While many people save money to buy their dream house or pay off their debt, only a few seek to prevent financial stress amidst life uncertainties by setting up a rainy day fund.

Whether you’re from the former group or the latter, one thing is certain, saving money is always challenging.

Life often finds ways to eat into my savings – car expenses, plumbing issues, birthday parties, and whatnot. Soon, you start losing sight of your goal and find it hard to save or make progress.

That’s why I’ve created this guide on how to save $5,000 in just 6 months.

With my step-by-step guide and included chart, you’ll learn how to budget more effectively, cut costs and increase your income, so you can reach your savings goal without losing track.

Let’s dive in.

Contents

How to Save $5,000 In 6 Months – Top 9 Tips From Experts

According to a recently published Federal Reserve Board report around 40% of US citizens don’t have enough savings to cover even a $400 emergency.

Another survey by PR Newswire highlights that over 45% of Americans don’t even have a savings account in the first place.

This is despite the fact that most experts like the Center for Retirement Research say that a typical household should save around 15% of its earnings to have a solid retirement and emergency fund.

Luckily, there are several ways to increase your savings and reach your goal of $5,000 in 6 months. Here are some tried and tested expert tips to help you get started:

Follow the 50/30/20 Rule

Elizabeth Warren’s 50/30/20 budgeting rule is one that has helped many households gain greater financial freedom – including my own.

In simple terms, the 50/30/20 rule is a budgeting guideline that suggests splinting your income into chunks and allocating:

- 50% of your income towards your needs and necessities

- 30% of your income towards your wants and desires

- 20% of your income towards your savings and debt repayments

Although the rule was initially introduced to help people manage their after-tax income, anyone can leverage it to save $5,000 in 6 months.

The basic idea behind this rule is to balance the needs of today with the needs of tomorrow, by ensuring that a significant portion of one’s income is directed toward savings and debt repayment.

Just remember, the rule is not set in stone and can be adjusted to suit an individual’s needs and circumstances.

Needs vs. Wants

Your needs are things you cannot live without. These include:

- Food

- House rent

- Basic clothing

- Transport and fuel

- Electricity and other utility bills

- Groceries and other essentials

Hopefully, your needs won’t take more than half of your salary. If they do, you might need to improvise and switch to a more feasible budgeting plan like the 60/20/20 rule.

Once you’ve figured out your needs, it’s time to consider your wants. These are all the nice-to-have things that you can survive without like:

- Netflix and premium cable TV subscriptions

- Branded clothing

- Spotify subscriptions

- Fancy meals at restaurants

- Expensive beauty products

Whatever your wants may be, always ensure you spend no more than 30% of your earnings on your wants.

20% for Savings

Paying yourself first is the best way to put 20% of your income in savings. This will keep you from accidentally splurging the money on something else.

Yes, it’ll feel like a struggle at the beginning, but the process gets fairly simple once you make it a habit. The best part is it lets you hit your savings goals faster.

Top Tip: Consider using automated savings accounts like these to help you automate the process and make sure you stick to your monthly savings goal every time you get paid.

Cut Down on Non-Essential Spending

According to CNBC non-essential spending is the biggest culprit behind most people’s budget squeeze.

So, why not trim the fat and start cutting a bit back on all of the non-essentials?

I’m not recommending you stop spending money on things you’d like to have, I’m just saying that there are usually cheaper alternatives you can switch to.

Here are a few examples:

- Save the $9-$20 you spend on a Netflix subscription by sharing it with another person. The streaming channel lets up to 5 people use the platform. This means that you can technically share the subscription costs with your friends or just get it for free if they’re willing to sign in to their account on your TV.

- Uninstall meal delivery apps like DoorDash and Uber Eats. Instead, cook at home more often and plan your meals in advance. This not only saves you money on delivery fees and markups, but it also allows you to control the ingredients and portion sizes, leading to healthier eating habits.

- Cancel gym memberships or expensive workout classes and opt for free or low-cost alternatives such as bodyweight exercises or outdoor activities like hiking or running.

