What if every college student was required to take a class that covered budgeting, investing, and how to get out of debt? Imagine the difference it would make! I wish more than anything that schools today would at least do one class on personal finance. It would be a game-changer.

The sad reality is that that will never happen. I was a finance major in college and in the 10 or so finance classes I took, none talked about personal finance. At best, I learned how to calculate rate of return and the time value of money.

Important, but not nearly as important as learning the basics of saving and investing money. My dream is for PF Geeks to become that go-to resource for college students and recent grads looking to make more, save more, and take control of their finances.

I still think getting a college degree in your field is one of the best investments anyone can make. Even if you don’t learn the most relevant stuff to your everyday life, a college education greatly affects your job opportunities and salary growth over time.

Contents

The Savings Rate Challenge: How to Increase Savings Rate!

But I wish they would teach students this basic concept: your savings rate.

At the end of the day, 90% of being “good with money” comes down to this metric. Your savings rate will play the most significant factor in how much you can save and how quickly you can grow your savings account.

What Is Your Savings Rate?

The gap between your monthly income and your monthly expenses is how much money you’re able to save each month. If you take your monthly savings and divide it by your income, you can figure out the percentage of your income that you’re actually saving.

Income – expenses = savings

Savings/income = Savings rate percentage

Way too many people get caught up trying to figure out what all gets included in their savings rate.

They ask questions like…

- Do you use after-tax or pretax income?

- Does your mortgage count?

- Does debt repayment count?

Increasing your savings rate by gaming the system won’t actually do you any good, even if it’s fun to play around with. The real key is increasing the gap between your income and expenses. For what it’s worth, here’s how I calculate my savings rate:

Aftertax income – expenses

I don’t count any minimum payments towards debt because, to me, those are fixed monthly expenses! But if I pay any extra towards my car loan or house mortgage, that would count! Anything I save towards retirement savings obviously counts, but employer contributions do not!

Why Is Your Savings Rate So Important?

Before I dive into the challenge, I want to talk about why your savings rate is essential AND why you should absolutely start tracking it.

If you’re early on in your investing career, increasing the amount of money you put into the market is the most critical factor in building wealth.

Too many people focus on increasing their return rate in investing when they would be far better off putting that effort into increasing their income or cutting costs.

You see, the key in your 20s is to build up your savings as much as possible and as fast as possible. Compound interest is one of the most incredible things in the world, but the only way it can work in your favor is if you give it time to work its magic.

If you graduate at 22, then you’ve got 8 years until your turn 30. My personal goal is to get as much money invested by the time I turn 30 so that I’ve got plenty of time for compound gains to do the hard lifting.

