Compared to the low national savings average of around 0.16% APY, online savings accounts such as CIT’s Savings Builder account offer competitive rates. In this CIT Savings Builder Review, I look closely at this online savings account to help you decide whether it is a good fit for you.

Contents

CIT Savings Builder Review – General Overview

CIT’s Savings Builder account fairly lives up to its name; it helps you build your savings while enjoying decent yields. Admittedly, its 1.00% annual percentage yield (APY) is not the most tantalizing, especially compared to the more prestigious CIT Bank Savings Connect (3.00% APY).

However, if you want to cultivate a healthy saving culture on a better-than-average interest rate, this account might just be what you want. By the end of this review, you should comfortably decide whether the CIT Savings Builder is the right saving partner for you or consider alternatives.

Let’s start with the basics.

What Is the CIT Savings Builder Account?

Savings Builder is an online savings account by CIT Bank (an online-only division of First-Citizens Bank & Trust Company). This is one of three popular savings accounts from CIT.

The other two are:

- Savings Connect with 3.00% APY

- Money Market with 1.55% APY

As you can see, the Savings Builder account has the lowest APY compared to the other two accounts. At the same time, all three accounts require a $100 minimum opening deposit, and the other two pack other attractive perks that the Savings Builder doesn’t have.

However, this savings account still comes with several benefits, such as:

- Zero monthly fees

- Zero transfer fees

- Easy funds transfer

- Daily compounding interest

- Ability to deposit checks remotely

How Does the CIT Savings Builder Work?

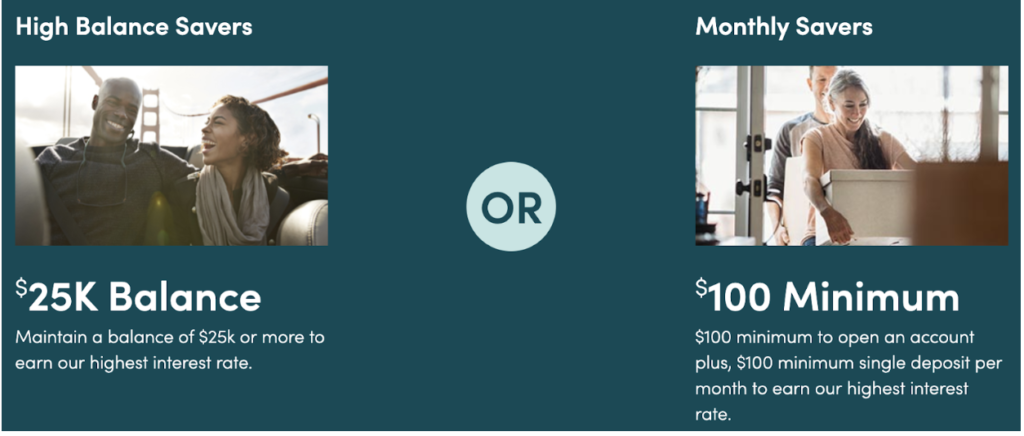

The Savings Builder is a tiered-rate account. This means that the APY varies depending on how much you are holding in the account. To understand this better, let’s circle back to the account basics. So, the Savings Builder account offers up to 1.00% APY. This is the upper-tier rate.

However, to consistently qualify for this rate, you will need to satisfy at least one of two requirements:

- Have a minimum balance of $25,000

- Deposit at least $100 into your account every month. This is also the minimum opening deposit.

Now, if you fail to meet these requirements before evaluation day (4 business days until the end of the month), your APY will be downgraded to a base tier of 0.4% the following month. As a welcome offer, you also enjoy a 0.995% interest rate for the first month you open an account.

Main Benefits of the CIT Savings Builder Account

The Savings Builder Account comes with several notable benefits. These include:

- Zero maintenance fees – Apart from the $100 minimum opening deposit, you will not pay account opening fees or maintenance fees.

- Free bank transfers – You will be able to transfer funds to any US bank account for free. However, if your account balance is below $25,000, you might be charged $10 for outgoing wire transfers.

- Remote check deposits – You won’t have to physically deliver the check to a brick-and-mortar bank

- High APY – According to CIT, their APY for the Savings Builder account is seven times the national average.

- Daily compounding interest – This allows you to grow your savings much faster

- Helpful resources – CIT’s resources page has several tools to help you better understand your saving potential. These include account calculators, CD calculators, forms, and frequently asked questions (FAQS).

- Low monthly payments – If you are serious about building up your wealth, putting aside $100 monthly for your Savings Builder account should not be a problem.