- Stop buying expensive coffee or energy drinks and instead make your own at home. Invest in a good coffee maker or a reusable water bottle and you’ll be surprised at how much money you can save in the long run.

- If you regularly hang out and socialize with your friends at the mall, consider arranging small get-togethers at home. This will keep you from making impulse purchases at your favourite clothing and electronics stores, and home-cooked food will cost less than what you eat outdoors!

These are just a few examples of how cutting back on non-essential spending can help you save money. By being mindful of your spending habits and finding cheaper alternatives, you can make a significant dent in your savings goal.

Earn More

Another effective way to save money is by earning more. This can be done by taking on a part-time job, freelancing, or starting a side hustle.

You can also ask for a raise at your current job, or look for a higher-paying job in your field. If you have a skill set that is in demand, you can also consider teaching others through online classes or workshops.

The digital world offers plenty of money-making opportunities. Not only will it help you create an extra stream of income, but it also hones your skill that adds to your career down the road.

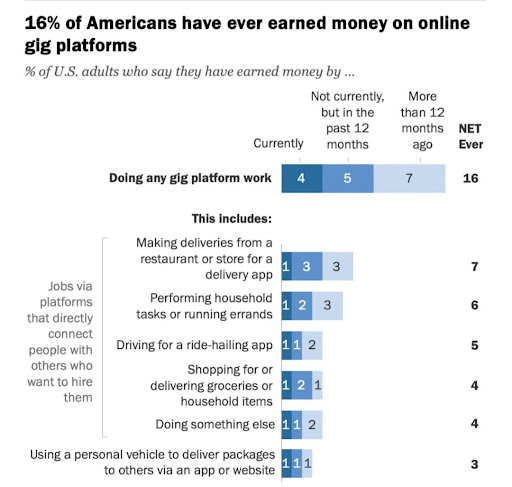

According to a report published by the Pew Research Center, approximately 16% of Americans are regularly making money through online gigs and this number is only expected to rise. So, why don’t you do the same?

Some popular jobs you can take online include the following.

- Copywriting. The job market for copywriters is predicted to skyrocket by 7.6% by 2026. The soaring demand means more businesses are calling for creative, visionary, and passionate writers. So, if you’re a player of words with a solid grip over grammar and sentence structure, this is a potential side gig you should look into.

- Social Media Marketing. With over 4.26 billion people using social media globally, it makes sense why more and more businesses are turning to social media to target their ideal audience. You can offer in-demand marketing services to small businesses or individuals who are looking to grow their social media presence.

- Data Entry. For those with good typing skills and attention to detail, data entry is a simple job that can be done from the comfort of your own home. You can find data entry jobs on sites like Indeed or FlexJobs.

- Graphic Design. It’s no secret that in today’s digital world, the demand for skilled graphic designers is on the rise. If this is a career you’re passionate about and you’re familiar with basic design principles, typography, and UX/UI design, it’s time to create a portfolio and reach out to clients on LinkedIn and other marketing platforms like Upwork and Freelancer.com.

Create Milestones

Once you start making more money, it’s time to create milestones. Breaking your savings into smaller, more manageable chunks makes it much easier to achieve and will help keep you motivated.

So, if you’re looking to save $5,000 in 6 months, your milestones could look something as simple as this:

- 1st Month: $833

- 2nd Month: $1,666

- 3rd Month: $2,499

- 4th Month: $3,332

- 5th Month: $4,165

- 6th Month: $5,000

But if having a monthly savings schedule feels intimidating, you can break your milestones into even smaller weekly or daily chunks.

For example, instead of feeling intimidated at the thought of having to save $833 every month, think of it as saving less than $210 a week or about $28 every day instead. If you end up having more money, you might want to increase your 6-month savings goal to $10,000, or even save up to $20,000 in a year.

Turn to DIYing

DIYing can also help you save money in the long run. Instead of spending money on expensive products and services, you can learn to do it yourself with the help of Google and Youtube.

For example, instead of hiring a professional to clean your plumbing system, you can and should try doing it yourself. Similarly, instead of paying for landscaping services, you can learn how to take care of your own yard.

