I know that saving money can sometimes feel like fighting an uphill battle against soaring living costs, inflation, and life’s uncertainties. Maybe that’s why 2 out of 3 Americans are dipping into their savings and struggling to build any at all.

But it doesn’t have to be that way!

In this post, I’ll show you how to overcome the challenges of saving money and reach your financial goal of saving $20,000 in a year with ease.

From budgeting tips to smart cost-cutting strategies, by the end of it all, you’ll be well-equipped with all the tools you need to make saving a breeze.

Plus, with my included chart, you’ll also be able to track your progress and see your savings grow right before your eyes.

So, let’s dive right in!

Contents

Saving $20,000 In a Year – Tried and True Tips

According to a report by CNBC, 63% of Americans want to save money in 2023.

This is mostly because putting a “safety net” sum aside helps in avoiding potential future financial hardship and ensuring a stable future.

So, if you’re on the same page, here are some tried and true tips to help you save $20,000 in a year:

Boost Your Income

Although 24% of Americans believe switching jobs is the best way to get a raise and boost their income, it’s risky and isn’t the only strategy there is.

So, if your 9-5 job pays you well and you like working there, I recommend sticking to it and negotiating a raise to increase your salary. What you can do, however, is add more to your income strategically.

Here are a few ways how:

Pick Up a Freelance Gig on the Side

Freelancing is a great option if you’re looking to earn outside of your day job, work on projects you’re interested in, and earn remotely.

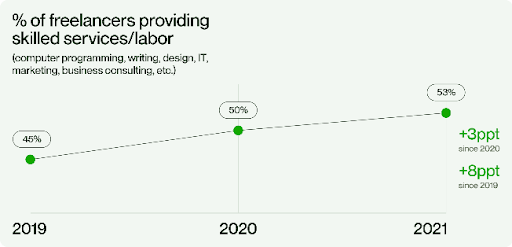

All these perks are why it’s no surprise that thousands of professionals are turning to freelance work to supplement their income.

In fact, a 2021 study conducted by Upwork, a popular freelance platform, shows that over 51% of post-graduates are switching to freelancing.

What’s more, 56% of non-freelancers are considering making the switch to freelance in the future – a number that is predicted to grow even more with the increasing popularity of the work-from-home trend.

A few side gigs you can pick to put your expertise and skills to use online include.

- Writing and Content Creation: The U.S. The Bureau of Labor Statistics (BLS) shows that the copywriting field is likely to grow by 4% by 2030. Although data shows only 15,200 job openings every year, the figure is certainly higher for freelancers because they get to work with clients from all over the globe. This career will likely add to your savings if you have decent writing skills, a creative side, and excellent communication skills.

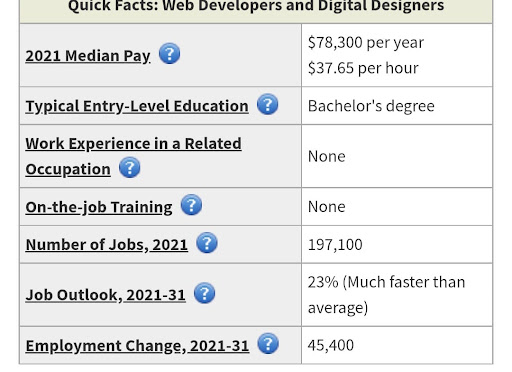

- Web Development: Another report by the Bureau of Labor Statistics depicts that the employment of web developers is anticipated to grow by 23-25% in the coming years. This gig is definitely worth it because businesses always need skilled programmers with experience in both front and back-end development.

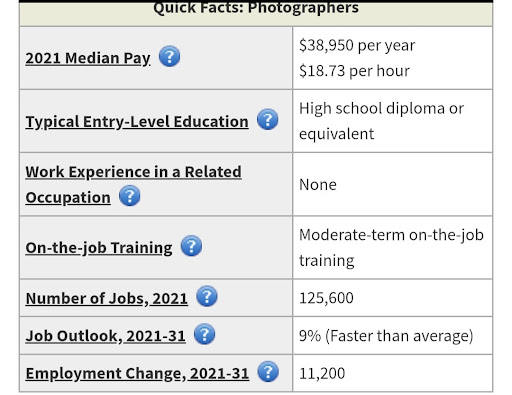

- Photography: If capturing images of people, places, and events piques your interest, you can consider taking up photography as a side hustle. The BLS data highlights that photography demand will grow by an estimated 17% in 2023. This is because more and more businesses and individuals are in need of professional photographers to capture images for their websites, social media, and other marketing materials, making it a potential stable source of money for years to come.

