There is a killer on the loose wreaking havoc on retirement and saving accounts around the world. Year after year, a portion of your hard-earned savings are being withdrawn, often without your knowledge. You’ve worked hard, trimmed your budget, picked up a side hustle, automated your investing, and said “No!” to all of the materialistic desires that constantly beg to be fulfilled.

I have something to tell you.

Your retirement accounts are bleeding money. I’m completely serious. You are probably throwing away hundreds and maybe even thousands of dollars a year.

If you’re anything like me, you probably spent hours each week prepping meals, avoiding social outings that would break the bank, and trying to scrimp and save everywhere you can so that you can fill up your retirement accounts like a responsible adult.

Once you’re on the right track, all that’s left is to execute your plan day after day.

Except there is one critical part of the plan left…

Before I tell you, let’s make a deal.

I want you to pay me $300,000.

Here’s what I’ll do in return:

1. I will manage all of your retirement accounts for the next 30 years.

2. I can give you a 95% chance that I will under-perform the stock market.

3. I will invest your money across multiple different funds to make it seem so complex that you couldn’t do it yourself. After all, I have to maintain the appearance that you need me.

Sounds ridiculous right?

That’s the deal that most Americans have made.

Thankfully, hundreds of thousands of people are starting to realize that they can pay less in property management fees and property taxes while making better returns. There has been a mass exodus from actively managed funds to more passive investments such as index funds.

So what’s the culprit?

Operating expense ratio (OER)

Let’s Talk Fees

Your retirement account is probably be savaged by fees. Worse yet, you may not even realize it. These operating expenses and fees can add up to an enormous number over time, potentially hundreds of thousands of dollars! Typically, these fees are bundled up and all together make up your “operating expense ratio”.

The operating expense ratio (OER) oftentimes difficult to find, can make or break your ability to retire with enough in the bank.

The bad news is that no matter what your investment strategy is, if you are invested in the stock market, then you are paying fees of some kind. Whether you are an individual investor paying stock commissions to build your own portfolio, or your money is with a financial investment company that manages it all for you, each year a portion of your money is going out of your pocket and into someone else’s.

You must do everything you can to lower operating expense ratio or the amount being paid out in fees each year.

The good news is that you can do this yourself.

It doesn’t matter who you are and and or how little experience you have managing your own finances. If you are willing to put a bit of time and research in, you can put yourself in the best position to succeed. You have no control on how the market will over the next ten years, but you can control how much you throw away in operating expense fees or property management fees.

You can find the right operating expense fund for you that will maximize your returns and lower operating expense ratio. In fact, I don’t think you will find a better return on your time investment than ensuring that you have the right, low-cost investment funds selected to park your life savings in.

Your investment vehicle and the fees associated with it might be one of the most important investment decision you make in your entire life.

Give me 5 minutes of your time and let me show you how you could legitimately save hundreds of thousands of dollars by the time you retire.

So in this post I’ll explain what an expense ratio is, why it is critical to your investment success, what you can do to minimize it. I desperately want to help you find the fund with the best expense ratio available.

I highly recommend checking my Vanguard’s mutual fund, VTSAX (Review).

What is an Expense Ratio?

An expense ratio is simply the yearly cost of investing in a mutual fund, index fund, or exchange traded fund (ETF). In other words, it is the annual fee that all funds or ETFs charge their shareholders. That fee is used to pay for the ongoing cost of operating the fund which includes paying people to choose the fund’s investments, overhead administrative costs, and depending on the company, it covers the operational and maintenance costs of marketing the fund to potential investors.

Boring stuff done.

So what does this really mean?

Example:

If initial investment in a mutual fund has a typical, 1% expense ratio, then you’ll pay the fund manager or company $10 per year for every $1,000 invested. That may not seem like a big deal, but this is not a one-time fee.

Every year you are invested, that same original investment as well as its returns will get tagged with a 1% hit.

The problem is that these fees are sneaky. You don’t notice them because the gains in the market cover up the fees you are paying.