Not only will you be able to save money, but you’ll also gain valuable skills and knowledge in the process.

So, the next time before you think about shelling out some money to pay for a new sofa, light fixture, or table, think about DIYing it instead!

Top Tip: If you’re lacking some tools for DIY projects, consider borrowing the equipment from a friend or neighbor to avoid purchasing and spending money on them from a hardware store. And if you lack DIY skills and feel you won’t hit the nail on the head alone, it never hurts to ask your tech-savvy friend to help you out!

Say Goodbye to Debt

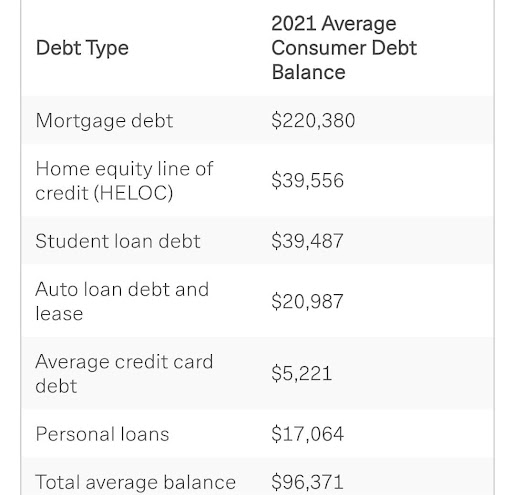

Did you know that monthly debt is one of the biggest money drains for most families in the U.S.? Unfortunately, over 64 million Americans carry a debt.

You will struggle to save money if most of your income goes into recurring debt with high-interest fees.

Experts believe no more than 15-20% of your net income should go into debt. Anything beyond that is a red flag and must be managed.

But the question is, what’s the best way to pay off debt?

Well, according to most experts, the snowball method is one of the quickest and most reliable ways to pay off debt without accruing more debt in the process.

Here’s what it entails and how it works:

- List all your debts starting from smallest to largest

- Make a minimum payment for all your debts

- Pay the maximum you can afford on your smallest debt

- Repeat the cycle until your debt is paid off

Essentially, the snowball method involves paying off debts from the smallest balance to the largest.

This creates a “snowball” effect as you start to pay off smaller debts and roll that money into paying off large debts, building momentum and reducing the number of debts you owe.

Another option is the debt avalanche method where you focus on paying off the debt with the highest interest rate first, as this will save you the most money in the long run.

Top Tip: Consolidating your debt through a personal loan or a balance transfer credit card can also help reduce the amount of interest you pay, making it easier to pay off your debt in a shorter period of time. However, it’s important to understand the terms and conditions of these options before taking them.

Nothing can encourage us to stick to the target more than a trusted friend or partner. Sometimes, a nudge is all you need to meet your savings goals, and a word of friendly advice can be just the thing you were missing all along.

Sharing your savings plan with someone else can hold you accountable, and provide a source of support and encouragement as you work towards your goals.

Top Tip: Make sure to choose someone who is supportive, trustworthy, and has similar financial goals to your own!

Know Where Your Money Is Going

The importance of this step cannot be emphasised enough.

It is essential to keep track of your expenses down to the smallest ones to see where your money is going if you’re planning on saving $5,000 in 6 months.

You can use a budgeting app, spreadsheets, or even a simple piece of paper to track your spending, categorize your expenses and identify areas where you can cut back.

A general list, for instance, may include the following.

- Costs of monthly grocery items

- Utility bills

- Gym memberships

- Rent

- Car or bike-related expenses

- Costs of upcoming wedding and birthday presents for relatives and friends

Creating a list like this and mentioning the amount side by side will help you have a better understanding of where your money is going and make it easier to make a budget and stick to it.

However, because unexpected expenses are inevitable, I recommend adding a 10% buffer on top just to be on the safe side.

Sell Stuff Online

A little smart work – and a smartphone – can help you boost savings within weeks.

Smart work to figure out which items you don’t want, and smartphones to click attention-grabbing high-quality photos.