Rent Out a Spare Room

If you’re dubious about your skills or don’t have enough time, consider doing something less demanding of your time like renting out a spare room in your home to supplement your income.

Just make sure you keep the following things in mind before you let a stranger onto your property though:

- Legal Requirements: Before renting out a room, make sure to check your local laws and regulations regarding short-term rentals. In some areas, you may need to obtain a permit or pay taxes on the rental income.

- Screening Tenants: Screening potential tenants is an important step in ensuring the safety and security of your home. This can include background checks, references from their employer or previous landlords, and interviews.

- Insurance Coverage: Consider increasing your insurance coverage to protect yourself from any potential liability issues.

- Rent Agreement: Draft a clear and comprehensive rent agreement that outlines the terms and conditions of the rental, such as rent amount, length of stay, and responsibilities of the tenant.

- Privacy and Access: Consider the privacy and access rights of both you and your tenant. It may be helpful to establish clear boundaries, ground rules, and schedules for shared spaces and facilities. However, be willing to compromise where possible.

Companionship is more valuable than you can imagine. Good friends encourage healthy behaviors, provide validation when needed, and motivate you to fulfill your desires.

This is why sharing your money savings challenge with a trusted partner can help you meet your goal earlier by helping you stay accountable and motivated throughout the challenge.

For example:

- They may review your spending habits and provide an outside perspective that can lead to new ideas for saving money.

- Additionally, with a partner, you can also celebrate your successes together, whether it’s reaching a mini-milestone or your final savings goal.

- This can help provide encouragement to keep you both on track.

Not to mention that working together on a shared goal can also deepen your bond and strengthen your friendship!

Save on Monthly Bills

A few hundred dollars for monthly utility and transportation may seem less, but trust me, not getting on top of every dollar can significantly affect your goal of saving $20,000 in a year.

After all, roughly 25% of all Americans agree that paying for basic necessities and bills is what plunges them into credit card debts.

Here are a few handy tips for cutting down on monthly bills to counteract the debt and add the money to your savings account instead.

Downgrade Your Cell Phone Plan

If your cell phone plan is one of your major monthly expenses, it’s time to cut back. Go for a plan that better suits your usage and lifestyle.

- If you use social media only occasionally, never use up most of your data plan by the end of the month, or rarely stream movies, there’s no point in subscribing to an unlimited or high-volume expensive plan.

- Instead, opting for a cheaper plan will leave you more money in your checking account by the end of every month.

- You can then transfer the extra amount to your savings accounts and expedite your money-saving goal.

Reduce Energy Usage

Did you know you could save a lot by making a minor lifestyle change?

The U.S. Department of Energy mentions that an average household can save up to $225 on energy bills annually by switching to LED lighting.

I know that swapping out old fluorescent lighting with LEDs in your entire house may cost you initially, but it’s worth your money and they practically pay for themselves within the first year according to Box Electric.

Think of it as a long-term investment that’ll help plummet your monthly energy bills for many years to come!

Use Public Transportation

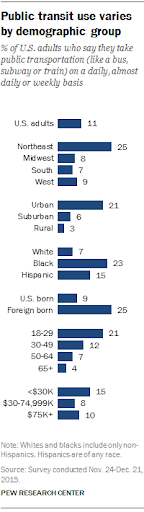

Only 1 in 10 Americans prefer using public transportation on a weekly or daily basis, according to a Pew Research Center survey.

Fortunately, now that the pandemic has faded, people now have to worry less about social distancing and can make use of cheaper travel alternatives.

So if you’re looking to save on fuel and transportation costs, using public transportation can be a good option to consider.

It can also have additional benefits such as reducing your carbon footprint and helping to reduce traffic congestion in your city while still being on the go.

