We’re all looking for more ways to save money. My guess is, you’re probably 1 of 3 people:

- You’re overwhelmed and struggling to make ends meet. You have no plan for your finances, but you’re determined to get started.

- You have a plan in place and it’s working. You’re well on your way to saving, but you’re open to learning something new.

- Maybe you’re somewhere in the middle. You kinda have your act together, but you’ve got room for improvement and know you need to make some changes.

Full disclosure, I’m in that third group.

No matter where you’re at I want to help.

I put together this massive list of 150 ways to save money to help you seriously cut expenses and skyrocket your savings. Spread throughout this list, you’ll get to see what some of the brightest minds in the financial advisor blogosphere had to contribute. Their advice is gold and comes from years of experience.

If you can apply a handful of new ways to save money, then you’ll be that much closer to reaching your goals.

My goal here at PF Geeks is simple. I want to help every day people make money, save money, and take control of their finances.

Money is only a tool to accomplish your life purpose. It is a means to an end, but it’s also the place you have to start.

Enough introduction, it’s time to share my full list of 150 ways to save money. I’ve split them all up into 11 major sections.

Contents

- How to Save Money Like a Boss: 150 Proven Ways to Save Money

- My 11 Favorite, Highest Impact Money Saving Tips

- 1. Automation

- 2. Put Money Earmarked for Major Spending into a High-Interest Savings Account

- 3. Stop Investing on Your Own

- 4. Pre-Tax Savings

- 5. Buy a Used Car

- 7. The $1 Per Pound Rule

- 8. Doing a No-Spend Month

- 8. Cut Your Own Hair

- 9. Come Up With a Weekly Ultra Cheap Meal

- 10. Create Passive Income Streams

- 11. Buy Stuff That Lasts

- 17 Habits & Mindsets That Will Help You Save Money (and live a better life)

- 12. Adopt a Long-Term Perspective

- 14. Visual Reminders of Your Debt Payoff

- 15. Calculate Purchases by Hours Worked Instead of Cost

- 16. Keep Compound Interest in Mind

- 17. Think Big

- 18. Patience

- 19. Stay Motivated

- 20. Prioritize Retirement

- 21. Quit Your Bad Habits

- 22. Make Saving Money Fun

- 23. Track Your Net Worth

- 24. Keep the Kitchen Clean

- 25. Monthly Spending Review

- 26. Pocket Your Frugal Wins

- 27. Set Goals

- 28. Start a Dinner Club

- 23 EASY Ways to Save Money on Groceries

- 29. Eat Healthy

- 30. Meal Prepping

- 31. Ibotta

- 32. Cutting Out Alcohol

- 33. Buy In-Season Produce

- 34. Make Your Own Coffee

- 35. Don’t Throw Away Food

- 36. Stop Buying Bottled Water

- 37. Ditch Sodas/Drinks at Restaurants

- 38. Buy Rotisserie Chicken

- 39. Unit Price for Food

- 40. Eat Less Meat

- 41. Load Up When Meat Goes on Sale

- 42. Buy Meat as ¼ Cow

- 43. Shop at Cheaper Stores

- 44. Get 2 Meals Worth When You Eat Out

- 45. Don’t Grocery Shop When You’re Hungry

- 46. Use InstaCart

- 47. Have a Monthly “Clean Out the Pantry” Week

- 48. Get a Slow Cooker

- 49. Make a List Before You Go Shopping (and stick to it!)

- 50. Lose Weight

- 51. Keep Convenience Items on Hand

- 14 Budget Tips That Will Save You Money Every Month

- 52. Make a Budget

- 53. Track Your Budget

- 54. Mint / YNAB

- 55. Avoid Gimmicky Saving Apps

- 56. Monthly Allowance

- 57. Debt-Paydown Strategy

- 58. Have an Emergency Fund

- 59. Budget for Vehicles

- 60. House Maintenance

- 61. Don’t Take on Consumer Debt (car, credit, etc)

- 62. Debitize App

- 63. Set Up a Sinking Fund

- 64. Stop Making Impulse Purchases

- 65. Go through Rosemarie Groner’s Budget Bootcamp

- 19 Effective Ways to Save Money On Housing Expenses

- 66. Multi-generational housing

- 67. Pay Your Mortgage Off Early

- 68. Live Somewhere Cheaper

- 69. Cut Cable or Find an Alternate

- 70. Republic Wireless

- 71. Buy in Bulk

- 73. Conserve Water

- 74. Become a DIY Champion

- 75. Install CFL Light Bulbs

- 76. Get a Quality Home Inspector

- 77. Downsize Your Living Space

- 78. Put 20% Down and Avoid PMI

- 80. Programmable Thermostat

- 81. House Filters

- 82. Turn Off All Lights

- 83. Insulate & Find Air Leaks

- 84. Surge Protector

- 9 Ways to Increase Your Income (when you can’t cut any more)

- 22 Awesome Ways to Save Money with Discounts and Cashback

- 94. Negotiate Your Bills

- 95. Look into Insurance Savings

- 96. Credit Card Rewards

- 97. Amazon Subscribe and Save

- 98. Buy Generic

- 99. Google for Promo Codes

- 100. Ebates

- 101. Groupon

- 102. Honey

- 103. Paribus

- 104. Get a Solid Cashback Card

- 105. Ask About a Prompt-Pay Discount

- 106. Have Your Hospital Bill Itemized

- 107. Coupons

- 108. Buy Discounted Gift Cards

- 109. Student Discounts

- 110. Teacher Discounts

- 111. Kids Eat Free Discounts

- 112. Military Discounts

- 113. Save Money on Pet Meds

- 114. Pet Insurance

- 115. Use your Flexible Spending Account

- Bonus! Take Advantage of Birthday Freebies

- 7 Powerful Ways to Save Money on Banking & Investing

- How to Save Money on Transportation: 8 Tips

- 11 Effective Ways to Save Money on Education

- 131. Borrowing / Renting Books

- 132. Kindle Books

- 133. School Scholarships

- 134. Outside Scholarships

- 135. “Good Student Discount” for Car Insurance

- 136. Work for Your School

- 137. Ask Your Employer to Pay for School

- 138. Refinance Your Student Loans

- 139. Utilize a 529 Savings Plan

- 140. Track All of Your Education Expenses

- 141. Pay Off Your Student Loans ASAP

- 9 Random Money Saving Tips to Ramp up your Savings

- Next Steps

How to Save Money Like a Boss: 150 Proven Ways to Save Money

This post may contain affiliate links

My 11 Favorite, Highest Impact Money Saving Tips

1. Automation

When it comes to dealing with money, I’m HUGE on automation. The less time and work I personally have to do to save, the better. There are a number of ways to automate your saving and investing. If you want to remove yourself from the equation, figure out how to automate your finances.

2. Put Money Earmarked for Major Spending into a High-Interest Savings Account

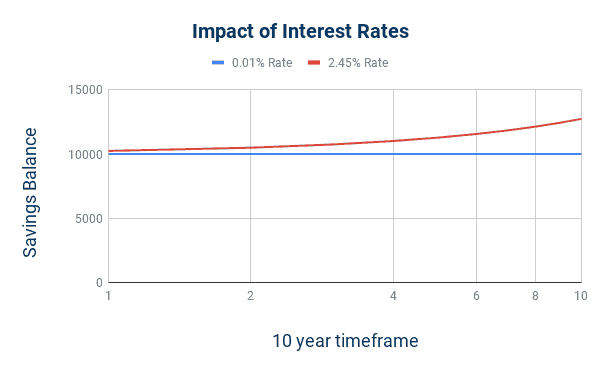

If you’ve got any large sum of money set aside for tuition, or a future down payment, then you should absolutely get that money working for you. Most people put this money into general checking or savings accounts that are only earning a measly .01% interest rate.

That means for every $1,000 you have in savings, the bank will pay you 10 cents a year. Sad right?

This is why you need to join CIT bank. CIT is fully online bank that will pay you an annual interest rate of 2.45%, earning you $24.50 on the $1,000 you have saved instead of a measly 10 cents.

That’s 245x as much as most major banks.

How does your bank line up against CIT? Sign-up today by clicking the image below or follow this link (Savings Builder) to start earning WAY more interest.

