to save money, but these are a couple of the steps I took to lower my spending this past year.

Downsized my living space

When I got married I was living in a 1250 sq. ft. two bedroom, 1.5 bath townhome with a back patio, six closets and two parking spots. I had more space than I knew what to do with, but it came at a cost. My monthly rent was $1200. The first choice I made was to downsize to a one bedroom.

Thankfully I was able to find a steal of a townhome that is running me $725 per month. This is $475 less a month than I was spending and is $400 below the average rent price for 1 bedrooms in Houston.

It is a huge sacrifice for me comfort wise, but I know that it will pay off.

I desperately wish I had more space, but the money that I was saving on rent, utilities, and a closer commute all together add up to a whopping $600 a month.

Yearly Savings: $7200

Slashed My Restaurant Spending

Like most people, I love to eat out for any and every occasion. My birthday? Let’s get dinner. Friend’s birthday? Let’s get drinks. Saturday morning? Time for brunch. Sunday after church? Lunch with friends.

While I wasn’t doing all of those all the time, my monthly restaurant spending was over $300! When I first sat down to total it all up, I couldn’t believe it. My eating out budget for this past year has been $150. Is this still too much? Definitely. But it’s a start in the right direction.

Check out my recent post, How meal prepping can save you $215,000

Yearly Savings: $1800

Total: $9000

Increased My Income

For both the first and second year of my marriage, I had the exact same income. I started my first year of marriage with a combined salary of $80,000 but I found myself unemployed for several months and my income ended up at $60,500 for the first year of my marriage. While unemployed I sought out the opportunity to start grad school, seminary, and shortly after began working part time. My wife had gotten a small, cost of living raise.

Me: $18,000

Wife: $42,500

My combined salaries ended up being exactly equal to the total income I brought in that first year, $60,500.

Babysitting

You’d be surprised just how many people you know are searching high and low for babysitters they know and trust. I started out babysitting for just one family and my sister and over the year had several families calling me regularly. I ended up bringing in more than $400 for the year, but that’s how much made it into my savings account.

If you want to get started, make a simple post on Facebook or Instagram advertising that you are looking for ways to make a bit of extra money and are offering your services to babysit.

SeekingAlpha

SeekingAlpha is a contributor style platform where authors can write and publish article covering individual stocks, investment strategies, etc. Contributors earn a base pay of $35 per article plus $0.01 per page view. Over the past few months I’ve written three posts and have earned around $280.

Investment Gains

The investment gains below were largely due to some stock picks that have done exceptionally well: Apple, Johnson & Johnson, Shopify, and Hannon Armstrong Corporation are a few of my high-flyers from this past year that have each gone up over 30%.

Fidelity Account +24.5%

Roth IRA +20%

Trading Account: +19.5%

Clearly, I choose to invest actively rather than passively. But I am beginning to transition away from stock picking to index funds.

My Plan for the Rest of 2017

Now here’s the shocking fact. I truly did most of this without following a set budget. Like most people, I put one together but then I never stuck to it. My wife and I both got substantial raises of $4000 and $6000 respectively for the 2017-2018 year.

Not to mention, this past July I inked a side gig of doing Social Media Marketing and SEO for a local small business. I have the opportunity to work anywhere from 5-15 hours a week making $25 an hour. I hope to average 5 hours a week, giving me extra $500 per month of pre-tax income.

My combined income for the next year is $76,000, giving me a $16,500 salary bump year over year. I’ve got out FI train on the tracks and now I am adding fuel to the engine!

As I look towards the rest of this year, I have a few bucket list items to cross off.

- Car Loan Pay-Down: An extra $1000 each month. $8,200 remaining on the loan.

- Contribute to my wife’s 403B in TIAA to get the school’s 4% match

- Max my 2017 Roth IRA

- Open and max my wife’s Traditional IRA through Vanguard

I am making more, saving more, and giving more than I ever have. I recognize that God has blessed me tremendously over this past year and I plan to continue giving 10% of my post-tax income, before pre-tax contributions to the church where I am employed. I am also supporting a close friend as he goes on mission overseas to the Middle East.

I hope this small snapshot into my life can give you some motivation and practical steps to take in your own financial journey!

What steps are you taking in your finances to make the most of the rest of 2017?