When it comes to money, most people are fragile, scared, and don’t know what they’re doing.

Think about it…

- US consumer debt hit an all-time high at an average of $136,000 per American

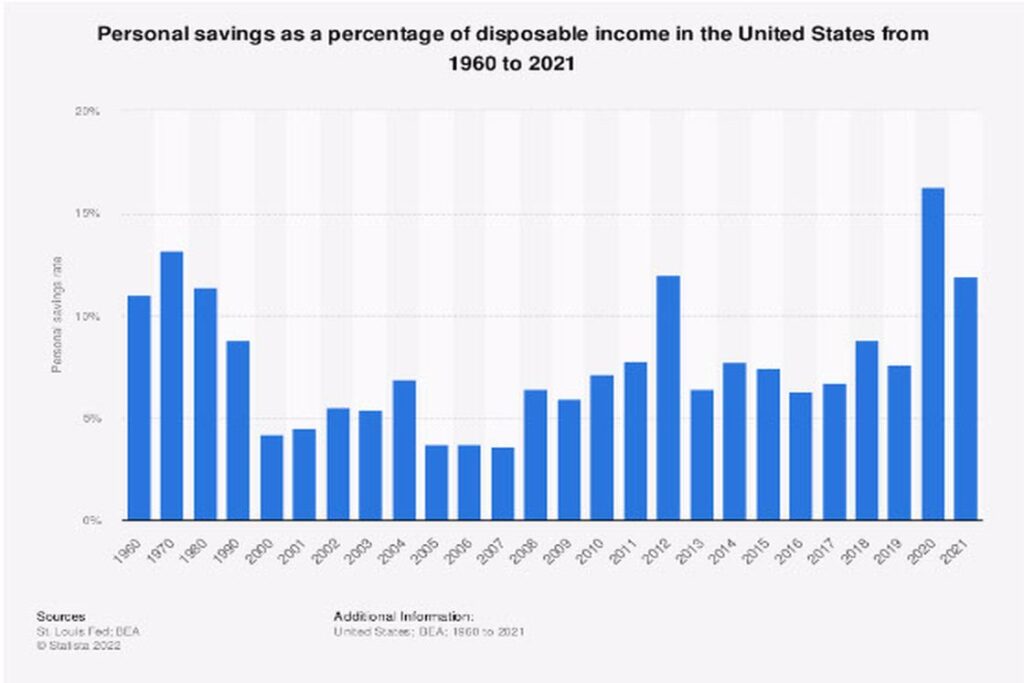

- In 2017 the average savings rate of Americans was 2.8% of income, the lowest that has been recorded.

- A study by the Federal Reserve showed that 50% of Americans couldn’t come up with $400 in case of an emergency.

- 78 % of people are going through life living paycheck to paycheck.

My main goal here at PF Geeks is to show you how to manage your finances so that you can accomplish your unique life goals.

The nuts and bolts of personal finance are straightforward.

- Spend less

- Cut costs on the majors: housing, transportation, etc

- Identify some daily habits that reduce monthly expenses

- Avoid lifestyle inflation

- Make more

- Ask for a raise

- Side hustle if that’s your thing

- Invest the rest

- Index funds

- Portfolio strategies

- Automate your investing

Don’t get me wrong, there are a ton of small details within that framework that can lead to HUGE gains, like how one small change will save you $400,000 more for retirement or how reducing food waste can save you an extra $215,000.

Once you’ve got the basic framework down, personal finance is about executing your plan and enjoying the present.

There is one missing piece from that framework.

Contents

How Can a Personal Financial Crisis Be Avoided

Whether you’ve got a million in the bank or are trying to climb out of a deep debt hole, you need to take steps to protect yourself. So here’s my question for you…

How protected are you? What would it take for you to break?

The reality is the world is nearly impossible to predict. One of my goals is to make my finances as resilient as possible. My goal is to protect my wife and me from the predictable and the unpredictable–from the risks I know and the ones I don’t even know to exist yet.

I want to be financially strong and have as few weak points as possible. I want you to take the necessary steps to protect your money so that you never have to worry about money again. When money is concerned, I so desperately want you to live a stress-free life. These days, you’ve got to put measures in place to protect your money for the future.

What is Financial Resiliency?

Resiliency is defined in two ways:

- The ability to absorb shocks

- The capacity to recover quickly from difficulties

Being financially resilient means that you can weather hard times, recover quickly from difficult circumstances, and absorb the shocks that life throws your way.

Personally, I want my budget, my finances, and my retirement to be as resilient as possible. I don’t want things I can’t control to set me back and keep me from providing for my family and chasing my financial goals.