Tip: This is also why your emergency fund should be set up with CIT bank! If you’ve got 3 months of living expenses saved up earning next to nothing, you need to be getting the best return possible.

3. Stop Investing on Your Own

Most casual investors are absolutely terrible at keeping pace with the stock market. The last report I read showed that the average investor earns an average of 4.3% per year while the stock market has averaged 11.65% over the same period of time.

If you really want to make the most of all the money you are saving, then STOP investing on your own.

BUT don’t run to the nearest financial services company and pay them to do it either.

Here are 3 incredible resources to learn how to invest on your own.

The economy can be a bit crazy, especially these days so make sure you don’t panic about the stock market.

4. Pre-Tax Savings

One of the best tips for saving money is to use pre-tax income to put away as much as you can and send money into your investment vehicles. If you have access to a 401k, 403b, or a 457 through your employer, take advantage of it! If you’re already maxing them out, then you can open up a traditional IRA as well depending on your income level. If you can get your taxable income low enough, you may be able to qualify for the earned income tax credit!

5. Buy a Used Car

Buying a used car rather than brand new is by far one of the easiest ways for saving money. Cutting your coffee habit, turning off the lights at home, and packing a lunch for work are great daily habits that add up over time, but their immediate impact is less noticeable.

Buying a used car will save you thousands of dollars.

Kelan and Brittany, The Savvy Couple

“One of the biggest financial mistakes people make is purchasing new cars. Financing a depreciating asset is a great way to keep yourself in financial ruin. Purchase a reliable used car, learn basic DIY maintenance, and always shop around for major repairs. Just remember a $1,000 in car repairs each year is cheaper than that $250/month car payment.”

7 Simple Ways You Can Save Money On Auto Repairs

7. The $1 Per Pound Rule

Of the 30+ tips I received from personal finance bloggers, this one was probably the most unique. It comes from a new blogger friend of mine, Jillian, mom of 5 kids who is all about intentional frugal living and this is how she was able to cut $7,000 a year on their grocery bill!

Spend $1 per pound of food on all your groceries.

Jillian, Montana Money Adventures

“The basic premise is most of the food you should buy is $1 a pound or less. Crazy right?

Often the food clocking in under $1 a pound is exactly what we should be eating more of. It’s real food. Fruit, veggies, whole grains, beans, eggs. And all the food that we probably ought to be eating less of is conveniently more than a $1 a pound. Processed foods, sweets, condiments, meat or cheese.”

1 Rule We Used to Cut Our Grocery Bill in Half

8. Doing a No-Spend Month

This tip for saving money comes from one of my fellow finance bloggers, Angela. She has been blogging for 6 months and I love how real and personal she gets on her blog. Since following her, I’ve seen a number of people doing “No Spend Months”.

The goal is simple: Spend as little money as possible. You can also try doing a no spend challenge to get started!

Angela Rozmyn, Tread Lightly, Retire Early

“We have always been good savers, but after a summer of seemingly endless unexpected expenses, I knew we had to take tighter control on our finances. Enter the “no spend” month. I set ourselves a limit of $1500 ($50/day) for anything outside of our mortgage and daycare. I expected to blow through this budget thanks to a planned vacation to Hawaii, but I wanted to start right away instead of waiting until the right time. Imagine my shock at the end of the month when we calculated our savings rate – it had doubled.”

What I Learned About Our Spending Habits From A No Spend Month

8. Cut Your Own Hair

This is probably easier for guys to put into practice. Stop paying $20-30 + tip to get your haircut when you can do it yourself, saving money and time.

It’s easy. Saves time. Saves money. And I can do it at home.

9. Come Up With a Weekly Ultra Cheap Meal

If you are trying to save money on food then this has to be one of the best hacks out there. My advice is to spend some time coming up with 4-6 ultra cheap meals that you can rotate through.

10. Create Passive Income Streams

There’s no question that finding ways to make money without extra effort is the holy grail of all things money. The idea being residual income is simple: put in the effort up front to establish an income stream that will keep on paying you without extra effort.

If you want to find ways to create additional income streams, my friend Denis from Chain of wealth has published the #1 guide that exists on how to create passive income. It goes into incredible depth and will teach you just about everything you could possibly want to know.

11. Buy Stuff That Lasts

One of my favorite ways to save money is to only buy things that last. For a while I was always focused on getting the best deal possible to save money but inevitably, 6 months later the clothes, shoes, or furniture was already falling apart.

One of my favorite places to find awesome, durable products is BuyMeOnce, a website all about helping you find products that will last.

17 Habits & Mindsets That Will Help You Save Money (and live a better life)

12. Adopt a Long-Term Perspective

Everyone wants to get rich quick, make a lot of money tomorrow, and be financially independent in a year.

If you want to save money, build wealth, and live a generous life it takes time to get there. The key is to remember that every choice and step you take today will help you tomorrow.

13. Avoid Lifestyle Inflation

Avoiding lifestyle inflation is one of the cornerstone mindset shifts of those who are on the fast track to wealth.

Adam Fortuna, Minafi

“After pouring through data from thousands of people, one thing is clear: the more money you make the more you spend. By avoiding lifestyle inflation year over year, you can increase your savings rate and retire earlier. The key to avoiding the lifestyle inflation trap for me was to track my spending in every category over time. By looking at this, it becomes crystal clear when I’m spending more than I intended – giving me an opportunity to adjust my spending before it goes off track.”

I’ve actually written about we are embracing lifestyle inflation, but it’s probably best not to follow our lead 🙂

14. Visual Reminders of Your Debt Payoff

When you are paying off debt, one of the best ways to stay motivated is to create visual reminders of your debt payoff progress. When everything is done online, sometimes keeping a physical reminder can make it feel more “real”.

15. Calculate Purchases by Hours Worked Instead of Cost

One of the most powerful mindset shifts in the early retirement blog community is seeing purchases not only in terms of dollars paid, but also by how many hours you worked to be able to make that purchase.

16. Keep Compound Interest in Mind

Everyone knows how big of an impact compound interest is when it comes to building wealth! The secret to saving for retirement is to get as much money as possible invested as early as possible.

17. Think Big

This tip comes from one of my favorite bloggers, Physician on FIRE. It’s good to focus on all of the small, daily habits that add up, but only after you’ve taken care of some of the major areas of spending.

PoF, Physician on Fire

“Think big. Your home. Your cars. Private schools. Second homes. Second wives.

These are the things that can bust your budget. An expensive home costs more to heat, cool, maintain, and improve. Property taxes are higher. You might get your own money back when it’s time to sell, but as many of us learned in the last decade, that is not always the case. Cars depreciate the moment they leave the lot. Public school tuition is 100% less than private school tuition. Owning two of anything rarely makes you twice as happy as having one.”

18. Patience

This money saving tip comes from Chris and Jaime at Keep Thrifty! I know I struggle with being patient, but the truth is a little bit of waiting can save more money!

Chris & Jaime, Keep Thrifty

“By waiting to buy things you want (but don’t need), you can get them at significantly reduced prices or even free. Technology items are a great example; phones and computers prices often drop 50% within the first year. Beyond this, waiting to watch movies and read books can mean getting them for free from the library instead of paying tons to watch in the theater or get the hardcover.” Patience is the Ultimate Passive Income

19. Stay Motivated

If you want to save money over the long-run, you’ve got to find your motivation. Anyone can stick to a budget for a couple of weeks, but those who can stick to the plan for years on end will find themselves financially healthy.

More money isn’t the goal. It is a tool to create the life you want.

You’ve got to find what matters to you. What are your goals? What are your dreams?

20. Prioritize Retirement

At the end of the day, you won’t be able to borrow your way through retirement. Rather than prioritize luxury cars and lavish houses, we are putting our money where we need it most.

21. Quit Your Bad Habits

One of the best ways to save money is to identify habits that can build on each other to accomplish multiple goals at once. Excessive drinking, smoking, dipping, and overeating are just a handful of bad habits that 1) cost money and 2) are bad for your health.

22. Make Saving Money Fun

If you’re new to budgeting, then one of the best ways to save money is to have fun doing it!

