Today I want to share one of my best tactics for sticking to a budget: a sinking fund. This one tip helps me avoid significant spending hits and allows me to avoid racking up credit card debt.

Contents

The Sinking Fund: Pros and Cons of Sinking Funds

With a sinking fund, you set aside a small amount of money each month for a certain amount before making your purchase. You set up your bank account to automatically transfer a monthly amount. Once you reach the amount you need, you can pause the transfers until you use the money saved in the sinking fund.

Once used, you can replenish the amount as needed. The sinking fund strategy is simple. Take the amount you expect to pay and divide it by the months you have until you need it. Let’s use Christmas as an example. If you roughly spend $600 on gifts for your family every year. Rather than wait until December to determine how you will pay for these gifts, make sure to set aside a small amount each month.

$600 / 12 = $50

This will allow you to get through the Holiday season without feeling like going into a budget crisis. Christmas is an easy one because it happens at the same time every single year. But sinking funds can also be used for one-time expenses. At its core, setting up a sinking fund is proactive planning. If you plan for as many significant expenses as possible so that your budget is more insulated from big-ticket spending.

What Is a Sinking Fund?

A sinking fund is a fund to periodically set aside money for the upcoming payment on an expense. A sinking fund is often used for annual recurring payments or significant future expenses such as home or vehicle repairs

Sinking Fund vs Emergency Fund: What’s the Difference?

All this talk about setting aside money saved each month for significant expenses might sound familiar. You can even save as much as $10,000 in 6 months if you follow a certain budget and financial tips! It’s easy to confuse emergency and sinking funds, but there is a straightforward difference that should help you out.

Emergency funds are for unexpected events that you don’t have control over. They are used when you get in a car accident, when your AC goes out, or to cover your expenses in case of an unexpected job loss. Emergency funds are used to protect you from the things you can’t predict.

On the other hand, sinking funds are set up for expected expenses. These are budget items you can reasonably plan for and predict. They happen every year, or you expect they may happen soon.

Types of Sinking Funds

There are several different types of sinking funds you will come across. The most common are:

- Callable Bond Sinking FundsCallable Bond Sinking Funds

- Specific Purpose Sinking Funds

- Regular Payment Sinking Funds

- Purchase Back Sinking Funds

Callable Bond Sinking Funds

A callable bond sinking fund is a type of investment strategy where a company or organization sets aside a specific amount of money in a fund to pay off a callable bond. This type of sinking fund is typically established when a company or organization issues callable bonds, which are bonds that can be redeemed or bought back by the issuer before their maturity date.

Example

A company may issue callable bonds with a maturity date of 20 years. However, the company may also establish a callable bond sinking fund, which allows them to redeem or buy back the bonds at any time after five years. This allows the company to have the flexibility to pay off the bonds early if they have the financial means to do so. It also allows the company to reduce the interest payments on the bonds and the debt on the balance sheet.

Specific Purpose Sinking Funds

These are sinking funds that are set aside for a specific purpose. You can establish this type of sinking fund for long-term projects or investments, such as building a house or purchasing a new car. The money in the fund can only be used for the specific purpose for which it was established.

Example

Let’s you want to buy a house in the next 5 years. This will cost you around $384,800 according to the National Association of Realtors. However, since you don’t want to take a full mortgage, you decide to save up to cover part of the costs.

So, you decide to set up a sinking fund where you save, say $2,000 every month for this specific purpose. In five, years, you will have around $120,000 to put toward your new house.

Regular Payment Sinking Funds

A regular payment sinking fund is a specific amount of money that you set aside on a regular basis, such as monthly or annually, to pay off a debt or to save for a future expense. You mostly use this fund to pay off a debt, such as a mortgage or a car loan, or to save for a future expense, such as a child’s college education.

Example

Let’s say you decide to establish a regular payment sinking fund to pay off a mortgage. You would set aside a specific amount of money each month into the fund, which you can use to clear that mortgage. This allows you to budget for the mortgage over a period of time, rather than having to come up with the funds all at once.

Purchase-Back Sinking Funds

A purchase-back sinking fund is mostly used by companies or organizations where they set aside a specific amount of money in a fund to buy back or repurchase their own stock. This fund is set up when a company wants to reduce the number of outstanding shares of stock in order to increase the value of the remaining shares.

What Is a Sinking Fund Used For? 7 Sinking Fund Examples

1. Vacation

Let’s say you know you have a backpacking trip next year or a destination wedding a few months down the road. Take the amount you expect the trip to cost and divide it by how many months you have left until you leave.

Set that amount aside each month into your sinking fund, and when the time comes, you can pay for it without worrying about paying the bills.

2. Car Insurance

One great way to save money on car insurance is by prepaying it every 6 months. So instead of paying $150 every month for 6 months at $900 total, you might be able to pay $850 upfront, saving you $50.

The trick is actually having the money saved ready upfront and then saving for the next bill 6 months later. A sinking fund can help you do precisely this.

Even better, you can automate your sinking fund to transfer automatically so that you don’t have to remember each month.

3. Car Repair or Tires

I’ll admit that this one is a little trickier to predict, but let’s say you look down at your tires one day and notice that the tread is starting to run low. Most people would shrug it off and try to ignore it for the next few months.

When the time comes, they put the tires on their credit card and rack up another $1,200 in high-interest debt. Not you. You’re better than that.

The same day you notice the tread starting to wear out, you set up a sinking fund for your tires. When you buy new ones, you can pay for them on the spot thanks to your sinking fund.

4. Contacts

My wife uses dailies for her contacts. I used to think this wasn’t a big deal until my first year of marriage when I choked on my lunch and saw a $400 bill for contacts. Being the inexperienced budgeted I was, I had the same shock a year later when I saw the bill again.