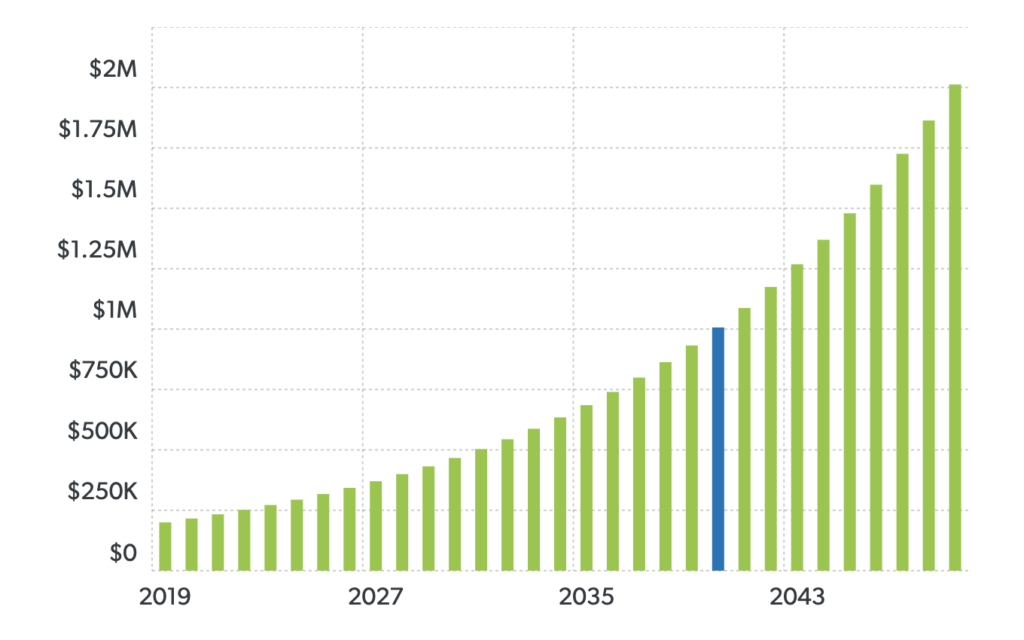

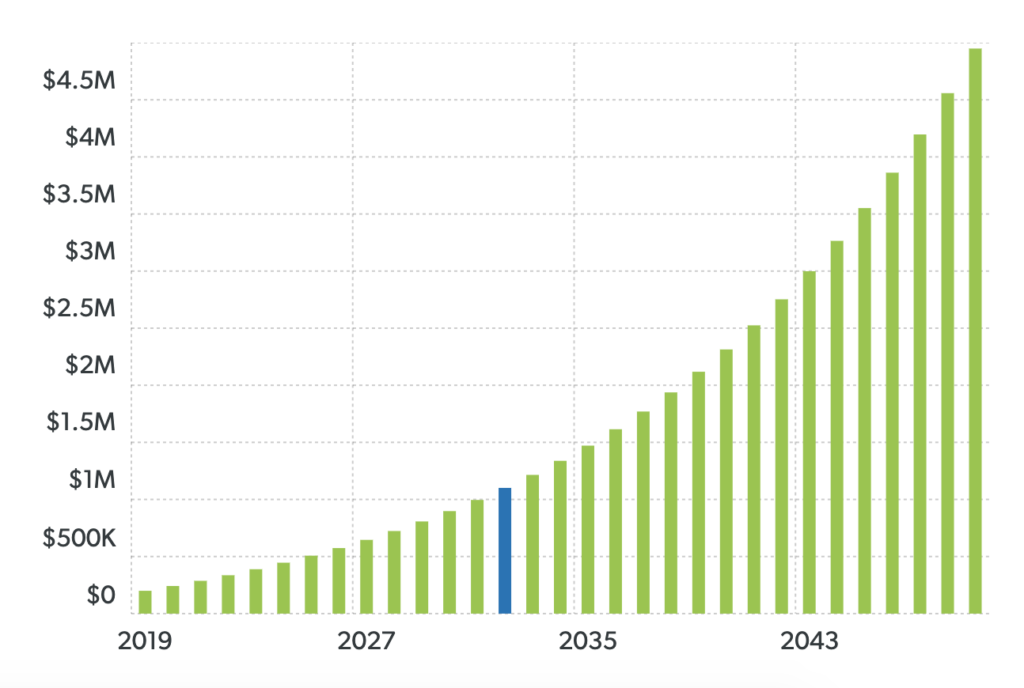

If you can get $200,000 saved by the time you turn 30, then that will grow to almost $2,000,000 by the time you turn 60, without contributing a single dollar.

If you keep contributing $2,000/month, your nest egg will grow to nearly $5,000,000. The key to getting rich is building wealth over time.

Outcome versus Process goals

Have you ever heard of the difference between outcome and process goals? Honestly, it completely changed my perspective on life when I stumbled across this idea.

When most people set goals, they are always focused on the outcomes that they are hoping to achieve. Whether it’s losing weight, paying off debt, saving for retirement, or writing a book, they hope to achieve each outcome.

The problem is that these outcome goals might seem lofty and too distant for me to set my minds on. You must break them down to figure out precisely what it takes to get there.

Processes are the actual daily steps needed to accomplish that outcome.

- Outcome: losing weight. Process: meal prepping & exercising daily.

- Outcome: write a book. Process: write 500 words a day

Think about your financial goals. Maybe you want to pay off all your debt, save up for a house down payment, or invest for retirement. Great goals. But they are all “outcomes.”

The key to reaching goals like saving for a down payment is to focus on the process. The process is having as much available cash as possible to funnel toward each of your goals. Increasing your savings rate is the single greatest factor in doing exactly that. The higher your savings rate, the bigger the gap between your income and expenses.

Let’s say you have a combined income of $80,000 and are currently spending $60,000 a year. That means you’d be saving around $20,000 a year or a 25% savings rate, which is fantastic on an $80k income. But what if you found ways to increase your income to $85k while lowering your expenses to $55k.

You’d have an extra $10,000 to invest every single year! Over a 10-year period, that’s an extra $100,000 put toward your financial goals. The way to put this into practice is to track your monthly spending. The more closely you can actually stick to your budget, the higher your savings rate will be!