Top Tip: If you’re new to using public transportation, consider using apps like Moovit, Transit, Citymapper, or MapQuest to help you plan your trip and get real-time updates on delays, directions, or changes to routes/schedules. Some of them even integrate with other modes of transport, like bike-sharing or ride-hailing services.

Invest Your Money to Make More Money

Making more money is one of the easiest ways to save money. While taking up a side hustle and renting a room works, there are also other ways to generate some passive income.

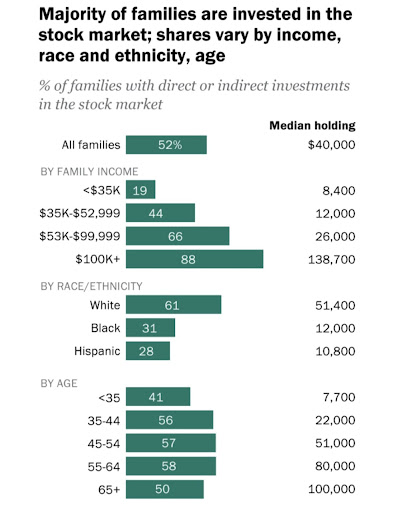

According to the Pew Research Center, even families who make less than $35,000 annually have 1 in 5 assets in the stock market. That’s primarily because people know the long-term benefits of investment.

Typically, experts recommend investing 15-25% of your post-tax income into investments.

You should, however, meet an experienced investor or financial coach to work out things with them before making a huge investment.

They might be able to assess your income and assets and come up with a suitable plan according to your specific situation.

Top Tip: Remember to keep track of your Return on Investment (ROI) to determine the performance of your investment.

Use Your Retirement Accounts

Retirement accounts are long-term savings accounts that people can utilize to increase savings while securing their retirement funds.

Here are a few ways to use your retirement accounts to save money:

- Employer-sponsored 401(k): If your employer offers a 401(k) plan or 403(b) plans, take advantage of it and make contributions regularly. Many employers will even match a portion of your contributions, which is essentially free money for your retirement savings.

- Individual Retirement Account (IRA): You can open an IRA on your own and make contributions up to the annual limit. There are two main types of IRAs: Traditional and Roth. The main difference is the timing of the tax benefits, with Traditional IRAs offering tax deductions for contributions made and Roth IRAs offering tax-free withdrawals in retirement.

- Employer-sponsored pension plan: Some employers offer a pension plan in addition to or instead of a 401(k). This type of plan promises a fixed payment in retirement based on your salary and years of service.

By using these retirement accounts, you can take advantage of the tax benefits and compound growth over time to help increase your savings for the future.

Just make sure you consult with a financial advisor to determine the best retirement savings strategy for you.

Cut Back on Discretionary Spending

A report published in CNBC shows that people spend a whopping $838 monthly on unnecessary expenditures. Now imagine how much you could end up saving annually by reducing wasteful spending.

Here are a few tips to help you limit bad money-draining habits and make reaching the target figure of $20,000 a year a lot easier:

Limit Dining Out

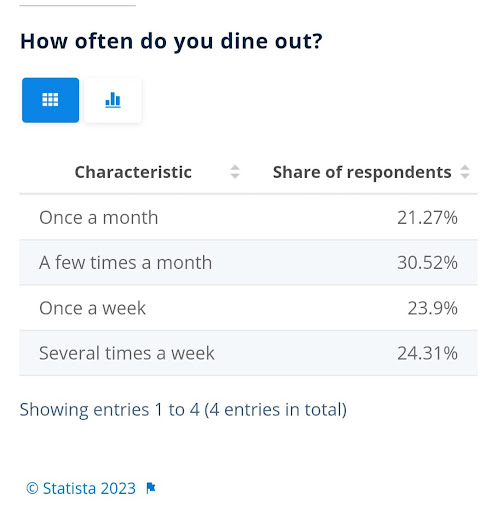

A recent survey by Statistica highlights that around 30.52% of US citizens dine out a few times a month. The same data reveals that 24.31% of Americans prefer dining out several times a week.

Another report published by CNBC unveils that an average American household spends up to $3,008 annually on dining out.