You don’t get a bill in the mail or an email notification, but once a year your portfolio will be reduced by your expense ratio percentage.

As you make deposits, receive employer contributions, and hopefully make positive returns in the market, more money each year will be pulled from your account.

The more money you invest, the more you pay in fees.

There really isn’t any way to get around this expense ratio. Every fund has one. But it is critical that you make sure you aren’t paying more than you need to. If the expense ratio is higher than it needs to be, then it will significantly drag down your portfolio’s return.

Saving for retirement with a high expense ratio is like swimming with an anchor or climbing a mountain with a 100lb weight.

What is considered a “low expense ratio”?

The good news is that the average expense ratio for funds of all types is trending lower year after year.

According to Morningstar’s 2016 research, “The asset-weighted average expense ratio across all funds was 0.57% in 2016, down from 0.61% in 2015 and 0.65% three years ago.” This is primarily due to the massive inflow of money being poured into passive, index-fund style investments that are designed to track market returns.

Here’s your litmus test to know if you are overpaying for your funds:

Are you currently paying more than 0.57%?

If so, you may want to shop around to find funds with a more competitive expense ratio.

Unfortunately, the amount of control you have over this may be limited, especially in your employer retirement plans such as a 401K or 403B. These typically have fewer options that incur higher fees. Depending on the company, you should be able to sort your options by lowest-fee.

Don’t jump for the highest yielding fund for two reasons:

1) They were likely started after the 2008 crash so the entire history of the fund has been a bull market

2) These funds likely carry a higher risk profile than you’d be comfortable with

Outside of your employer-sponsored plan, you should exercise as much control as possible to get yourself the lowest expense ratio fund.

Keep reading below to step #2 to see the 3 best, low cost index funds that I would consider starting with.

Why this might be the Most Important Investment Decision You’ll Make

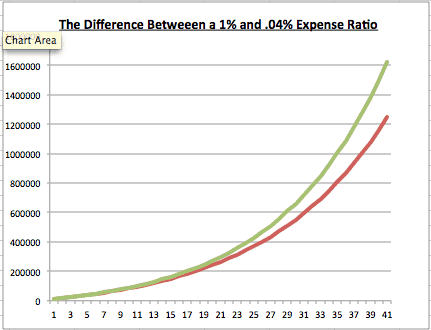

Your goal as an investor is to maximize returns and minimize the fees you pay out each year. An 8% average return with an annual fee of 1% nets you 7%, but if you can find an investment vehicle with an annual fee of 0.04%, then you’d be earning 7.88% each year!

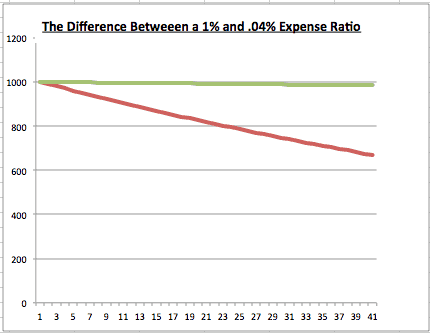

Let’s look at the differences this can make over different time periods if you were to start with an initial investment of $10,000 and make additional annual deposits of $5,500.

$400,000.

Assuming your operating income stays even or increases over time, this gap will only widen. As you can see, the longer your time horizon, the more of a difference this makes.

Why?

Because each year you get charged this fee. As your gross revenue and monthly contributions increase, this will also make even more of a difference.

If you held your investments in a 1% fund over the course of 40 years, you would pay out roughly $400,000 in fees versus $55,000 in a low-cost index fund. This is incredibly important whether you are saving for retirement, almost retired, or already retired.

Imagine what $400,000 more would mean for you come retirement.

Are you content to be throwing away possibly hundreds of thousands of dollars over your investing lifetime?

I sure hope not.

4 Steps to Find the Fund With the Best Expense Ratio

At this point, I hope you are asking the question, “What now? What do I need to do to get on the right path? Do I need an operating expense ratio calculator or a operating expense ratio formula?”

Let me walk you through some simple steps to get you started.