Introducing the Savings Rate Challenge

The goal for the challenge is simple. But it might be the most important step you make with your money. The goal of the Savings Rate Challenge is to increase the gap between income and expense as much as possible so that you can create more monthly cash flow.

The bigger your monthly surplus, the more you have to put to work to reach your financial goals! You can also double up and do a $1,000 Savings Challenge!

Living life Differently

If you really want to build wealth and jack up your savings rate, you will have to make some lifestyle changes that will set you apart.

The reality is that most people have hardly any gap between their income and expenses. Even as their income increases, their expenses tend to follow suit. Most people need to keep up with everyone else around them and their lifestyles inflate.

The result is that you have people making excellent salaries but struggling to get by. Most people are loaded with debt, struggling to get by, and have nothing saved in case of an emergency. The key to growing your savings is to keep your expenses down while your income continues to grow.

Putting your Dollars to Work

That entire green section in between is all the money working to help you reach your goals. Think about your dollars as soldiers. Each extra $1 you save is another soldier who can do work for you.

The best part is, this $1 will continue to work for you for as long as you have it! If you want to get more of your hard-earned money working for you, then it’s time to join the Savings Rate challenge!

The goal is to find ways to increase your income and cut expenses so you can save as much as possible each month. Each month, you’ll try to increase this bit by bit!

How to Increase your Savings Rate

You need to focus on two numbers in the equation to increase your savings rate. Increasing your income will boost your overall cash flow, and reducing expenses will lower your monthly spending.

There’s no limit to how high you can increase your income, but at some point, there is no more you can cut from your spending–no matter how frugally you are willing to live.

Cutting expenses is often the quickest way to boost your savings rate, but increasing income is the way to really ramp it up over the long term. Let’s look at ways to increase your income and lower your expenses.

Increasing your Income

The best way to increase your income is to maximize the money you make when you show up to work each day.

1. Ask for a Raise

The easiest way to boost your day job income is to ask for a raise. Increase your employer contributions and get paid more for each hour you’re already working.

Look, if you’re working 40 hours a week and making $50,000 a year, that’s a great start! But if you can increase that to $55-$60k, that’s a significant chunk of extra money you’ll make without putting in more hours.

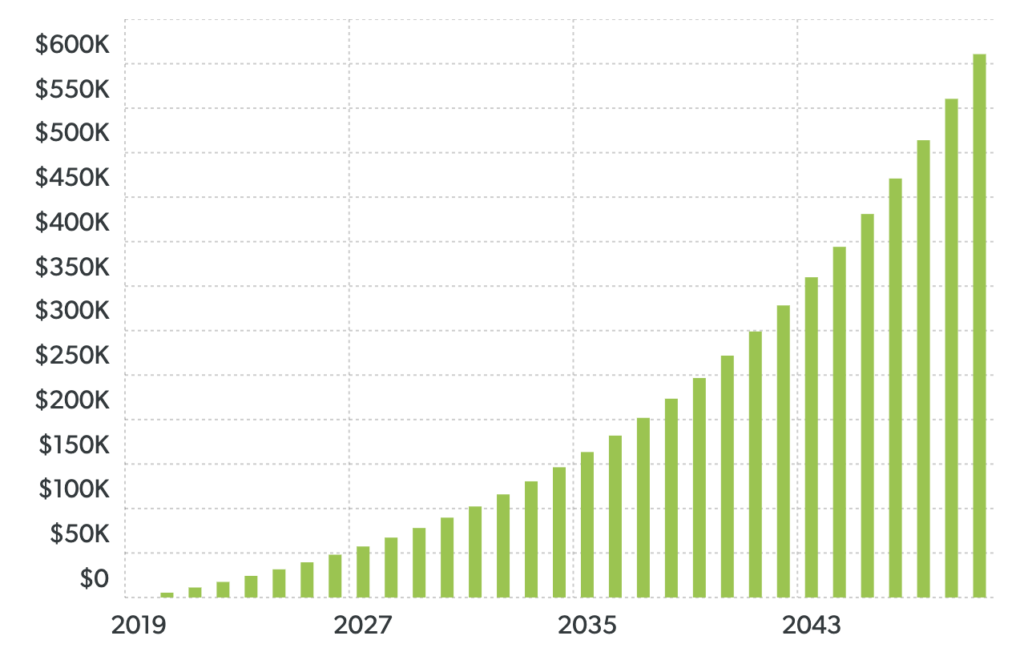

That $5,000/year raise will net you an additional $600,000 over a 30-year career if you invest it.