Even though eating out is convenient, it is still 4 times more expensive than preparing a meal at home.

So, if you want to get your budget in order, consider turning to home-cooked meals instead whenever possible.

Top tip: Prepare the day’s meals in advance to minimize your dine-out habits. This way, you’ll know you have your food ready, and it’ll keep you from grabbing a burger from a fast food chain on your way home.

Avoid Impulse Purchases

A recent survey shows that 73% of adults make impulse purchases. In fact, an average person spends up to $314 monthly on spontaneous purchases, according to PR Newswire Research.

Here are a few tips to avoid impulse purchases and put cash in your savings account instead.

- Shop with a trusted friend who knows about your money savings goal.

- Avoid shopping when you’re emotional. Let your emotions subside before making a purchase decision. It’ll help you calculate your needs and keep you from buying a product you don’t need.

- Restrain yourself from window shopping. It’s always tempting and might push you to buy something you don’t need.

Shop Sales and Coupons

There’s no point buying items at full cost when you can pay less!

Keep an eye on coupons and sales and make the most of them, purchase groceries in bulk as soon as they go on sale, and use cashback and discount apps like Rakuten, Ibotta, and Dosh to save every extra dollar you can.

Top Tip: Many retailers offer exclusive coupons and sale alerts to their email subscribers so be sure to sign up for your local retailer’s newsletters and keep checking on Sunday papers for any discounts you can find.

Quit Your Expensive Spending Habits

Another great way to start saving money is by challenging yourself to cut down on your most expensive habits. Initially, it may seem like a hard row to hoe, but it’s worth the effort.

Some costly habits you may be guilty of include:

- Drinking alcohol. The Bureau of Labor Statistics reports Americans spend around $435 on alcoholic beverages. The figure is a lot more than what is spent on non-alcoholic beverages.

- Smoking. 40 million US adults smoke, according to the Centers for Disease Control and Prevention (CDC). A cigarette pack costs around $10, and some people smoke a pack daily. That rounds out to about $300 monthly for smoking cigarettes.

- Tossing food. US citizens discard around 222 million tons of food. Any food you throw away is money wasted. Imagine how much you can save on your meals by planning out your meals properly.

- Getting coffee. Americans love Starbucks and specialty coffee costs around $5. Purchasing one every day will cost you $150 every month. So, consider purchasing a coffee machine instead and treat yourself to a Starbucks coffee only when you really need it.

How to Save 20000 In a Year Chart

I know that saving $20,000 in a year can seem like a daunting task, but with a well-thought-out plan and some discipline, it’s possible.

Here’s an example of a simple year-long savings chart that you should keep in handy around the house or on your phone to help you save $20,000 in a year:

| Month | Deposited Amount | Savings |

|---|---|---|

| 1 | $1,670 | $1,670 |

| 2 | $1,670 | $3,340 |

| 3 | $1,670 | $5,010 |

| 4 | $1,670 | $6,680 |

| 5 | $1,670 | $8,350 |

| 6 | $1,670 | $10,020 |

| 7 | $1,670 | $11,690 |

| 8 | $1,670 | $13,360 |

| 9 | $1,670 | $15,030 |

| 10 | $1,670 | $16,700 |

| 11 | $1,670 | $18,370 |

| 12 | $1,670 | $20,040 |

Key Takeaways

- 63% of Americans want to save money in 2023 to avoid potential financial hardship and ensure a stable future.

- To save $20,000 in a year, you need to boost your income by:

- Picking up a freelance gig on the side, such as writing and content creation, web development, or photography.

- Renting out a spare room in your home.

- Sharing your money-saving challenge with someone can help provide motivation, support, and accountability.

- Setting realistic and specific financial goals, tracking your expenses, and creating a budget can also help you reach your savings target.

Saving money can be a challenge, but with the right strategies and mindset, you can reach your financial goal of saving $20,000 in a year.

Whether you decide to pick up a freelance gig, rent out a spare room, or share your savings challenge with someone, taking proactive steps to boost your income and reduce expenses can help you achieve your goal.

Best of luck and read my guide on 7 Steps to Save $10,000 in 6 Months next.