Everyone has a different financial personality. You’re either a spender or you’re a saver. Maybe you’re genuinely somewhere in between or you have spending habits where you spend and others where you save, but generally… you lean one way or the other.

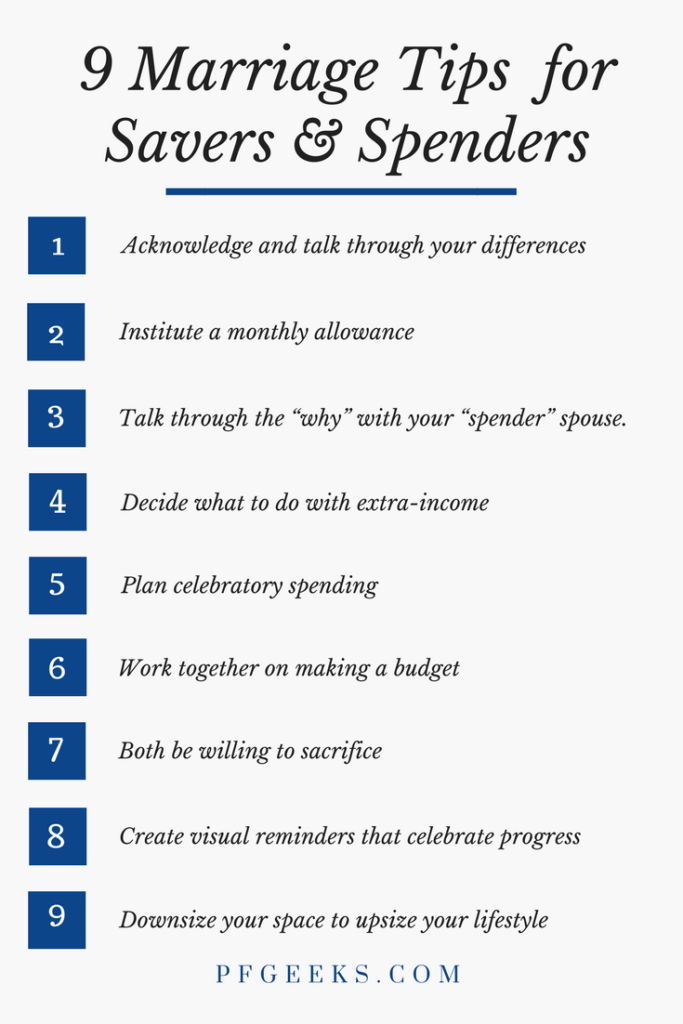

9 Great Money Tips for Spender and Saver Marriages

When it comes to marriage there are three possible money-spending habits dynamics for a spender or a saver out there.

- Two Savers

- Two Spenders

- One partner is a saver, and one is a spender

Contents

- Here Are 9 Helpful Tips for Saver Spender Marriages

- 1. Acknowledge and Talk Through Your Differences in Spending Habits

- 2. Institute a Monthly Allowance

- 3. Talk Through the “Why” With Your “Spender” Spouse

- 4. Decide What to Do With Extra Income

- 5. Plan Celebratory Spending

- 6. Work Together on Making a Budget

- 7. Both Be Willing to Sacrifice

- 8. Create Visual Reminders That Celebrate Progress

- 9. Downsize Your Space to Upsize Your Lifestyle

- Wrapping It Up

Here Are 9 Helpful Tips for Saver Spender Marriages

1. Acknowledge and Talk Through Your Differences in Spending Habits

Honestly, this step would hopefully come before you say your “I do’s”. People spend money differently, and talking through finances is an essential part of dating and engagement.

For my wife, she grew up in a well-off family with a good financial status, but they spent their money on private school education. Her parents were huge Dave Ramsey fans and so for 10 years, my wife believed her family was severely in debt (mortgage debt) because every time she asked for something that’s what she heard.

Well, now that I am not in debt and saving 50% of my income, she doesn’t see the need to save more than I already have. Why not enjoy life a bit more?