- FDIC insurance – CIT has partnered with the Federal Deposit Insurance Corporation (FDIC). This means that if the Bank stops operation, you will be paid up to $250,000. That is the maximum amount you should save with this bank.

What I Don’t Like About the CIT Savings Builder Account

While I believe that this is the best savings account for beginners, it does come with a few setbacks. Several things could be improved to make this account even better.

Here are some concerns I have.

- Inability to use ATMs can be inconvenient: While most online banks do not issue ATMs, it would make it much easier to access your savings as soon as you need them. The current process of requesting a check or sending the money to your bank takes time and might not come in handy during an emergency.

- The tiered APY model is a bit unfair: While this encourages you to keep saving, only some have access to $100 per month. Some people might find it discouraging if their APY is downgraded.

- The lower tier APY is, well, low: Reducing APY to encourage people to save money consistently is a good strategy. However, reducing it by more than half is aggressive and might discourage some people from saving. I am guessing that is the exact opposite of what the tiered interest model is meant for.

- Customer service can be improved: customers can only contact the support desk through the phone. While you can get help faster this way, people who need to improve at or be able to explain themselves verbally might prefer email or other online options. Several customers have also complained that they might hold you for more than 20 minutes before you can speak to an agent.

So, Who Should Use the CIT Savings Builder Account?

CIT’s Savings Builder account might not be the right fit for everyone. While I think it has some decent perks, people who want to use ATM, access high constant APY, or enjoy flexible and reliable customer services might want to consider alternatives.

So, who should use this savings account?

- People who want to build a good saving habit – If you keep saving $100 every month for long enough, you will get accustomed to saving and develop a good saving habit.

- People who want to maintain a high balance: If you can afford the $25,000 required minimum amount, you can maintain a high balance in your account.

- People who want to build an emergency fund: The Builder Savings account is a great way to build an emergency fund since it encourages you to save every month or maintain a decent balance in your account.

- People who use CIT bank: If you bank with CIT, this would be your ideal starter account. You can also easily access their other products, such as money market accounts and CDs.

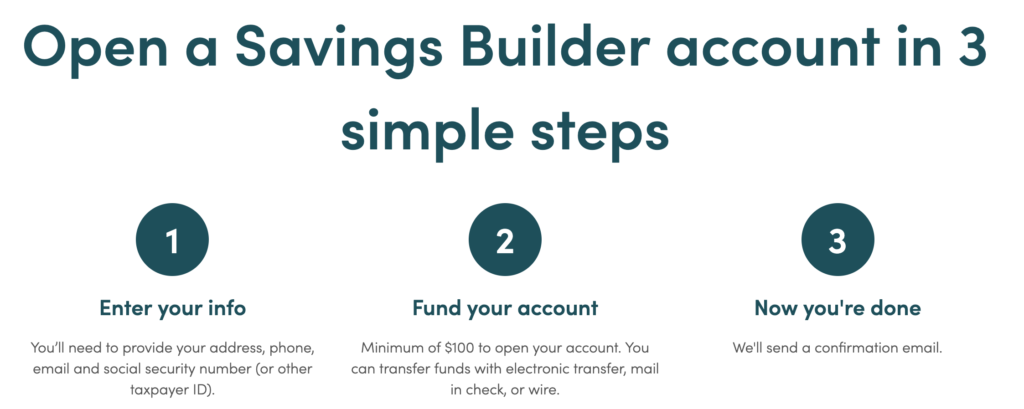

How to Open a CIT Savings Builder Account

So, if you think this CIT savings account is the right fit for you and are ready to open an account, I will show you how to do that. Lucky for you, the whole process is simple and only takes about five minutes.

Here is how to do it:

- Visit the Savings Builder page on the CIT website

- Click on Get Started. You will be redirected to a new page where you can either open a new account, open another account if you already have one, or continue updating an existing account.

- If you want to open a new account, click on Open Account Now. You will be taken to a registration page.

- Choose the type of account you want to open. That is Personal or Custodial

- Next, select Savings & Money Market from the Product Type dropdown menu

- Choose Savings Builder

- Click on the Continue button

- On the next page, fill in your personal information and then click on Save and Continue

- You will receive an email confirmation that your account has been opened

Conclusion

CIT’s tiered interest model encourages users to keep saving every month to enjoy the 1% APY. In particular, people who don’t have $25,000 lying around will need to deposit $100 every month to enjoy decent interest. This means that you can build a consistent saving habit while also maintaining a high balance in your account.