Alexis Schroeder, Fitnancials

“Make saving money fun. Create a fun game such as using a swear jar and putting a dollar in every time you say a bad word. Or, come up with another idea like putting $1 into the jar every time you’re handed back a $1 bill. Over time, this will add up and can be put toward being debt free, a vacation, or whatever you’re saving for!”

23. Track Your Net Worth

I tell anyone willing to listen that tracking their net worth can be one of the most helpful monthly practices. The truth is, what gets measured, gets improved. If you don’t know where you are, then how can you know where to go?

My wife and I didn’t get serious about saving and budgeting until we realized how little of our income we were actually saving.

There are some awesome online tools that make tracking your net worth incredibly easy. Personal Capital is the favorite by most bloggers in the personal finance space. We just signed up and you should too!

24. Keep the Kitchen Clean

There’s nothing worse than wanting to cook a meal, but having to spend 20-30 minutes emptying the dishwasher and loading it again. Rosemarie Groner’s Budget Bootcamp has a whole section all about how this one habit is key to getting your food spending under control. When your kitchen looks messy, it is much more tempting to just eat out another meal.

25. Monthly Spending Review

At the end of each month, take some time to review your monthly spending. What categories did you go over on? Did you manage to save on any?

Make adjustments to your budget and adapt your spending as needed.

26. Pocket Your Frugal Wins

This ties right in with your spending review. If you have a few categories that you underspent on such as food or entertainment, then save that difference!

If you pay cash for a vacation, then take that week’s worth of food budget and use it to chip away at your loans or put the more money into savings.

27. Set Goals

There’s no doubt that setting goals can put some fire in your belly to stick to your saving plan. The key is to set long-term goals, break them down into shorter, more achievable steps, and then figure out what daily, weekly, and monthly steps are needed.

The key to financial goal setting is to break down your goals between process and outcome. We all tend to focus our goals on what the outcome will be–in every area of life.

- Retire with $2 million dollars

- Save 20% for a house downpayment

- Being debt free

- Lose 20 pounds

- Get 10,000 monthly visitors in blog traffic (maybe that’s just me)

- Read 25 books this year

- Spend more time reading the Bible

Those are all great goals! But they need to be broken down into the tasks and objectives that will actually drive results.

If you’re goal is to 25 books a year, then you need to read an average of 25 pages each day.

If my goal is to reduce my grocery spending by taking my lunch to work, then I need to meal prep each week.If you want to learn how to meal prep, check out my post for Jeff Rose on Meal Prep 101.

Goal setting with the process in mind will help you clarify the exact steps needed to reach your target.

Three Steps to Better Goal Setting

- Make a list of your long and short-term goals

- Break each of them down into daily, weekly, or monthly processes or habits that will drive success

- Decide when you will take action on the systems needed in step 2.

Vincent, Finance for Geek

“In my humble opinion, one of the best way to be able to save money is to define some goals as well as strategies to reach every single one of them. Instead of saying I want to save $5,000 dollars before next year, plan ahead some strategies and how you plan on reaching your goals. Having proper strategies tailored specifically for your goals is the key to reaching them, and even more when it comes to saving more money!”

28. Start a Dinner Club

It’s easy to make regular dinner outings part of your social life with friends. We have a monthly dinner club with three other couples. Rather than pay $40-50 every month, take turns hosting the group.

This alone saves us around $350 a year. Instead of going somewhere and dropping $40-50 each time, cook at home and invite everyone over!

23 EASY Ways to Save Money on Groceries

29. Eat Healthy

Most people automatically assume that eating healthy means a higher grocery bill. Sadly, they are mostly right if you only count the up-front costs. However, a poor diet will cost you much more down the road. If you want to start saving money on really nutritious food, you can start an organic food garden!

Amy, Life Zemplified

“Like money, our health is only as valuable as we make it. A diet full of junk food costs you well beyond the initial purchase since the foods you eat can have a dramatic impact on how you look and feel (your mood, energy levels, skin, hair, etc.), as well as how you age. An unhealthy diet, even for people at a healthy weight, is associated with significant health risks which can cause serious illness and even death. On top of that, it typically takes more calorie-dense junk food to fill you up versus eating more nutrient-dense foods, so you end up eating more calories and spending more money.

By taking steps towards a healthy lifelong diet, full of nutrient-dense foods versus calorie-dense foods, you’ll not only save money but also set yourself up for an active, strong, and healthy life for years to come.”

30. Meal Prepping

There’s no doubt that meal prepping is one of the most effective ways to make cut your spending by thousands of dollars every year. Stop paying $10 every day for lunch and start cooking your own meals.

Learning how to meal prep by checking out our Ultimate Meal Prep Guide to Save you Time and Money.

Other Resources on Meal Prepping:

- 46 Easy and Cheap Meal Prep Recipes You Can make for $2 or Less Per Serving

- 43 Easy Keto Meal Prep Recipes to Save Time and Eat Right

Penny, ShePicksUpPennies

“Frugal living gets a bum reputation when it comes to meal planning. While it’s certainly true that I love oatmeal, my husband and I eat meals that are full of variety and only spend about $200 a month on groceries. We also eat pretty healthfully. The trick was switching over slowly and being more strategic about where we shop.”

31. Ibotta

Ibotta is an app that can save you money on all of your grocery spending! Check out the list of offers they’ve got and see how you can start saving money today. My wife and I have been using it and love the app. You can check out our full ibotta review to get more info & tips.

Sign up here and get a free $10 to start!

32. Cutting Out Alcohol

It’s not a bad thing to enjoy a drink from time to time, but if you are in crunch mode trying to save money then this should be one of the first places you cut.

33. Buy In-Season Produce

There’s no doubt that a diet rich with fresh fruit and vegetables can cost a bit more, but it doesn’t have to. When food is in season, there is simply more supply of it available and it costs less to keep fresh throughout the year. You can also get creative by finding more ways to eat vegetables in your every day diet.

34. Make Your Own Coffee

As a student it can be tempting to hit up coffee shops to fuel those long study sessions. Trust me, we’re on the same page. Coffee shops are where I get some of my best work done and at times the extra few bucks is worth the change of environment.

That being said, it is a total waste of money. If you are in debt payoff or prevention mode then don’t pay $4-5 for overpriced coffee when you can make your own for about 15 cents a cup.

Personal note: I’m a huge fan of cold brew since it is less acidic and typically has more caffeine. I started making my own at home using this cold brew maker and it has been a huge money saver for me. Every batch I make saves me $15-20.

35. Don’t Throw Away Food

The average American throws away over $640 worth of food every single year. The easiest way to do this is to plan out your meals ahead of time and only buy what you need.

36. Stop Buying Bottled Water

A bottle of water from a gas station or grocery store is going to run you on average $1.22 a pop. I get it, sometimes you want the convenience. Just know that you’re paying 300x too much for that water. Get on amazon and buy yourself a nalgene or other refillable bottle. You’ll save money and help the environment.

37. Ditch Sodas/Drinks at Restaurants

Saving $2 on soda won’t make you wealthy, but avoiding the worthless calories will keep you healthy. Why waste money?

38. Buy Rotisserie Chicken

This is an easy way to save money on protein! You know those delicious rotisserie chickens that most grocery stores carry? At Kroger you can get them for half off after 7:30 pm. At Whole Foods, they offer half off every Wednesday and Wal-Mart makes their chickens every 3 hours so if you score on the right hour you could walk out with a $1.99 chicken.

If you eat a lot of protein week to week, this is an awesome way to save a lot of money over the course of a year. You can also use an air fryer with rotisserie attachment.

39. Unit Price for Food

One of the easiest ways to save money on groceries is by looking carefully at the quantity of food you’re getting for the price. If you’re trying to eat healthy, then you definitely want to make sure you get the most bang for your buck.

40. Eat Less Meat

Meat is generally the most expensive source of protein. Eating lots of chicken, beef, and fish can quickly rack up the grocery bill. Reduce your spending by adding beans, rice, and vegetables to stretch your meat consumption.

Here are 40 vegetarian meal prep recipes that taste great and are cheap!

41. Load Up When Meat Goes on Sale

I have a personal goal that I try to never pay full-price for meat. If you’re willing to test out new cuts or protein sources you can almost always find one that is on sale. When they do, load up while you can.