That doesn’t even consider that most raises are a % based on your income. The higher your salary, the bigger your jumps will be.

2. Get a Side Hustle

The next step in increasing your savings rate is finding ways to boost your income outside your full-time job. If you can find a way to make more money each month and put it into your savings accounts, you’ll be able to increase your savings rate.

The extra cash you make can help you…

- Pay down your debt quicker

- Build up your emergency fund

- Dump extra cash into your retirement income accounts

The question, though, is, where do you start? What’s the best way to start making extra money? These are Normal questions to ask. I wish I had all the answers, but I don’t.

Here are 25 side hustles for college kids that can work for almost anyone! My buddy Forrest highly recommends using a 3D printer to make money.

3. Consider One-off Incomes

The last way to increase your income is to find one-off opportunities to bring in extra cash. This stuff can be a great way to start saving. Services like Uber, Favor, Rover, or other apps can be easy ways to start a little side gig. It’s another way you’ll be trading time for money, but it might be worth it if you need the extra cash.

If you have the knowledge in a given area, a more lucrative side gig might be tutoring. My sister made $100/hour doing English tutoring for international students!

If you don’t feel like using precious free time to make more money, you can still get a little cash infusion by selling off old things and furniture you no longer need. Check out craigslist, Facebook marketplace, or other selling services to get rid of stuff and make a little money.

Cutting Expenses

When cutting costs, the first place to look is your “Big 3” expenses: housing, transportation, and food.

1. Big 3 first: Housing, transportation, food

If you’re trying to spend less, you don’t need to meet with a certified financial planner; focusing on these 3 areas will get you about 80% of the way there. You could cut out wifi, coffee, Netflix, and your gym membership and save around $150 a month! OR you could get a smaller apartment/house and keep all the small luxuries.

You can also try to lower your memberships if you don’t want to cut them. I negotiate my gym membership every year and save about 25% off the total cost.

I call this downsizing your space to upsize your lifestyle. If you can save more money on things like housing, you can afford small luxuries that add a lot of joy and convenience to your life. Here are a few ideas for each of the Big 3.

Housing

- Live in a smaller place. Less space = less furniture & stuff needed to fill it

- Get a roommate

- House hack by buying a place and renting out the other bedrooms

- Use energy-efficient features

- Live in a low-cost-of-living (LCOL) city or neighborhood

- Become a DIY champion

- If you’re willing to invest in a programmable thermostat like Nest or Honeywell, you may be able to decrease your electricity bill by anywhere from 10-30%.

Transportation

- Buy used cars to save on depreciation

- Drive less often: bike, carpool, etc.

- Use public transportation

- Do regular care to prevent expensive repairs

- Become a “one-car” family

Food

- Reduce food waste!

- Buy in-season produce

- Consume less meat

- Load up when meat goes on sale

- Meal plan every week using my list of 50 cheap meal prep recipes (all less than $2 a serving!).

- Use my favorite cashback app: Ebates–Read my Ebates Review before signing up!

Check out these 23 money-saving tips if you need more ideas!

2. Debt Reduction

One of the most effective ways to increase your savings rate is to eliminate all your debt payments. Any payment you make on your student loans, credit cards, car loans, or other forms of debt is a drag on your monthly cash flow.

The lower your debt-to-income ratio, the better. Let’s say you have the following monthly payments:

- Car Loan: $330

- Student Loans: $600

- Credit Card: $170

Total all of those up, and you’re looking at $1,000 every month that you aren’t able to save! Once you have it all paid off, you can invest an extra grand every month toward your financial goals. That’s 1000 more little soldiers working for you! The key is to put a plan in place to pay off your debt as quickly as possible.

My #1 recommendation is the debt avalanche approach. With this strategy, you list each of your loans in order of highest interest rate to lowest. Then, you pay the minimum necessary on all except the high-interest debt. This allows you to pay off the loan that is building the most interest first.

Once paid off, move your focus to the second-highest interest-rate loan. Repeat until all of your loans are paid off! Personally, I don’t count my mortgage in this category. Of course, it is debt! But I’m talking about consumer debt and student loans.

Here’s an excellent list of student loan calculators to determine your best repayment plan!