Step One: Gather Information about yourself and your spouse if married

How much do you currently have invested or are you looking to invest?

How much per month/year will you be able to set aside and contribute?

Does your employer contribute to a 401K or 403B? If so, how much? What about your spouse?

If you currently have investments, what are the expense ratios?

Step Two: Select your investment options

At this point, you need to identify what your investment options are. For those looking to retire early, I recommend maxing out your pre-tax buckets with an employer 401K or 403B and traditional IRAs first, and then moving on to taxable investment accounts.

What type of fund should you get?

For many people, finding and picking the right fund to invest in can be a paralyzing situation. Its easy to get overwhelmed. Here is a super helpful chart from NerdWallet that outlines the average expense ratios for different types of funds.

The clear winner are equity index funds which come it at an incredibly low average expense ratio of 0.09%!

The biggest reason that index funds are able to maintain such low fees is because they are passively managed, meaning that they do not actively buy and sell stocks to trade in and out of positions.

Essentially, an index fund aims to track the performance of the overall market.

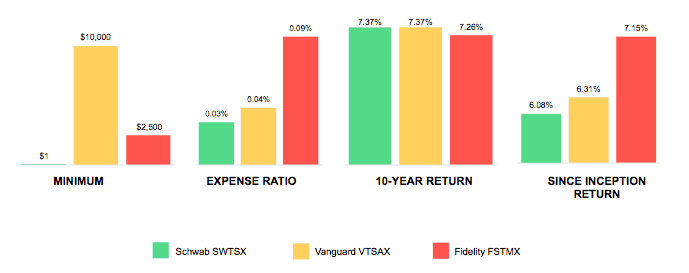

The Best Expense Ratio Funds 2017

Here are 3 of the best performing, lowest cost index funds to get started with today.

Step Three: Investment Strategy

My wife and I have three goals when it comes to allocating my retirement savings and I highly recommend them to you. I want to…

- Put as much money into pre-tax investment accounts. Once I hit the 12% bracket I put money into my Roths.

- Minimize my expense ratios

- Receive the maximum amount of contributions (free money!) from my employers.

I have been able to put together a simple strategy that prioritizes how dollars work. If my annual savings change year to year either up or down, I know exactly where those funds will be added to or pulled from.

- Contribute the exact amount to receive the full 4% match from my wife’s employer

- I contribute only this amount because the expense ratio on her account is the highest. I want all the free money I can get, but I want the rest of my investments to have lower fees.

- Pro-tip: Find out if your employer can front-load your contributions, or if they need to be set up as a % of each paycheck.

- Contribute the exact amount to receive the full 4% match from my employer

- Max my Roth IRA: $5,500

- I invest in VTSAX, one of Vanguard’s funds.

- Max her Roth IRA: $5,500

- Same as above

- Max the rest of my wife’s 403B

- Max the rest of my 403B

The great thing about this strategy is that I can scale it up or down depending on my savings. My first priority is to receive the maximum contribution possible from her employer, and then I max out my lower expense ratio buckets, and then with the remaining funds, I put it back into my 403B’s.

Step Four: Execute the Plan

Once you have your accounts selected, your strategy in place, all that’s left for you is to execute. The first step I would take towards executing your plan is to automate your savings. This way you are saving the same amount each month and it takes the guess work and discipline out of the equation.

After that, there are two things you can do to accelerate your retirement timeline.

- Increase your effective gross income

- Find more ways to cut from your budget.

Check out my massive list of 150 Proven Ways to Save Money or download the PDF below!

Who does this matter for?

The truth is, no matter what your timeline is for retirement, whether you are 5 or 35 years away, selecting the lowest expense ratio possible must be one of your top priorities. This is incredibly important for building up your nest egg, as well as making sure it lasts.

The choice you make in where to put your hard-earned savings could be the difference between retiring years earlier or having a significant amount more when you retire.

If this guide was helpful to you, then please SHARE it! Share it with your spouse, best friend, on Twitter, or the Facebook finance groups you’re on.

Bonus points if you comment. I’d love to answer any questions about finding the funds with best expense ratio for you.