42. Buy Meat as ¼ Cow

If you know someone with a farm or ranch this is another great way to get high quality meat for much cheaper than you can find in stores. This takes buying in bulk to a new level, but if you’ve got the freezer space and the cash up front, you can usually end up with a couple hundred pounds of meat.

43. Shop at Cheaper Stores

Research the grocery stores in your area to find the best pricing.

The blog, Root of Good, recently published a controversial article outlining that Costco is actually less cost effective than most people think! If you’re a Costco member, you should definitely take a read.

Costco Costs More: A Cautionary Tale of Bulk Buying Gone Wrong

“Nothing was cheapest at Costco… I went on a search for things that are great values at Costco. I mostly came up empty-handed but did notice a few things.”

44. Get 2 Meals Worth When You Eat Out

It should go without saying that if you want to save money on food you shouldn’t be eating out. But let’s be real… life happens. One thing my wife and I do is intentionally try to stretch our meals out into two meals.

45. Don’t Grocery Shop When You’re Hungry

Unless you have the discipline of a navy seal, grocery shopping when you’re hungry is just a bad idea. It’s like a buffet. Your eyes are bigger than your stomach, or in this case, your stomach AND your wallet. You end up buying way more than you need.

46. Use InstaCart

These days, most grocery stores offer the option to have your food delivered or pick-up ready. This usually comes at a small fee, but if it means you only buy exactly what you plan to eat, then chances are the money you spend will be worth it!

47. Have a Monthly “Clean Out the Pantry” Week

If you’re anything like me, your pantry tends to accumulate stuff. Most pantry items have a long shelf-life but that doesn’t mean they last forever! Go through your pantry and freezer items at the end of each month and use what you can.

48. Get a Slow Cooker

I don’t know of a kitchen gadget that is more useful than a slow cooker. Turn it on before you leave for work, dump in your ingredients, and come home to the wonderful smells of an already made dinner.

The great thing about slow cookers is that the recipes tend to be extremely low budget.

Here’s the one we use! If you aren’t sure how big of one to get, check out this guide on crockpot sizes.

49. Make a List Before You Go Shopping (and stick to it!)

The biggest grocery killer for most people is simply buying what you don’t need. This starts with failing to actually plan out your meals for the week. One of the easiest ways to save money on groceries is to make a list before you get to the store. Only buy what you are planning to eat for the week.

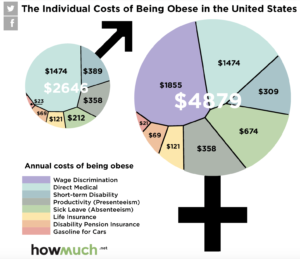

50. Lose Weight

When trying to find ways to save money most people don’t consider their weight, but it might be the best place to start. Maintaining a lower body weight is one way to cut costs on groceries. If you’ve been trying to lose weight but are having a tough time, you might benefit from implementing these simple tips for losing fat.

Plus, a healthy person is typically a sign of a healthy bank account:

- Workers who exercise regularly make on average 9% more than those who don’t. Source

- The lifetime cost of obesity is around $92,500. Source

Read more: The Costs of Being Fat, in Actual Dollars

51. Keep Convenience Items on Hand

This semester my wife and I have started keeping a few quick & easy meals on hand at home. Sure, it’s better to cook budget friendly, healthy meals. But sometimes we just don’t have time. Sometimes we’re just lazy.

This happens all the time. I get caught in this frustrating limbo where I’m too lazy to cook, but too frugal to eat out.

2 Easy Meals to Make at Home

They are both dirt cheap and won’t go bad sitting in your pantry.

14 Budget Tips That Will Save You Money Every Month

52. Make a Budget

If you’ve never taken the time to put together a budget, then please. For your sake. Make a budget. If you don’t have a set budget, then you likely have no earthly idea how much you are actually overspending each month. My favorite way to budget the zero based budgeting method but if you want a simpler form of budgeting, the 50/30/20 rule might be right for you. If you’ve tried and struggled with budgeting, check out my friend Kevin’s post where he broke up with their monthly budget.

53. Track Your Budget

I bet this seems obvious, but this step is truly where the magic happens. This is where the difference is made between those who crush their debt by paying it off way ahead of schedule and those who spend half of their life paying off student loans.

Once you have a budget made, you actually have to track it. Your budget won’t be perfect the first time you put it together. You will forget things like vehicle registrations, wedding gifts, drivers license renewal, oil changes, replacing your phone, or getting sick.

There are great programs and apps that can let you do this for free or cheap. We recently just got back to tracking our spending.

54. Mint / YNAB

Please do yourself a favor. Sign up for a budgeting program or software like Mint or You Need a Budget. Sign up, link your bank accounts, create a budget, and then do an expense review at the end of each month.

Both of the programs are great and have cult-like followings. We use the free version of Mint and absolutely love it. YNAB is a paid app, but is free for the first year if you verify that you are a student.

If you hate modern technology and want to make your life harder than it needs to be, print off your bank statements and do all of this manually.

At the end of the day, the best choice for you is whichever one will help you stick to and follow your budget.

Nick True, Mapped Out Money

“The best way to save money is to know where your own money is coming from and where it’s going. You can’t save money you don’t have, and you won’t have it if you’re not tracking it. Tracking your own money is the foundation of building a financial buffer and a solid financial future, period. Personally, I use YNAB to track all of my expenses and budget every single dollar. If you’re serious about saving money, but you’re not tracking it, then you’re not serious.”

Ultimate YNAB Review and How To Start: Best Budgeting App

55. Avoid Gimmicky Saving Apps

Saving apps like Acorns can be a great way for budgeting rookies or major spenders to save money, but if you want to really accelerate your ability to save, you need to make a plan and stick to it.

I love what one of one of my blogging idols, Jeff has to say about these…

Jeff Proctor, DollarSprout

“Instead of relying on “rounding up” apps to help you save, set actual goals. Putting money away 50 cents at a time isn’t going to make a meaningful dent in your savings (especially once you factor in the fees of many savings apps).

Instead, set weekly or monthly savings goals and automate the process. Many banks let you set up automations to transfer funds from checking to savings on a set schedule.”

The team at DollarSprout recently put together an incredible article with 19 Legitimate Ways to Earn Extra Money From Home. If you’re trying to make money online then you definitely need to check them out.

56. Monthly Allowance

The key here is to set a monthly limit on your guilt-free spending while keeping every other area of your budget in line. Save money everywhere and then spend money on the things that matter most to you.

57. Debt-Paydown Strategy

If you’re loaded down with debt, then you need to come up with a strategy to pay it off. My friend Jamie put together an awesome debt snowball spreadsheet that can help you put together your own plan to pay off your debt!

The best debt payoff strategy is ultimately the one that you will stick with. You’ve probably heard of the personal finance celebrity, Dave Ramsey.

58. Have an Emergency Fund

Sometimes life decides to punch you in the face. An emergency fund help shoulder the blow. If you are trying to avoid taking on student loans, then the last thing you want to do is take on more debt. The amount you keep set aside is up to you.

The riskier your financial situation, the bigger of an emergency fund I would have. Dependent on one income? Living on a razor thin budget just to get by? Have kids? Those are all reasons to increase your emergency fund and safety net.

If you have an emergency fund, make sure to read tip #116 to find out the best place to keep your own money! Here’s my ultimate guide on how to start and build an emergency fund!

59. Budget for Vehicles

Car maintenance is my budget killer. New tires, new batteries, new brakes, water pump, timing belt, replacing an axle(Yes, I know this should never happen…). Those are just a handful of the things we’ve paid for over the last two years. None of them were budgeted or planned for.

That’s no longer the case. We now set aside money each month for future, major car maintenance. Depending on your mechanic or shop, the ability to pay cash can definitely get you a discount.

60. House Maintenance

When it comes to housing expenses we are fortunate to still be renting. But like vehicles, houses take work. Set money aside each month into your emergency fund. DIY everything you can and pay cash for the rest.

The better job you do at maintaining the condition of your home, the less you’ll have to spend down the road.

61. Don’t Take on Consumer Debt (car, credit, etc)

Debt 101: If you are trying to avoid debt then don’t take on new debt.

If you are trying to aggressively pay down your student loans, then don’t finance a new car, phone, tv, mattress, or anything else you think you need.