Now, I transfer $35 each month into a sinking fund, and when the time comes, the money saved is sitting there, ready to be spent.

5. Any Annual Memberships

If you have any memberships that are paid annually, then a sinking fund is a great way to spread the cost out per month. I have a Costco membership, so I deduct $5 each month into a sinking fund.

6. Home Repair, Appliances, or Furniture

This is another one that could fall into the emergency fund category, depending on how you look at it. I hope that all of you smart budgeters out there will plan as best as you can for possible house expenses.

For example, let’s say you just bought your first home. It’s an older house, so you know you will need to replace the AC unit in the next year or two.

The smart budgeter will start saving immediately for that upcoming expense in their sinking fund.

7. New Car

If you are driving an older car with some serious mileage on it, then you know that you are eventually going to have to replace it and you’ll need a sinking fund. If your 2005 Camry with 217,000 miles dies on you next week, that is something you should have been planning for.

Sure, you can’t predict when exactly you’ll need the money to buy a car. The more you plan, the less of a curveball this will throw at you.

How to Structure a Sinking Fund into your Budget

Most people love the idea of setting up a sinking fund. A sinking fund reduces financial stress, helps you budget for future purchases, and gives you a plan to stick to. How do you actually structure a sinking fund into your budget?

Easy. Here’s the full guide on using a zero -based budget to save more money! You could also check out the 50/30/20 rule for budgeting.

Income: How much you bring home each month

Fixed Expenses: These don’t change month to month. There may be wiggle room for you to negotiate these rates and lower them, but until you do, they are static.

- Rent

- Wifi

- Debt Payments

- Gym Membership

- Phone Bill

- Insurance

Variable Expenses: These change month to month. If you put the effort in, you can probably reduce some of these!

- Utilities

- Food

- Travel

- Eating out

- Gas

- Entertainment

- Etc

The problem for most people when they budget is that they stop after outlining their monthly expenses! And then, they get whacked every few months with a significant bill they should have been expecting.

The best thing you can do for your personal finances is to automate as much as possible. When you get slammed by unexpected expenses that could have been planned for, you have to adjust your savings plan for that month. Christmas comes at the same time every year! Why not start budgeting for it this January?

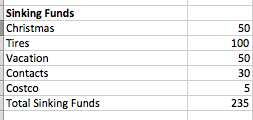

So here’s what you do. Set up a third expenses category and title it “Sinking Funds”. Underneath, list each of the significant expenses you know you have coming up. Use the sinking fund list above if you need some ideas! Next, input the “Amount Needed” and “Months Remaining”. And now you know the monthly amount you need to save for these sinking funds.

Sinking Fund Line-items

Finally, total them all up.

Now that you have a subtotal, your next step is to figure out where to keep your sinking fund.

Frequently Asked Questions

Why Are Sinking Funds Important?

The magic of sinking funds is that they keep your monthly budget steady. The best approach to saving money is to remove yourself from the process as much as possible. The more you can automate your saving and investing, the better.

Sinking funds require saving money, and planning for the future, this forward-thinking will actually help your budget stay consistent. You won’t be caught off guard by things you could have planned for, such as house repairs, vehicle maintenance, or trips. Sinking funds are essential because they help you plan for the future.

Where To Keep Your Sinking Fund?

This is where a sinking fund gets tricky. Don’t worry, I will hold your hand and walk you through the exact steps. There are probably a dozen sinking fund options for where to keep your money. I’ll walk through three sinking funds options from most accessible to most difficult to set up.

As you could probably expect, the most challenging sinking fund scenario is also the most rewarding. The key to all these sinking fund scenarios is to set up an automatic transfer each month, pulling money out of the account your money comes into from your employer and your sinking fund.

1. Savings account attached to your current bank

This is by far the easiest sinking fund option you’ve got. Whoever you do your regular banking with, set up a separate savings account.

Pros: Super easy to set up. All your money stays in one place.

Cons: The lowest interest rate. Your return is next to zero, and you lose money over time when you account for inflation.

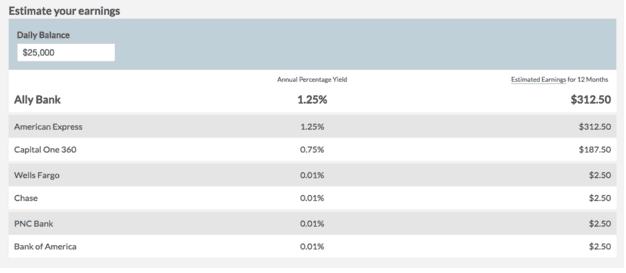

2. Online bank account

The only difference between this one and the first is the location. Big banks like Wells Fargo, Chase, and Bank of America have interest rates ranging from .01% to .09%.

An online bank like Ally offers 1.25% interest, roughly 100x as much as your traditional big banks.

3. Checking account with your insurance provider

This is another similar approach. Most auto insurance providers offer discounts if you can set up additional savings accounts. Depending on how much you have in your sinking fund, setting up different savings accounts is an easy way to get an effective 2-6% yield.

4. Bank account bonus hacking

While this is the most complicated sinking fund option, it yields the best results by a long shot. Banks frequently offer cash bonuses to attract new clients. You have the chance to take advantage of the free money.

I’m not going to pretend to be an expert on this, so I’ll point you to the #1 resource you need to know about: The blogger, Doctor of Credit.

A Beginner’s Guide to Bank Account Bonuses

Best Bank Account Bonuses

I’m putting those two guides into practice this year, and I’m looking forward to sharing my results.

Wrapping It Up

Setting up a sinking fund isn’t sexy or exciting, yet a sinking fund is one of the most intelligent budgeting decisions you can make. Do me a HUGE favor and comment below with any thoughts regarding sinking funds you have! I’d love to hear if you have any examples of what a sinking fund can be used for.