On the other hand, I grew up in a solidly upper-class family. I’m not ashamed to admit that. My grandpa and dad were incredibly successful in their careers. They worked hard and took advantage of every opportunity they were given. They both provided well for their families and have given their kids a head-start in life. I’m thankful for that, not ashamed of it.

I want that same security and I want that same level of comfort. More than that, I want to be the kind of dad and grandpa that they were.

My mentality is this: If I want to provide for my kids and live the comfortable life I desire then I’ll have to make sacrifices to get there! The only way to do that is to scrimp, and focus on my saving habits while I’m young, and let compound returns take care of the rest.

Here are a few of my favorite books on marriage! If spenders and savers want to get better at communicating and loving each other well, check them out

1. Mingling of Souls by Matt Chandler

2. Catching Foxes by John Henderson

3. Next up: Meaning of Marriage by Tim Keller

2. Institute a Monthly Allowance

I know this one might seem childish, but it has been a life-changer. The first year of marriage I might as well have been “Mr. No”. Every time my wife asked to buy something big, I said no. She thought I was unfair and at the same time, I thought she was spending money like crazy on dozens of $8-15 purchases.

I was being unfair and dictatorial about money, and she was spending money like crazy. I have put into place a monthly allowance that could be spent ANY way I like with more pleasure.

If I wanted to spend all of mine on starting a blog and buying fancy coffee while studying, I could–and I did! If she wanted to spend it all with more pleasure the first week of the month, she could–and she did!

3. Talk Through the “Why” With Your “Spender” Spouse

If you’re the one reading a personal finance blog then I’m just going to assume that you’re the saver in your marriage. One of the best spending habits you can do is share the “why” with your spouse. Why do you care about saving money? What are your financial goals? Why is this important to you?

My wife probably thought I was just being selfish and greedy. It totally changed her perspective when I shared with her that I’m trying to be frugal with my spending habits now so that I can be a great provider.

4. Decide What to Do With Extra Income

This one is hugely (bigly?) important. Once I had a monthly allowance in place, I thought I was all set. No more arguing, no more debating, just pure marital bliss.

Wrong!

If you’re in a spender or a saver marriage, then you definitely need to put together a plan for when your income increases, AND you should do this before it actually happens. I had it all together until I got my year-end bonuses.

Me: “Great! Time to put this into the IRAs.”

Her: “Let’s go buy a new couch!”

Same thing happened when I got a raise.

Me: “Time to go change my automatic withdrawal, so I don’t inflate my lifestyle”

Her: “Now I can move into a nicer apartment!”

This is what has worked for me: any extra income from job raises is automatically saved for retirement and split the bonus into fun money and my future house downpayment.

5. Plan Celebratory Spending

Have you ever gotten into a fight over how much should or shouldn’t be spent on birthdays? For all the saver-spender marriages out there, take some time to budget and be on the same common ground on how you’ll enjoy spending and celebrating some of the bigger events that come up every year.

- How much are you going to spend on each other’s birthdays?

- What about your anniversary?

- Do you have an allotted gift amount for Christmas?

- Wedding gifts?

Those are great spending habits to iron out ahead of time! My wife and I know exactly how much I plan to spend on each of those enjoyable activities.

6. Work Together on Making a Budget

This one should be totally obvious, yet SO many spenders and savers mess this up, including yours truly. Usually, the saver in the relationship puts together a budget and then forces it to be run by their spender or a saver partner. The spender or a saver gets no say in how the budget looks, and then by the end of the month, you’re back to arguing.

The best thing spenders and savers can do as a couple is make a budget together that will meet your shared goals. The more involved both of you are the more successful you’ll be together,.

7. Both Be Willing to Sacrifice

Marriage is about working together, compromising, and loving each other well. This post isn’t meant to let the saver get their way and just learn how to “manage” their spender or a saver spouse. I truly want y’all to learn how to work together to save money and have a better marriage.

To do that, both halves of a marriage have to be willing to sacrifice and compromise.