Credit cards aren’t evil, but in the hands of a spender they are incredibly dangerous. If you can make your payments each month and treat your credit card like a debit card.

If you want to learn how to use a credit card properly, check out Debitize, the next tip!

62. Debitize App

Debitize is this awesome app that helps you treat your credit card like a debit card. If you want to build up your credit score, earn travel rewards, or get some cash back then you need to be using credit cards.

Credit card companies make some money when you spend money. But they really make their profit when people spend way more than they actually have and get stuck with high interest credit card debt.

Debitize keeps that from happening in a simple, yet genius way.

You link your credit card and checking account to one account with Debitize. Whenever you make purchases on your credit card, they will automatically deduct that amount and at the end of the month, they use that money to pay off your credit card.

63. Set Up a Sinking Fund

Sinking funds are a great way to automate your finances and plan for major expenses coming up. If you know you’re going to spend $600 on Christmas every year, then starting setting aside $50 each month so that it won’t be such a shock when the time comes.

Mint automates all of this for us. It takes us about 15 minutes to go through each of our budget categories to make sure that everything went to the right place.

Check out my full guide on sinking funds: What is a Sinking Fund? The Key to Smart Budgeting

64. Stop Making Impulse Purchases

Most people who have problems with money usually have problems with discipline. One of my best money saving tips is to stop making impulse purchases. These can add up over time and greatly impact your ability to save money.

65. Go through Rosemarie Groner’s Budget Bootcamp

If you haven’t found your way to Rosemarie Groner’s website, Busy Budgeter, then you are seriously missing out! She is a huge inspiration for my own blog. About six months ago, I signed up for her 90 Day Budget Bootcamp and it was seriously life changing.

Over the course of 90 days Rosemarie will take you step-by-step through the exact steps that helped her family become debt-free. If you want to take major & effective steps to reduce your expenses, sign up today.

19 Effective Ways to Save Money On Housing Expenses

66. Multi-generational housing

A great way to save money and spend more time with relatives is to intentionally have a multigenerational household. You can have your parents live with you, help raise your kids, and share household costs.

67. Pay Your Mortgage Off Early

Putting extra money into your principal each month will save huge amounts of interest over time and help you build up equity much quicker. You’ll want to weigh the options of investing versus making extra mortgage payments.

68. Live Somewhere Cheaper

Everyone knows that living expenses account for the majority of people’s spending. If you can find a way to earn a high salary in a lower cost of living area, you’ll find that your ability to save will dramatically increase.

69. Cut Cable or Find an Alternate

Stop paying $125 a month for cable. Being frugal isn’t always easy, but at the end of the day it comes down to opportunity costs. Cutting cable is by far one of the most effective ways to save money.

Take the $125 you’re saving, put it in an index fund earning 7% and after 30 years you’ll have an extra $150,000 sitting in your bank account.

If you think cable is absolutely necessary then check out either of these step by step guides to watch TV for cheap.

70. Republic Wireless

Want to stop paying $60 a month for your phone bill? Make the switch to Republic Wireless and start saving today. You can get a plan for as low as $20 a month.

My friend has some more tips on saving money on your phone bill!

Note: My wife and I have not done this yet as we are locked into a contract with AT&T!

71. Buy in Bulk

There’s no doubt that buying in bulk can save you money. But don’t rush out to go drop $500 at your nearest Costco. Take some time to figure out what items you buy regularly that have significant cost savings in bulk. You also have to consider how much space you have to store items.

72. Get a Roommate

Housing expenses typically make up around 30% of take-home pay. One way to reduce this is by getting a roommate to split rent.

A typical 1 bedroom apartment in Houston, TX runs around $1,000 while a 2 bedroom only costs $1,300 total or $650 each. This one change alone could free up $350 every single month.

73. Conserve Water

Conserving water is a great way to save money whilst also helping the environment. You can save hundreds of dollars per year on your water bill by following some of these ways to conserve water tips.

74. Become a DIY Champion

Any product or service you buy is going to be marked up to make someone else a profit. Whether you are buying furniture, having your car battery replaced, creating your own plan for retirement, or picking up some crafts from Hobby Lobby, you are paying a premium.

The best thing about developing some DIY skills is that they are often repeatable. Learn how to replace your battery once, and you’ll never pay someone to do it again.

You get the satisfaction of working with your hands to create something and the added bonus of saving money.

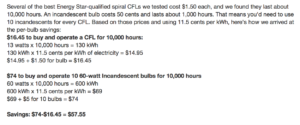

75. Install CFL Light Bulbs

If you want to save a bit of money in your home, then start buying CFL or LED light bulbs. They require less energy so you save on electricity and you won’t have to replace them nearly as often.

Consumer Reports estimates that you can save as much as $57 per bulb over the life of your CFL bulb.

Source: Q&A: How much can I save by replacing incandescent bulbs with CFLs?

76. Get a Quality Home Inspector

There are a few things in life that are absolutely worth paying the money for and a home inspector is one of them. Paying a couple extra hundred bucks for an inspector with a good reputation who will put in the time can save you thousands of dollars if they catch any major repairs that are needed.

77. Downsize Your Living Space

Moving to a smaller apartment, townhouse, or house can greatly reduce your monthly living costs. When my wife and I moved from a 2 bedroom townhouse to a 1 bedroom, we ended up saving around $600/month.

Not to mention, with a smaller living space you need less furniture, less decorations, and you pay less in utilities. These are just some of the benefits of downsizing!

78. Put 20% Down and Avoid PMI

If you’re trying to buy your first home sometime soon, put 20% down so that you can avoid paying private mortgage insurance, PMI for short.

PMI usually costs between 0.5-1% of the entire loan on an annual basis split into monthly payments. This means that on a 200,000 loan you’d be paying up to $166/month just to insure your loan. The worst part about PMI is that it doesn’t go towards your principal.

79. Heat / AC

Raising or lowering the temperature by just a few degrees can save as much as 10% off your monthly bill. The bigger your living space, the more money you can save each month.

The next several tips will give you some more specific ways to save money on your electric bill.

You can also check out a company called OhmConnect that can help you save money on electricity! My friend Bri recently wrote a full OhmConnect review to help you make the most of this money saving app.

80. Programmable Thermostat

If you’re willing to invest in a programmable thermostat like Nest or Honeywell then you may be able to decrease your electricity bill anywhere from 10-30%. It costs some money up front, but you’ll recoup the amount you spent after a few months depending on your current bill.

81. House Filters

Filters for your house are one of those small maintenance items that most people overlook. Replacing these monthly will keep your system working at peak efficiency. We buy ours on Amazon Subscribe & Save. We don’t have to worry about buying them each month or remembering what the right size is.

82. Turn Off All Lights

Turning off the lights in your house is one of those small daily habits that can save you a tiny bit of money every day.

83. Insulate & Find Air Leaks

If you have a sky-high electricity bill then there is a good chance the place you live is poorly insulated. Buy some spray insulation and make sure your attic is completely sealed.

You’ll also want to check your external doors and windows to make sure they are completely sealed. Doing this will waste money.

84. Surge Protector

Even when appliances aren’t being used, they can suck up electricity. If you don’t want to unplug everything constantly then buying a cheap surge protector is an easy way to save time and money.

9 Ways to Increase Your Income (when you can’t cut any more)

At some point you can only cut costs so much–boosting your income might be the answer to making ends meet month to month.

If your kids are wanting to make some extra money, here is an awesome guide on how to make money as a kid and a list of 24 ways for kids to make money!

85. Become a proofreader

One of the best remote side hustles is becoming an online proofreader. You can make big money editing and proofreading for individuals or businesses. It also takes almost no up front investment to get started. It definitely takes some hustle to land your first gig, but here are some of the best online proofreading jobs out there.

86. Surveys / Swagbucks

Swagbucks is essentially a rewards program where you can earn points, gift cards, and cash by watching videos, taking surveys, and doing the things you already do every day online.

It sounds scammy, but to date, Swagbucks has already paid out over $243,157,016 in cash and free gift cards.

If you use my referral you can get a free $5 to get started.

My buddy Kyle recently put together a full list of all the best survey sites out there, can’t recommend checking out his resource enough!

