Did you know: according to a recent survey, nearly 43% of Americans have less than $1,000 in savings? It’s a staggering statistic, but it doesn’t have to be your reality.

If you’re looking to build a solid financial cushion, save for a down payment on a home – or even go on a dream vacation – you can achieve it by saving for it beforehand using the right budgeting strategies and tools.

In this post, I’ll share some practical and proven tips on how to save $10k in a year successfully.

Let’s dive in.

Contents

- How to Save 10,000 In A Year – 10 Expert Tips To Ultimate Saving

- Setup A Tailored Monthly Budget Using AI-Powered Budgeting Apps

- Lower Your Monthly Bills

- Keep Track Of Your Expensive Spending Habits With Spending Tracker Apps

- Take Advantage Of The Benefits Of Compound Interest

- Automate Your Savings

- Cook At Home

- Create Ways To Generate Passive Income

- Sell Unnecessary Items

- Thrift More Often

- Don’t Throw Away Your Coupons

- Key Takeaways:

How to Save 10,000 In A Year – 10 Expert Tips To Ultimate Saving

Here are 10 expert tips to help you get started on your journey of saving 10,000 in a year.

Setup A Tailored Monthly Budget Using AI-Powered Budgeting Apps

I know that creating a budget can be a daunting task, especially if you’re not sure where to start!

Luckily, AI-powered budgeting apps can help simplify the process and make it easier for you to set up a budget that works for your unique financial situation:

- They use machine learning algorithms to analyze your spending patterns and help suggest a personalized budget that suits your needs

- They allow you to set savings goals and track your progress toward achieving them.

- They help provide a better understanding of your overall financial health – which can help you make more informed decisions about your money

- They can also track your expenses in real-time, so you can see exactly where your money is going and make adjustments as and when needed

22seven is a good example of an AI-powered budgeting app that does pretty much what a financial advisor would do to boost your financial strategy.

The app analyzes your bank accounts, credit cards, and other financial statements to analyze your spending patterns and help you identify areas where you can save money.

- For example – 22seven can help you identify recurring subscription charges that you may have forgotten about, such as gym memberships or streaming services, and help you cancel them to save money.

- These apps can also suggest ways to cut back on discretionary expenses – such as eating out or buying coffee, by showing you the total amount you’ve spent in those categories over time.

- Lastly – it can also provide personalized recommendations on how much you should be saving each month to meet your goals.

Lower Your Monthly Bills

By reducing the amount you pay for regular expenses – like utilities, insurance, and subscriptions – you can free up more money to put toward your financial goals, pay off debt, or invest in your future.

You can lower your bills by:

- Negotiating your bills

- Upgrading your home with energy-efficient features

- Shopping around for better prices

Negotiate Your Bills

Negotiating your bills is always worth it according to most experts – especially if you’re planning on cutting any or all extra expenses you have to reach your goal of saving 10,000 in a year.

- One way to lower your monthly bills is to negotiate with your service providers.

- Many companies are willing to offer discounts or promotions to customers who ask – especially if you’ve been a loyal customer for a long time.

- For example – you could call your internet provider and ask if they have any current promotions or discounts that you could take advantage of.

Top Tip: You could also ask if they can lower your monthly bill in exchange for a longer contract or if you bundle services with them.

Bring Down Your Energy Requirements

Similarly, upgrading your home with energy-efficient features can also help you save money on your monthly bills.

Plus, reducing energy usage also has a positive impact on the environment. Talk about a win-win situation!

Some energy-efficient household upgrades you should consider include:

- Installing energy-efficient appliances or light bulbs

- Adding extra insulation to your home by upgrading to double-pane windows and doors

- Installing solar panels to curb energy requirements

These upgrades may require an upfront investment – but they can save you money on your energy bills over time.

In fact, most energy-efficient household upgrades tend to pay for themselves in less than three years.

You can find out a rough estimate of the return on investment, payback times, and yearly savings for your next household upgrades using this Home Energy Saver tool.

Top Tip: If you’re one of the 36% of Americans planning on installing solar panels to bring down energy costs, consider using AI-powered tools like EnergySage to make sure you get the best deal on your solar installation.

The platform uses AI to provide personalized solar quotes, which can help you find the best solar options based on your specific energy needs from pre-screened installers in your area.

Switch To A Better Service Provider

Lastly, you can also lower your monthly bills by shopping around, comparing prices, and going with the best value service provider’s services.

- This is especially true for services like insurance, where premiums can vary widely depending on the provider

- By doing your research and comparing rates from different companies, you should be able to find a policy that offers the same coverage at a lower cost

Keep Track Of Your Expensive Spending Habits With Spending Tracker Apps

Personalized AI spending tracker apps like Cleo are essential if you want to meet your goal of saving 10k in a year.