Find out what no longer serves your needs, click some photos, and upload them on platforms like eBay or Etsy.

For example, if you travel via public transport and occasionally use your car, you can sell it to pay off your debt. Other things you can sell online include:

- Clothing

- Electronics

- Old furniture

- Books

- Hardware tools

Alternatively, let your creative juices flow and repurpose old stuff to make it enticing for buyers. Here are a few tips for drawing inspiration.

- Sell handmade products. Crafts like jewelry, soap, and knitted blankets are timeless commodities and can be made at home and sold online via digital platforms like Amazon and eBay.

- Repurpose old clothes. If you have a knack for fashion, consider turning your old t-shirts into cute crop tops or repurposing old jeans into a trendy denim skirt and selling them online.

- Sell old furniture. Transform old furniture into statement pieces by adding a fresh coat of paint or reupholstering the cushions.

- Start gardening: If you have a green thumb, you can also grow and sell potted plants or seeds for quite a profit.

- Decorate coffee mugs. If you’ve strong creative and artistic skills, you can also paint coffee mugs and sell them to your relatives, friends, or online.

By being creative and finding new ways to make money from your possessions, you can boost your savings and pay off debt faster.

Save Money Using This Chart (5000 In 6 Months)

A chart can be an effective way to visualize your progress and track your spending in order to reach your 6-month savings goal of $5000.

However, I know that saving a significant sum like $833 a month can feel like an overwhelming and unachievable goal.

To make it more manageable and less stressful, I’ve created the following weekly savings chart for you guys to follow:

| Week | Deposited Amount | Savings |

|---|---|---|

| 1 | $231 | $231 |

| 2 | $231 | $462 |

| 3 | $231 | $693 |

| 4 | $231 | $924 |

| 5 | $231 | $1,155 |

| 6 | $231 | $1,386 |

| 7 | $231 | $1,617 |

| 8 | $231 | $1,848 |

| 9 | $231 | $2,079 |

| 10 | $231 | $2,310 |

| 11 | $231 | $2,541 |

| 12 | $231 | $2,772 |

| 13 | $231 | $3,003 |

| 14 | $231 | $3,234 |

| 15 | $231 | $3,465 |

| 16 | $231 | $3,696 |

| 17 | $231 | $3,927 |

| 18 | $231 | $4,158 |

| 19 | $231 | $4,389 |

| 20 | $231 | $4,620 |

| 21 | $231 | $4,851 |

| 22 | $231 | $5,082 |

| 23 | $231 | $5,313 |

| 24 | $231 | $5,544 |

| 25 | $231 | $5,775 |

| 26 | $231 | $6,006 |

As you can see from this chart, breaking down a big milestone into several smaller ones can make it so that you seemingly take out less cash from your income but end up saving the same amount.

Hopefully, this chart will serve as a valuable visual board to help you save weekly, stay focused, and track your balance after completing each deposit.

Top Tip: I recommend printing out a copy and displaying it in your room or on the fridge and crossing each week to keep an eye on your progress as you move forward.

Key Takeaways

- According to a Federal Reserve Board report, 40% of US citizens don’t have enough savings to cover a $400 emergency and 45% don’t even have a savings account.

- The 50/30/20 budgeting rule, created by Elizabeth Warren, is a helpful guideline to allocate 50% of income towards needs, 30% towards wants and 20% towards savings and debt repayment. This can be adjusted to suit individual needs.

- Distinguish between needs and wants, with needs being necessities like food and rent, and wants being non-essential items like fancy meals or premium cable TV subscriptions.

- Pay yourself first by putting 20% of your income into savings, which can be automated with a savings account.

- Cut down on non-essential spending, such as meal delivery apps, gym memberships, or beauty products.

- Consider other ways to increase income such as taking on a part-time job, selling unwanted items, or negotiating a raise.

- The goal is to save $5,000 in 6 months, by effectively budgeting and cutting costs while increasing income.

Best of luck and check my guide on 21 Financial Goals to Help You Build Wealth in 2023 next.