There are other sites like Swagbucks that can help you make money as well!

87. Start a Blog

There’s no question that blogging can make serious money, but don’t expect to get there overnight. A number of the bloggers you’ve seen contribute to this list actually make money blogging. Some like TheSavvyCouple make a few thousand a month now $10k+ per month(!!) while others like Michelle Gardner make over a million a year.

That being said, you need to ignore the bloggers out there who are selling the dream that blogging is a get rich quick scheme.

BUT…

If you do want to start a blog, then check out what my friend Pete McPherson has to say first. He has an incredibly valuable podcast and he tells it like it is.

Pete McPherson, Do You Even Blog

“STOP STARTING BLOGS TO TRY AND MAKE MONEY.

There are far easier ways to make side income (go mow grass or babysit or freelance), and if you’re looking to retire early and rich… stay in your day job, work hard, save 40-60% of your income, and invest.

Start blogs when you can’t shut-up about something. Money comes from that later, but it’s a long, hard grind.

If you’re a blogger and still reading, I recommend you start by listening to some of the most successful (seriously) bloggers on my long-form podcast.”

If you are interested in blogging, you absolutely, 100% need to follow Pete’s guide on how to start a blog. My buddy Mike got started blogging after taking a course on blogging that he highly recommends! You can check out his wealthy affiliate review to see if its a good fit for you.

88. VIPKID

Have any teaching skills? Know english decently well? VIPKID is a program that offers American elementary education to Chinese students. could be your chance to earn an extra $20 an hour with a couple hours a day.

If you want to read a full review on VIPKID and one user’s experience, check out this Chelsea’s 6,000+ word review on how you can start teaching with VIPKID.

89. Babysit

Babysitting for friends and family can easily earn you anywhere from $10-20 an hour. The best part is that once the kids go to sleep you can often use this time to work on side projects, study, or catch up on email.

The easiest way to get started? Join a couple of Mom groups on Facebook and make a pitch.

3 More Ways to Get Leads

- Ask your current clients to refer you out to their friends.

- If you are involved with a church, contact one of the admins and ask if there are any needs. Most churches hire nannies to take care of toddlers and babies during services.

- Put a flyer up at local coffee shops.

90. Pet Sitting / Dog Walking

Follow the exact same strategy above, but for people’s pets! If you love animals and have a flexible schedule, you could easily make $30-50 a day walking dogs, feeding them in mornings and evenings.

For pet sitting, use the strategies above during Summer, Christmas-time, Thanksgiving, and Spring Break.

This can be a great way to supplement your income. If you’re able to generate your own leads and clients, all the income you bring in is yours.

Sign-up with Rover to get started!

91. House Sitting

I’m not trying to beat the same drum over and over, but people will pay you serious money to watch their house while they are on vacation. When it comes to house sitting, you’re a lot more likely to get leads from people you already know or have a relationship with.

Start with babysitting or pet sitting, and then kindly let them know that you are always willing to house sit if they need it.

92. Social Media Marketing

These days every business knows they need to have an online presence, but many business owners don’t have the knowledge or experience to do it themselves. Want to start your own business?

Launch your own social media marketing agency. Reach out to local businesses in your area and offer them your expertise.

93. Pinterest Marketing

Honestly, I think setting up your own business that offers Pinterest marketing & coaching could be the best move for 2018. If I had any experience with Pinterest, I’d be all over this.

Blog owners all over the world are clamoring to set themselves up to get website traffic through Pinterest, but many of them don’t have the time to manage it themselves because they are so focused on creating content.

Check out what Kate Ahl is doing over at SimplePinMedia to get some ideas!

22 Awesome Ways to Save Money with Discounts and Cashback

94. Negotiate Your Bills

A great way to save a few extra bucks every month is to negotiate all of your current bills. It may surprise you, but nearly every bill you pay can be lowered.

95. Look into Insurance Savings

Every year or so you need to audit your insurance costs. It is easy for these to slowly rise over time, especially for vehicle and home insurance.

To lock in some savings on insurance follow these steps:

- Check your current rates

- Shop around at other companies to see their best offer

- Call your current provider and ask them to price-match.

If you need help figuring out the best way to get great car insurance, check out this awesome resources on frequently asked car insurance questions.

Just remember, you’re talking to a real live person on the other end. Be nice. Be courteous. And if they are able to give you a deal, be thankful. If they can’t, just know that the customer service rep isn’t the one setting the policies.

This whole process only takes about 20 minutes and can save you money for at least the next year. This ranks high on my return on effort scale.

If you’re considering early retirement and are worried about what your health insurance will look like, check out this guide on Barista FIRE.

96. Credit Card Rewards

If you want to make the most of the money you are already spending, then you absolutely need to check out credit card rewards. You’ve probably heard of this before, but credit card companies will pay you major rewards that can be redeemed for travel or cash back.

The real secret to earning credit card rewards is to find cards that offer massive bonuses when you hit a minimum spend.

97. Amazon Subscribe and Save

An easy way to save a few bucks is to utilize Amazon’s subscribe and save feature. Think of all the things you find yourself running out of each month… laundry soap, dog food, toilet paper, etc.

Find the product on amazon and set it up to be delivered each month. This won’t make you rich, but this one money saving tip will put a few extra bucks in your wallet.

98. Buy Generic

I know this one isn’t sexy, but you can easily save a few bucks on hundreds of items you buy every year. Skip the well-known, premium brands and stick with generic or store brands.

For 90% of the things you buy (groceries, medicine, cleaning products), you won’t even notice the difference. But your bank account sure will.

99. Google for Promo Codes

This one is easy and takes almost no time. Before you buy anything online or in stores, do a quick Google search to see if there are any promo codes out there that can save you money. You’d be surprised what all you can be saving money on!

100. Ebates

Ebates is an awesome company that offers discounts and cash back when you shop online at your favorite stores. It’s incredibly easy to get started. Make one account, and before you buy anything, check on Ebates to see if there are any discounts available!

If you want to get started with an extra $10 feel free to sign-up using my referral link!

This is what it’ll look like when you’ve got it activated:

101. Groupon

Of the apps/websites on this list, Groupon is probably the one that is the most mainstream. If you want to get major discounts on most restaurants and services, click on over and sign-up.

102. Honey

Honey is an extension that you add onto your internet browser. When you go to check out, it will automatically apply discount codes to get you the best possible price.

Get yourself a free $5 when you sign-up today.

103. Paribus

Unlike the others, Paribus saves you money on purchases that you’ve already made! After your account is made, Paribus monitors your online receipts and checks for price drops on the items purchased. If they are eligible for a price adjustment, Paribus will alert them and the retailer and work to get the user the money they deserve back.

Paribus is 100% free to join and customers keep 100% of the savings – no hidden fees.

104. Get a Solid Cashback Card

If you don’t already have a solid cashback rewards card, then you are missing out on free money. Get yourself a card like Citi’s Double Cash and start getting 2% back on everything you purchase. If you spend a lot on travel, groceries, or gas then consider getting a card specific to those categories.

105. Ask About a Prompt-Pay Discount

Hospitals have an incredibly difficult time collecting money from patients. Usually if you offer to pay the entire bill up front, you can get the price GREATLY reduced. I’ve heard of people getting discounts anywhere from 10-40% of the total.

106. Have Your Hospital Bill Itemized

Another way to get your hospital bills slashed is to ask them for an itemized list of charges. This allows you to see exactly how much you are getting billed. You’d be shocked to see how much that 1-minute consult from the specialist cost you. Negotiate these away and then ask for a prompt-pay discount.

107. Coupons

Nearly every grocery store on the planet offers discounts and coupons on select items. Just this past week I managed to leave the store saving around 25% on my total cart purchase. I will say, couponing isn’t my favorite hobby, but spending 5-10 minutes before you shop online can make a huge difference.

Check out these 2 bloggers who teach people how to save tons of money by using coupons:

- Living on the Cheap

- The Krazy Coupon Lady

108. Buy Discounted Gift Cards

Buying gift cards online to the restaurants or businesses you frequent is a great, easy way to save money. It won’t be much, but saving 5-10% on everything you buy is just one money saving tip you should take advantage of.