3. Small stuff

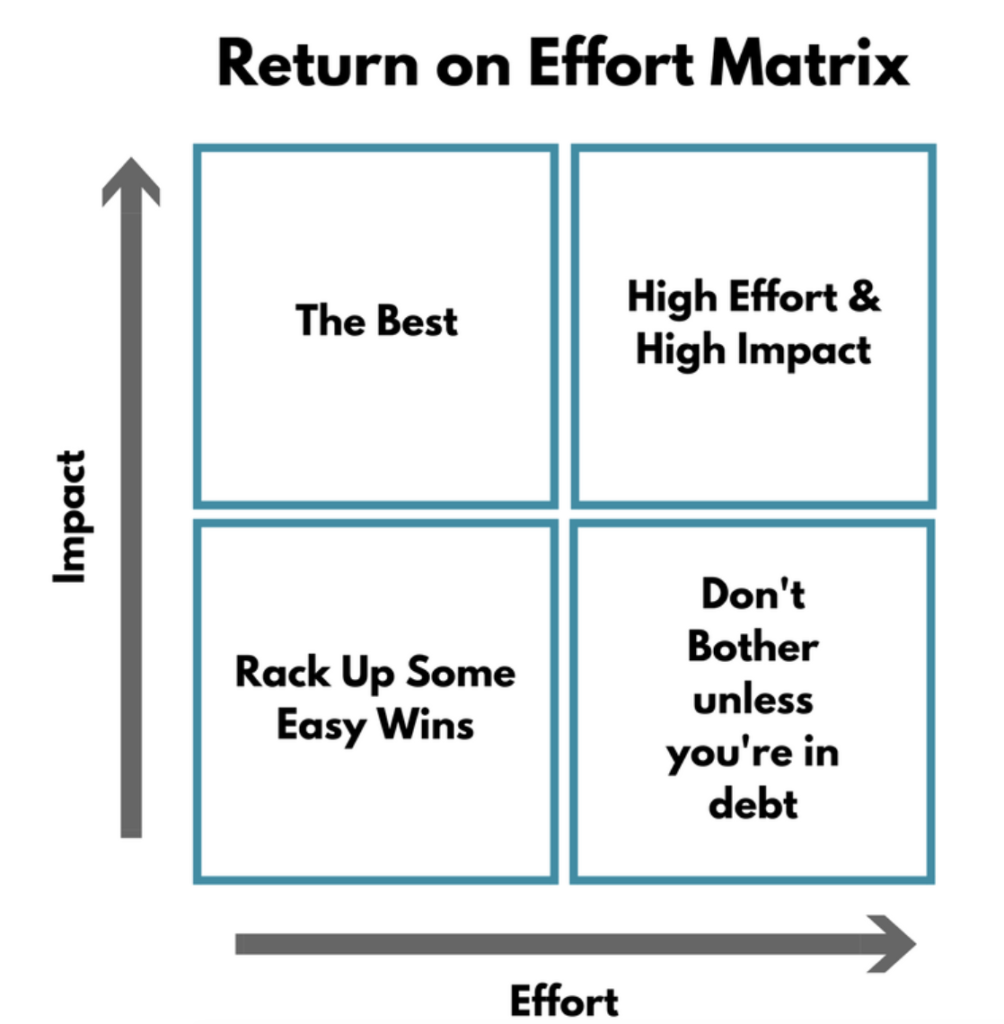

Once you’ve minimized your significant expenses and made a plan to pay off your debt, the next place to look to cut expenses is all of the small stuff. Another easy way to cut costs is to stop buying things you can make yourself or don’t need. One helpful framework for identifying budget wins is this Return on Effort Matrix.

So take a look at your budget and determine where the easy wins are. Personally, I love to look for two types of budget wins:

1. One & Done: Canceling subscriptions, lowering a membership fee, or moving to a high-interest bank are good examples. You put in the effort once and continually increase your monthly savings.

2. Easy & Repeatable: I love to look for small daily or weekly spending habits that don’t take much effort but save me decent money for the time invested. Making my coffee each morning, shaving my head each week, and packing a lunch. Those 3 habits alone save me around $250/month.

Big Fat Takeaway

Saving money, and growing your net worth is about your ability to increase your savings rate or the amount of money you’re saving each month. Focus on having a financial plan, growing your monthly gross income, cutting expenses, and putting the surplus towards your savings goals. Get after it!