8. Create Visual Reminders That Celebrate Progress

Research shows that most spenders tend to love the feeling of tangibility when it comes to money. My wife loves being able to hold, use, see, or take advantage of something that money has bought her. Every time she lights a candle she gets to enjoy that $8 purchase.

She knows that my retirement accounts are growing, that my emergency or rainy day fund is fully loaded, and that I am on track to buy a house. None of those quality items feel real to her because she doesn’t see progress. If your significant other is the same way, I HIGHLY suggest putting together some visual reminders.

Here are 8 things you could make visual reminders for:

- Student loan payoff

- Credit card debt

- Retirement accounts

- College tuition for kiddos

- Your “Freedom date” for those chasing financial independence

- Vacation fund

- Emergency fund and rainy day fund progress

- Total Net Worth

9. Downsize Your Space to Upsize Your Lifestyle

Two years ago my wife and I downsized out of necessity. I had been unemployed for several months and was about to start a 6 year long grad school program. I lucked into an amazing deal on a one-bedroom here in Houston and my living expenses (rent + util) went down by about $600/month.

After two years of living here, with back to full-time incomes and saving over 50% of it all. I’ve been thinking lately about moving out into a bigger place but I cringe at the idea of seeing my monthly living expenses double.

So for now, I’ve come to a compromise. As long as I am living here, I’ll live it up and still come out ahead. Downsizing your living space is a great way to upsize your lifestyle. I am embracing some lifestyle inflation. If you don’t mind a smaller or not-updated place to live, then this can be a great way to save money and enjoy some of your favorite luxuries.

Wrapping It Up

To everyone out there in a spender or a saver marriage, hope is not lost! You can still save money, plan for retirement, AND be happy together. It takes work on your money habits, and it will definitely take some compromise. But more than that, it takes communication.

If you get anything out of this post, then I just hope you walk away knowing that you need to communicate better with your spouse.

I would LOVE to hear what you think about money habits in the comments below. What advice would you have to those in a spender or a saver marriage? What has worked for you?

Fantastic post Rich. I think you’re right that most couples have a spender/saver relationship. I think it’s partially because even with two savers, somebody always more of a saver and seems like a spender to the other. It’s hard to know for sure but I believe that my wife is a saver at heart. Yet, compared to me, she seems like a spender because I have a very strong saver mentality.

She knows we’re doing well saving so encourages me that spending some today is okay. I know we are doing well saving but have not reached our goals. I want to save more. When you put us together I think we balance the YOLO and the savings pretty well. That’s really the key right? Finding the right balance.

I think the tips you have are great. We’ve never downsized per se’ but we have lived in “small” places well below our means for all but two years of our adult lives. Those decisions alone let us “live it up” while still saving quite a bit.

Jason, you are totally right! There is definitely a spectrum and so even though you might both be savers compared to the rest of the world, you are further to that side than she is. That’s how my wife and I are honestly. It sounds like we have a pretty similar marriage dynamic! My wife keeps me focused on enjoying the present and having fun. Without her, I’d probably live my whole life looking 5 years down the road.

Number 7 all the way. In fact, that could be the nutshell tl;dr of this article, and really any article having to do with relational intelligence. Always be willing to compromise while keeping hold of your needs and respecting your partner’s needs. Nicely done!

You’re exactly right! Marriage is really all about being willing to compromise and meet your partner where they’re at. This entire posts comes to compromise and communication, both of which are signs of a healthy marriage.

Number #3 was the big one for us – having a why of our financial goals and not just saving to save. We were never big spenders individually too so that helped a lot

That’s cool to hear! My wife and I are both generally frugal although I’m much more of a saver. Finding our “why” was probably the key to getting on the same page.

I think it’s possible to have 2 savers. But even then, no one is going to be a complete miser. Each party is going to have things that he/she wants to spend money on but the other doesn’t. It’s just about compromise.

Definitely! You can have two savers, but one might be more hardcore/strict about it. OR each of the saver will have their more “spendy” areas of the budget. I’m definitely a saver but have a weak spot for eating out whereas my wife loves to buy things for our apartment.