109. Student Discounts

One of the best parts about being a student are the countless discounts out there. Restaurants want your business and are willing to offer discounts, usually 10% or a free drink to get you there. Even if you’re trying to save money on food sometimes you just need to get a quick bite before you hit the books.

110. Teacher Discounts

I have a crazy amount of respect for the work that teachers do. My sister was a teacher, my wife works in the admissions officer at her school, and several of our best friends teach. If you work in this field, then take advantage of the savings that are out there.

111. Kids Eat Free Discounts

If you want a way to reward your kids for cheap, check out restaurants in your area where kids eat free. This won’t make you rich overnight, but if you find yourself eating out every week as a family then this is just one more way to keep more money in the bank.

112. Military Discounts

First off, if you have served or are serving in our country’s armed forces, I can’t thank you enough for fighting and giving of yourself to protect us. Your sacrifice is recognized.

Secondly, I’m glad to know that there are a number of establishments that offer discounts to members of our country’s military.

113. Save Money on Pet Meds

One way to save money is to buy your pet’s medications online through 1800PetMeds.com.

I was tired of paying our vet $30 a month for our dog’s flea/heartworm/tick medicine. A little bit of research online and we’re now able to buy it for less than $20, saving us around $120 a year.

114. Pet Insurance

Pet insurance is one of those things most people shake their head at, but for many people the peace of mind is worth it. Depending on who you get it through, it usually runs around $30/month.

It costs you a bit each month, but it can save you thousands if your pet ever gets cancer or has to have surgery.

115. Use your Flexible Spending Account

A Flexible Spending Account, or FSA, can be used to set aside pre-tax money for healthcare related expenses. If you don’t have access to an HSA, then an FSA can be a decent alternative to save some taxes on money that goes towards your health.

The key is that it doesn’t allow for carry-overs more than $500 per year, so don’t treat this as an investment account.

Bonus! Take Advantage of Birthday Freebies

Birthdays are a great time to celebrate with family and friends, and why not try to score some Birthday freebies along the way? My friend Olivia wrote a massive post with over 300 Birthday freebies to help you save money on your favorite day of the year!

7 Powerful Ways to Save Money on Banking & Investing

116. Expense Ratio

An expense ratio is simply the yearly cost of investing in a mutual fund, index fund, or exchange traded fund (ETF). The problem is that these fees are sneaky. You don’t notice them because the gains in the

market cover up the fees you are paying.

There really isn’t any way to get around this expense ratio. Every fund has one. But it is critical that you make sure you aren’t paying more than you need to. If the expense ratio is higher than it needs to be, then it will significantly drag down your portfolio’s return.

If you want more info, check out my Ultimate Guide to Finding the Best Expense Ratio.

117. Bank Account Hacking

One strategy to make the most of your emergency fund or other cash balances is to move bank accounts to take advantage of sign-up bonuses. This is a more advanced strategy, but bank account hacking can be lucrative. Banks offer sign-up bonuses all the time to get you to open bank accounts with them.

Their assumption is that you’ll keep your bank accounts forever and they’ll make their money back over time.

If you want to take your emergency fund to the next level, start #bankaccounthacking to earn sign-up bonuses. They usually range anywhere from $100-300.

There’s an awesome site, Bank Bonus, that helps people find the best bank account bonuses out there! Check out their page on the best bank promotions.

118. Waive Your Fees

If you pay any kind of annual fees for financial services (checking, savings, investing, or credit cards), call your provider tomorrow and ask them to waive them. Many providers are willing to do so if it means keeping you as a client.

119. Negotiate New Rates on Your Credit Cards

Credit cards are known to have incredibly high interest rates. When you consider the fact that the average American with credit card debt has a balance over $6,000 you start to realize that these credit card companies are making a fortune.

If you’ve got credit card debt, don’t be embarrassed or ashamed. Instead, do everything you can do pay it off.

One easy way to pay it off faster is to simply call your credit card provider and ask if they are willing to lower the interest rates on your cards. Depending on your outstanding balance, a few % points could save you hundreds in interest.

120. Avoid Overdraft and Late Fees

There’s nothing more annoying to me than paying money for absolutely nothing. When you overdraft your checking account or fail to make a credit card payment on time, you usually get hit with a $25-35 dollar fee.

Most banks these days allow you to set-up automatic transfers each month to pay off your card balances. Stop paying late fees when you don’t transfer funds on time.

121. Check Out Your Credit Card Rewards

Do you actually use your credit card to its full potential? Most likely not. Credit cards offer awesome incentives to get you signed up because they know this one major secret.

You’ll forget about them.

Now, I’m not talking about the rewards points or cashback you earn. I’m talking about the bonuses, discounts, and incentives you probably forgot about that your credit card offers. Here’s a list of some of the best travel rewards credit cards.

Take a look at the list of benefits that the Propel American Express card has:

- Discounted hotels

- Discounted airfare

- Lost luggage reimbursement

- Auto rental collision and liability insurance

- Roadside assistance

If you have a credit card, make sure you are making the most of all the benefits you have access to. Want to learn how to travel hack with your credit cards? Check out this awesome guide by Cody from FlytoFI: How to Use the CapitalOne Venture Card for Travel Rewards

122. Improve Your Credit Score

Your credit score is a measurement of how trustworthy you are in the eyes of potential lenders. If you are planning to buy a house or car in the next year, you should try to improve your credit score as soon as possible.

Improving your credit score is one of the smartest things you can do. Start today by signing up with CreditKarma and getting a free credit report. It will identify your weak areas and give you advice on how to improve it.

How to Save Money on Transportation: 8 Tips

123. Become a One-Car Family

This might be on the more extreme side, but only having one car can be a huge money saver! Think about all the costs that add up and imagine your budget without them.

124. Buying Cars: Don’t Budget Around Your Monthly Payment

If you do go out to buy a used car, then you want to be prepared to negotiate. One of the killer tactics that car salesmen use is to distract you from the total price tag by turning your attention to the monthly payment.

Stick to your budget and don’t let the salesmen distract you with the monthly payment. A $10 increase in your monthly payment over a 5 year loan will end up costing you nearly a thousand bucks.

Here’s a guide to help you decide if you should buy new, used, or lease a car!

125. Slow Down Your Driving

Driving fast 1) costs money and 2) rarely gets you anywhere quicker. As soon as you cross 50 MPH, every additional 5 MPH will basically cost you an extra 18 cents per gallon.

126. Clean or Change Out Your Car’s Air Filter

Changing out your air filter will help your car system to run more efficiently. Saving you money in gas and repairs over time.

127. Check Tire Air Pressure

When your tires are deflated, it takes your car a bit more effort to get from place to place. If you want to improve your gas mileage by 3%, then keep your tires inflated to the proper PSI. Check your tire pressure regularly and make sure they are topped off.

One of our best purchases last year was a portable tire pump. They’re cheap and you’ll be thanking me next time your tires go flat.

128. Find a Cash Only Mechanic

Car repairs can run up some serious additional cost. An easy way to save enough money is to find a cash-only mechanic for the repairs that are out of your league.. Buying the parts at cost and paying our mechanic for labor saves us on the mark-ups.

129. Get a Bike / Walk

Car insurance, gas, and maintenance can add up to thousands of dollars a year. If you live in an area where you can get by with biking, then you should absolutely consider making the switch. This might seem like an extreme step, but some debt situations call for extreme action.

130. Drop Collision and Comprehensive Coverage

Collision and comprehensive car coverage can be great. My wife and I both have it because the last thing we want is having to replace either of our cars. But there is going to come a day when the cost to insure our vehicles isn’t worth the money.

If your car is worth less than $2,000, drop the coverage and start saving it for your next car purchase.

11 Effective Ways to Save Money on Education

131. Borrowing / Renting Books

Next to tuition, buying textbooks every semester is usually the biggest education specific expense. There are plenty of ways to save money on book expenses and the only cost to you is convenience. This alone can save you hundreds a year.

- Check out books from your school’s library

- Buy used from older students

- Rent from Chegg.com and save up to 90% on textbook costs

What’s awesome about Chegg is that you can also sell back the textbooks you already own!

132. Kindle Books

Another way to save money on books is by buying books for Kindle. These are usually WAY cheaper than buying the exact same book in hard copy. The only up-front cost is the kindle itself, but you’ll after just one semester you’ll have saved more than the kindle cost.