Here are some of the benefits of monitoring your splurging habits:

- According to a recent survey – a pretty significant 65% of Americans have no idea how much money they spend on non-essential purchases each month

- Another study by Rutgers University found that people who track their spending are more likely to stick to a budget and save money in the long run

- Americans as of 2022 have increased their impulse spending by 14% even though most of them have the same income they did last year

- A Yahoo survey found that at least 30% of Americans have credit card debt between $1000 and $5000 and the percentage seems to be increasing each year. Keeping track can help you avoid any debt since you will be able to identify areas you may be overspending.

Here are some ways a spending tracker app like Cleo and how can help you save money:

- They let you set spending limits: Once you’ve identified your spending patterns, you can use Cleo to set spending limits for different categories. This can help you stay within your budget and avoid overspending.

- They provide personalized insights and tips: AI-powered solutions also are able to provide personalized insights and tips based on your spending habits. This can help you make more informed financial decisions and save money over time.

- They help you stay accountable: By tracking your expenses using Cleo, you’ll be more aware of your spending habits and more accountable for your financial decisions. And because it’s powered by a quirky AI, it even roasts users when they fail to stick to a routine!

Take Advantage Of The Benefits Of Compound Interest

Compound interest is a powerful tool that can help you save money and grow your wealth over time.

It works by earning interest not only on the initial principal amount but also on the accumulated interest from previous periods. So, the longer your money stays invested, the more it will compound and grow.

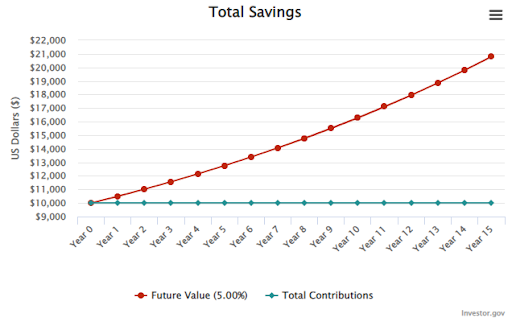

Here’s an example to illustrate the power of compound interest.

Let’s say you invest $10,000 in a savings account that earns 5% interest per year. After one year, you will have earned $500 in interest, bringing your total balance to $10,500.

In the second year, you will earn interest not only on the initial $10,000 but also on the additional $500 in interest from the first year. So, in the second year, you will earn $525 in interest, bringing your total balance to $11,025.

As you can see, the interest you earn each year continues to compound and grow over time.

Eventually, 15 years down the line, you’ll have more than doubled your initial investment and should have around $20,790 in your bank account.

Now, remember, this example is based on a relatively low-interest rate of only 5% and an investment of just 10k, in reality, the profits can be much higher, depending on the investment option you choose and how much you put into your account.

So, how can you take advantage of the benefits of compound interest to save money? Here are some tips:

- Start saving early: The earlier you start saving, the more time your money has to compound and grow.

- Make regular contributions: Consistently making contributions to your savings account will help you double your savings and maximize the benefits of compound interest. This could be a monthly or bi-weekly contribution, or even a small amount every week. Even small contributions made over a long period of time can add up to a significant amount of money.

- Choose the right savings account: Look for a savings account that offers a high-interest rate to maximize the benefits of compound interest. You may also want to consider investing in a mutual fund or another investment vehicle that has historically provided a higher rate of return.

- Reinvest your earnings: Reinvesting your earnings can help you take advantage of the compounding effect. This means that you let your interest accumulate and earn interest on that interest, which will help your savings grow even faster.

Top Tip: For a much more in depth look at how you can use the beauty of compound interest to your advantage – read my How To Turn 10k Into 100k article here.

Automate Your Savings

Automating your savings is a simple yet effective way to save money without even thinking about it.

With automation, you can set up a regular transfer of a fixed amount from your checking account to your savings account, investment account, or retirement account.

This means that a portion of your income is automatically set aside each month, which helps you build your savings without having to do a thing.

By automating your savings, you can:

- Stay consistent with your savings plan

- Avoid the temptation to spend money that you intended to save

- Make your savings a top priority in your budget

- Reduce the stress and effort of manually transferring money to your savings account

Top Tip: To get started with automating your savings, contact your bank or financial institution to set up an automatic transfer of funds from your checking account to your savings account. You can also use a budgeting app that offers automated savings features, such as Qapital or Digit.