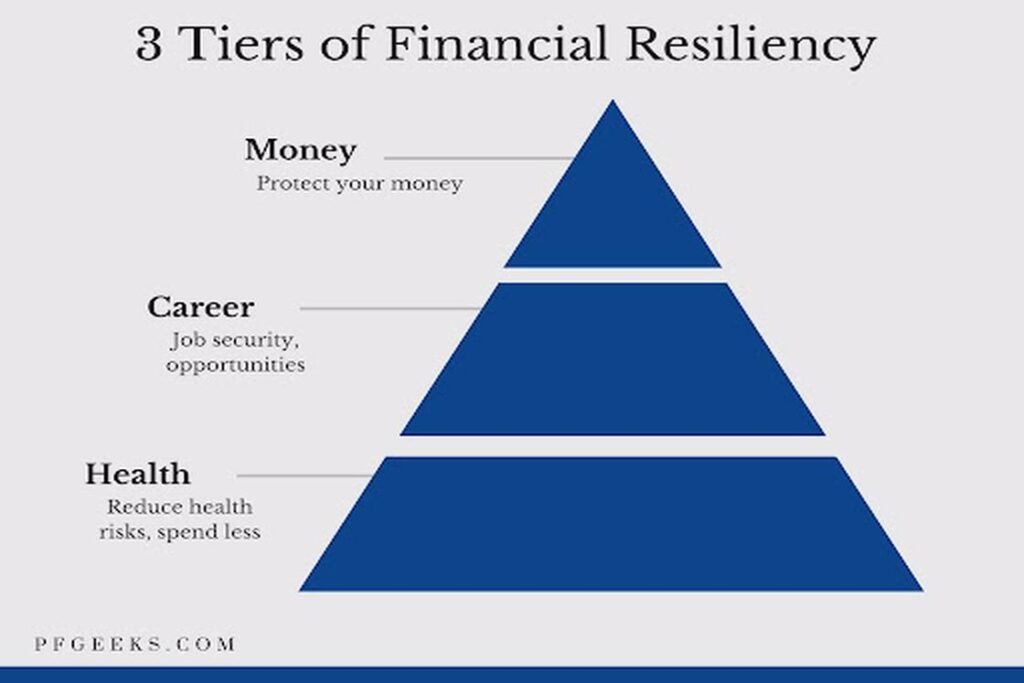

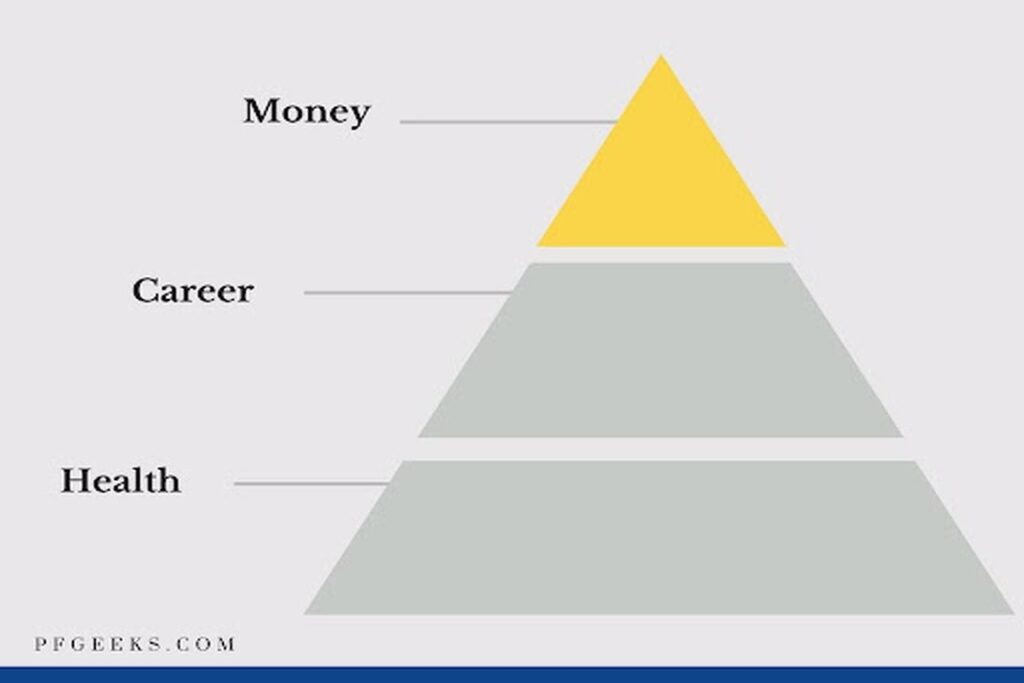

I want to run through 3 tiers of financial resiliency and some specific actions you can take to build up a life foundation that is shockproof.

- Career

- Health

- Money

- Tier One: Your health matters because it is the most significant risk to your financial well-being and the biggest unknown in your retirement plan. Also, being alive is generally a good thing. When your health is at risk, you can’t work.

- Tier Two: Your career matters because without it you wouldn’t have money coming in. Job security is both how secure you are in your current job, but also how quickly you are able to find new employment.

- Tier Three: Money isn’t the end goal, but it’s the tool you need to live your life. The more secure you are financial, the more resilient you’ll be in hard times or recessions.