133. School Scholarships

You might be amazed at just how few of your classmates actually take the time to apply for scholarships at your school. Nearly every school (public, private, undergraduate, graduate, etc.) offer merit-based and need-based scholarships.

134. Outside Scholarships

If you’re like me, you probably get emails every week from some spammy scholarship website. Those emails might be annoying, but there are millions of dollars in scholarship money available if you are willing to put in the time to apply.

The hardest part in getting money from outside scholarships is finding the ones you qualify for and have the best shot at getting.

Pro-Tip: Email your financial aid or scholarship office and ask if they have a list of outside scholarships they recommend.

135. “Good Student Discount” for Car Insurance

Most car insurance providers offer a “good student” discount, so if you’ve got the grades, typically an A or B average, then log in to your insurance provider, click over to discounts, and check the box.

136. Work for Your School

If you have the opportunity to work for your school, then you can probably score some solid tuition savings. Usually this is for full-time employees only, but this can be an awesome way to get your grad school tuition covered or majorly discounted.

137. Ask Your Employer to Pay for School

The goal here is to ask your employer to designate a portion of your current pay to go towards tuition.

You see, every dollar is taxed first and then paid towards your tuition. If you can approach your employer and convince them to designate a portion of your salary to be paid directly to the school, then you save money in taxes.

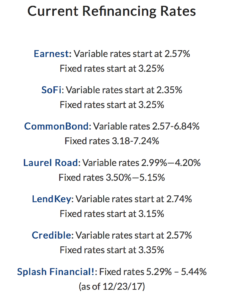

138. Refinance Your Student Loans

If you’ve got a number of loans at high rates, you should at least look into your refinancing options. Refinancing is simply taking your various student loans and bundling them up into one loan. The amount you owe doesn’t change, but you can often score yourself a better interest rate.

My friend Denis from ChainofWealth just wrote the best designed and most helpful guide to refinancing that is on the internet today. He’s got an interactive refinance calculator that’ll help you figure out exactly how much money you can save. There are some things you need to know depending on your loan type. My friend Bob wrote a great post on AES student loans that should help you out!

I’m not an expert on this, but check out Physician on Fire’s massively helpful Student Loan Resource Page!

139. Utilize a 529 Savings Plan

If you’ve got kids and plan to pay for their college education, then start saving the minute they’re born! One of the best vehicles to use is a 529 savings plan. With the new tax reform bill, these can also be used to pay for private education expenses for elementary through high school years.

There are some drawbacks and limitations to 529’s, so make sure you make your own educated decision.

If you’ve got kids, you should definitely check out Ryan’s podcast on 529 plans! The choice you make can make a huge difference.

Ryan of FinancialResidency

“One major takeaway from this episode is around expense ratios within the 529 plans. The expense ratios range between 0.2% to 1.3%. That is a massive gap between a bad 529 plan and a best in class 529 plan so make sure you really analyze the cost of the 529 before you start funding it for the next 10-18 years.”

The Best Way To Save For Your Kid’s College

Resources to learn more:

- How Much Should You Have Saved In A 529 Plan By Age

- What happens to your 529 plan if your kids don’t go to college?

140. Track All of Your Education Expenses

There are a number of tax deductions and credits available to students. At the end of the year you may be able to save money on your taxes but this is only possible if you have the numbers recorded to back it up. Tuition, fees, books, and even mileage can be deducted.

141. Pay Off Your Student Loans ASAP

The average college graduate in 2016 left college with a whopping $37,172 in student loan debt. Talk about an anchor holding you down! If this is you, your number one priority needs to be wiping these out.

The whole reason I’m spending time to write this guide is to help you NOT take on student loans. But if you must… at least get a decent interest rate and pay them off as soon as possible.

Jonathan Mendonsa, Founder of ChooseFI

“Paying off the student loans aggressively was by far the most difficult and tedious decision, but my life is so much simpler and less expensive without it that I would make the same choice today. I found that while I might regret a purchase of a new gadget #buyersremorse. I never regretted looking back and seeing that my loan balance had gone down. My cash flow is so much better and I can embrace risk because of my newly achieved financial flexibility.”

9 Random Money Saving Tips to Ramp up your Savings

142. Find a “Go-To” Gift

Coming up with awesome & cheap gift ideas is always a challenge for my wife and I. We either forget to buy something ahead of time or we struggle to find a decent gift that we can afford. I highly recommend coming up a couple of “go-to” gifts that won’t break the bank, but will impress the one receiving it.

143. Understand the Healthcare System

This money saving tip comes from one of my new favorite bloggers, RogueMD.

“Once you understand why a system penalizes certain behaviors, you can make the system work for you. The US healthcare system isn’t designed to help you improve your health. Once you understand how and why it penalizes you, you can use it to make yourself healthier and more financially prosperous.”

The Financial Folly of the U.S. Healthcare System

144. Cheap / Free Exercise

You don’t have to have an expensive gym membership to get and stay in shape. All it takes is discipline and a willingness to think outside of the box. Spend some time outdoors, go on walks, get a bike, or start a frisbee group.

If you have the space, look on Craigslist and see what it would take to set up a home gym of your own. Warning though, the home gym fanatics I know never hit the point where they have all that they need.

My buddy, Miguel from TheRichMiser, has an awesome post on why he invested in a home gym.

145. Go Camping

Entertainment doesn’t have to be expensive, but it might take some creativity to come up with ideas to do it for cheap or free. And you may have to convince others to join you. One of the best ways to have fun for cheap is to go camping! 2020 was the year we really got out of the house to get out in nature.

If you are new to it, check out these awesome camping essentials!

146. Sell Stuff You Don’t Use or Need

Over time, we all have a tendency to accumulate stuff like books, movies, furniture, clothing, video games, etc. If you have already gotten all of the value from a product then try to resell it on Ebay, Craigslist, or your local Facebook resale groups. The longer they sit in your apartment or house, the less valuable they become.

Here’s a great guide on how to make money on ebay!

Take time once a year to do a cleaning purge and a home inventory. Sell everything you can and donate the rest. Here is a list of the best Craigslist alternatives to sell stuff that might help you out!

147. Contribute to a Health Savings Account

This one is tricky, but if you are eligible for a health savings account (HSA), then you absolutely need to be taking advantage of it. They are considered by many to be the ultimate savings account because you get to combine the tax benefits of a traditional IRA with the future withdrawal benefits of a Roth IRA. One of my blogging friends has written a post all about how he uses his HSA: Why I’m Saving HSA Receipts Again

148. Check Out Your Local Library

I’m a huge geek when it comes to libraries. If you love reading and are always buying books, then go check out your local library. It can be an easy way to save hundreds a year or… it will just free up enough money to buy the books your library doesn’t carry.

149. Groom Your Own Pets

Here’s one more way to save money on pets… Getting your dog groomed doesn’t have to be expensive. Buy yourself some clippers and trim them yourselves! Our dog needs a haircut every couple of months and our local groomer costs around $40.

This one money saving tip saves us around $240 each year.

150. Split the cost on Netflix / Hulu / Amazon Prime

Find 2-3 friends who you trust and split the cost on monthly services such as Netflix, Hulu, Amazon Prime, etc. This may not save you the big bucks, but an extra $50-60 a year can add up.

Next Steps

If you’ve made it this far, then congrats! I hope you’ve found some new ways to save money and cut costs.

Now, can you do me a HUGE favor?

It would make my day if you would share this massive list of ways to save money on your favorite social media platform!

Join me in the comments below and let me know if you’ve got any money saving tips that should be added!

#26. Pocket your frugal wins. This is one I’ve been terrible at. You’re only saving money on things like not having cable if that money actually ends up in savings at the end of the day. We’ve always been good about not spending on the consumerist stuff, but then we end up spending more money on books/tools/food/craft beer. In order for it to be savings, I have to pretend it’s “spent” and immediately move the money, or it just ends up getting spent on other things.

Totally! That is one I’m definitely working on this year–to actually save the money whenever we “save money” on something.

Woohoo thanks for this article! So much great advice here. Bookmarking to refer back to over and over again.

Glad it was helpful! Thanks again for contributing!