Cook At Home

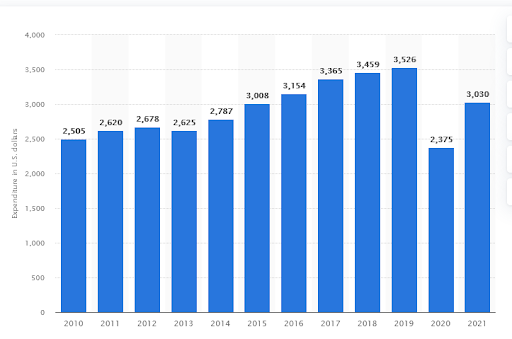

According to a study on Statista, in 2021 the average American household spent over $3,030 USD on food away from home.

That’s a significant amount of money that could be saved by cooking at home instead.

Cooking at home is almost always going to be cheaper than going out and it helps you save money in several ways:

- Ingredient costs: When you cook at home, you have more control over the ingredients you use, which means you can often buy them at a lower cost. You can also buy ingredients in bulk, which can save you money in the long run.

- No extra taxes: Along with the annual taxes an American has to pay, eating out also involves paying taxes on the food you eat.

- Leftovers: If you cook enough food to last for multiple meals – or cook in batches – you can save time and money by not having to cook as often.

- No extra tips: Eating out involves tipping for services. The average tipping percentage varies from 15% to 20% in America. Another extra expense you won’t have to worry about when you cook food at home.

- No travel expenses: When you eat out, you often have to drive or take public transportation to get to the restaurant – which can add up over time. By cooking at home, you eliminate these travel costs altogether.

- Less travel time: You can save time by not having to travel to a restaurant by having meals pre-prepared at home – which can be especially helpful if you have a busy schedule.

- Portion control: When you eat out, the portion sizes are often larger than what you would eat at home. By cooking your own meals, you can control your portion sizes – which can help you save money on food costs.

But I know the cooking process can get boring really fast – especially if you’re making the same dish every day.

That’s why I recommend giving the following AI-powered cooking recipe software a try. They do pretty much exactly what they say on the tin and can make the cooking process more easier and fun:

- Whisk: Whisk helps generate personalized recipe recommendations, creates shopping lists – and can even order groceries from your favorite stores with the help of AI.

- FoodAI: An AI-powered recipe generator that uses machine learning to find and organize recipes based on the user’s dietary preferences and restrictions.

- Cookpad: A recipe-sharing platform that allows you to search for recipes based on ingredients, meal type, and cuisine, and even generates shopping lists to help you stay organized. And – for those really passionate about cooking – it also allows you to connect and chat with a like-minded community of culinary enthusiasts.

Create Ways To Generate Passive Income

Creating ways to generate residual income is a great strategy to increase your savings. Not only is it an excellent way to earn money but it still lets you have time for other pursuits.

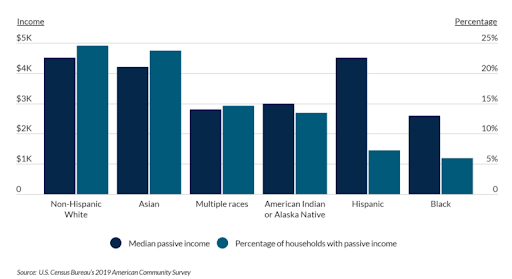

Unfortunately – according to the U.S. Census Bureau – only about 20% of us have a means of passive income.

This is where new AI tech can come in handy. With the help of AI-powered tools, you can easily identify and create new opportunities for passive income.

Here are a few examples:

- Robo Advisors: Robo advisors are digital platforms like Wealthfront and Betterment that use AI algorithms to provide investment advice and portfolio management services. These tools use AI tech to analyze your financial situation and recommend the best investment options based on your risk tolerance, financial goals, and other factors.

By using these tools to manage your investments, you can potentially generate passive income – without having to actively manage your portfolio.

- Automated Trading Bots: AI-powered trading bots can help you earn passive income by automatically executing trades on your behalf. These bots use machine learning algorithms to analyze market data and identify profitable trading opportunities.

Examples of such bots include commas and Pionex.

- Chatbots: AI-powered chatbots can help you generate passive income by automating customer support, sales, and lead generation. By providing 24/7 customer support, chatbots can help you save time and money – while also improving customer satisfaction.

- If you’re good with coding, you can even consider making one yourself and creating your own AI SaaS business – like Tars and ManyChat has.

Sell Unnecessary Items

Did you know that on average, Americans have more than 300,000 items in their homes?

While this number may seem staggering, most of these items are not necessary and are just taking up space. In fact, you can turn your unwanted items into cash by selling them.

So, go through your closets, garage, and attic and start listing those items that you no longer need on online marketplaces – like OfferUp, Facebook Marketplace, and eBay. You’ll not only declutter your space but also make some extra money toward your savings goal.

Here are a few examples of things that you might have lying around the house that may be worth a lot:

- Rare Books: If you have any first edition or rare books lying around the house, they could be worth quite a bit of money. Be sure to go through your collection carefully because most of us aren’t even aware if a book is rare or valuable. For example, see how Jared Padalecki mistakenly nabbed a first edition James Bond Novel that seems to be valued at more than $3,500 from his “Gilmore Girls” drama set.

- Old Trading Cards: Even sports trading cards can be worth a significant amount of money to avid collectors – especially if they are rare or in good condition.

The same goes for pokemon cards. Did you know Youtuber/Influencer Logan Paul recently bought a Pokemon card worth $5.275 million?

Even if you don’t have a rare card, a collection of cards in good condition could still be worth a substantial amount.

- Retro Gaming Consoles: If you have old gaming consoles gathering dust in your attic, you could be sitting on a gold mine. Vintage gaming consoles – like the NES and Sega Genesis – can be worth hundreds or even thousands of dollars to collectors. For example, new-in-box (NIB) copies of the Nintendo 64 are still being sold at $250,000 on eBay today.

Even if your consoles aren’t NIB, they could still be worth a significant amount, especially if they are in good condition and come with original packaging and accessories.

- Lego Sets: Lego sets are not just for kids. They can also be valuable collector’s items, especially if they are rare or discontinued. Some sets can even increase in value by several hundred percent over time.

In fact, according to one study on ScienceDirect, Lego sets yield an average ROI of 11% annually, more than gold and other traditional investments.

So, if you have any old Lego sets lying around, you might want to check their value on sites like BrickEconomy or eBay and consider selling them to earn some extra cash.

Thrift More Often

Thrift shopping can be a great way to save money on everyday items, reduce waste, as well as net you some unique and interesting finds.

According to CNBC, thrift store shoppers on average can save up to $150 a month or almost $2,000 yearly. This potentially means that by shifting to thrifting, you can easily hit one-fifth of your target of saving 10k in a year with ease.

The prime example of a great thrifter is Canadian TikToker Ashlee who finds designer items for cheap prices in Thrift stores. She saves thousands of dollars and never goes out of fashion!

Don’t Throw Away Your Coupons

Coupons are a great way to save money on everyday purchases, yet many people throw them away or forget to use them.

But did you know on average coupon users report a 7% savings on their grocery bill with coupons?

A typical family is set to save around $10 per week using coupons – that may not seem like a lot but that adds up to be more than $520 a year.

So, don’t throw away your coupons – make it a habit to check for coupons before making purchases and take advantage of the savings they offer.

Over time, these small savings can add up and help you reach your goal of saving $10k in a year.

Top Tip: In addition to traditional paper coupons, there are also digital coupons and cashback offers available through apps and sites.

For example – Rakuten offers cashback on purchases made through their platform (as well as a free $10 on the first sign-up), and Honey automatically applies coupon codes at checkout letting you potentially save an extra $126 annually.

These tools can make it easy to save money without much effort.

Key Takeaways:

- Nearly 43% of Americans have less than $1,000 in savings.

- AI-powered budgeting apps can simplify budgeting by analyzing spending patterns and suggesting personalized budgets and savings goals.

- Lowering monthly bills, including utilities and insurance, can free up more money to save.

- Bills can be lowered by negotiating with service providers, upgrading to energy-efficient features, and shopping around for better prices.

- Energy-efficient household upgrades can save money on energy bills over time, and tools like EnergySage can help find the best solar options.

- Shopping around and comparing rates from different companies can help find a policy that offers the same coverage at a lower cost.

- Personalized AI spending tracker apps like Cleo can help track expensive spending habits.

- Saving money requires discipline, but it can lead to a more secure financial future.

- Creating a budget can be daunting, but it’s an essential step towards financial stability.

- Small steps towards saving can make a big difference over time.

- Cutting back on discretionary spending can help increase savings.

- Personal finance is a skill that can be learned and improved over time.

- Saving for an emergency fund is crucial to avoid relying on high-interest loans or credit cards.

In conclusion – with the right approach and a bit of discipline – saving $10,000 in a year is an achievable goal if you have the right mindset (and if you embrace the AI help of apps!).

Personal finance is a skill that can be learned and improved over time, and saving for a $10k fund is crucial to avoid relying on high-interest loans or credit cards.

Remember to stay focused, stay committed, use my tips above – and always keep your eyes on the $10,000 prize. Once you get there, you’ll need to learn how to double your $10k!

Next: If you found this article helpful, consider reading my How to Save $5,000 in 3 Months guide.