Health

In almost all of the discussions I see online about personal finance, healthcare comes up more than any other. Not only are there so many unknowns about the future of healthcare in my country but you really have no way to predict your own health.

The healthier you are, though, the better off you’ll be.

Tanja Hester, an incredible blogger at OurNextLife has put together a series of posts detailing how they are planning for healthcare in early retirement. I HIGHLY recommend checking them out on their “Start Here” page.

Here are 5 quick & easy ways to improve your health.

1. Walk More Often

Walking is by far the easiest daily habit you can start to reap massive health benefits. Walking will keep your hips healthy, lose weight, improve your posture, and increase your energy levels.

This is double important if you’re like me and spend 90% of your working hours sitting. Walking 30 minutes a day can also reduce your risk of heart disease and stroke by 27%. It’s also been known to help prevent type II diabetes and asthma.

2. Kill Bad Habits

This one should obviously go without saying, but bad health habits like smoking and excessive drinking are costly and bad for your long-term health. Smoking alone can cost upwards of $1,000,000 over a lifetime.

3. Eat Healthily

People who eat healthily are usually happier, wealthier, and more successful. You’ll be less likely to spend money out of pocket on health-related issues, and you will spend significantly less later on in life.

Eating healthy also doesn’t have to be expensive. Chicken, beef, vegetables, sweet potatoes, and beans are staples of a healthy diet that is budget-friendly.

Want to get all of my favorite cheap recipes?? The PDF of 46 recipes all comes out to less than $2 a serving.

4. Maintain A Healthy Weight

If you want to improve the quality of your life, maintain a healthy weight. This is something I’ve been working on personally. College and my first few years post-grad haven’t been good to me, but it’s time to right the ship!

Here are just a few ways that maintaining a healthy weight can protect your money:

- Insurance: Some insurance providers will provide discounts for losing weight. The healthier you are, the less you cost them. Good providers will pass these savings along to you, the customer. If you want help figuring out where to start, check out this excellent resource on life insurance basics.

- Clothes: If you find yourself yo-yo dieting, then you probably are familiar with the pain of spending money on more clothes when you know you have clothes that are just 10 pounds under your current weight. Trust me, I know what that’s like.

- Healthcare: Take diabetes, for example. The average person will spend close to $8,000 every single year on healthcare for diabetes.

5. Sleep

Want to know my top-secret, ultra-effective, productivity-producing life hack?

Sleep more.

HarvardMed put together a great study on the effects that sleep can have on your health. It is definitely worth a skim, but here are some of the highlights:

- People who habitually sleep less than six hours per night are much more likely to have a higher than average BMI, and that people who sleep eight hours have the lowest BMI.

- Insufficient sleep is also associated with lower levels of leptin, a hormone that alerts the brain that it has enough food. As a result, poor sleep may result in food cravings even after I have eaten an adequate number of calories.

- One study found that sleeping too little (less than six hours) or too much (more than nine hours) increased the risk of coronary heart disease in women.

- Chronic sleep issues correlate with depression, anxiety, and mental distress.

- Sleeping five hours or less per night increased mortality risk from all causes by roughly 15 percent.

6. Insurance

The entire point of insurance is to protect yourself from massive financial loss. There are different kinds that you may need: term-life insurance, disability insurance, home insurance, and flood insurance if you’re in Houston like me.

Career

When it comes to being financially resilient in your career, the key is to reduce your risk of being fired and be as hireable as possible in case of job loss.

1. Become Invaluable To Your Organization

The best way to prevent job loss is to be as valuable as possible to your organization. Do excellent work, beat deadlines, and contribute positive value to the company. This means bringing in more than the company is paying you if you’re in sales. If you’re a project manager, this means beating deadlines and meeting expectations.

I take a wide and profound approach to this. I love to be strong in one area while still having a hand in multiple other areas. The more you handle in your job, the more difficult you are to replace. My buddy Erik is wicked smart when it comes to growing his career. He just shared his best advice on how to become a 6 figure earner!

2. Build A True Friendship With Those In Charge

The truth is sometimes companies have to let people go. Once all the under-performers have been fired, the next round of cuts will probably target the fluff jobs or the workplace jerks.

No one in charge enjoys firing, but they would especially not fire a friend. Don’t pursue friendship just to avoid losing your job, but this is one of the perks to being well-liked around the office. Learning some basic principles of persuasion can help you establish yourself in the workplace without being manipulative.

3. Update Your Resume Every 6 Months

If you ever lose your job, the quicker you can have your resume put together, the sooner you can take action on applying for new jobs. I knew a guy who had been at the same job for 17 years and when it came time to update his resume he had no idea where to start.

The more regularly you update your resume, the better.

4. Always Be Networking

The best time to be networking is while you actually have a job. Get to know people in your industry at other companies. Meet with them to learn and grow to perform better in your current role, but also to build some ties at competitors in your industry.

5. Accept And Reply To Linkedin Requests From Recruiters

I know those cold-messages you get from recruiters are obnoxious, but you don’t need to burn a possible bridge for no reason. Whenever you deny these message requests, you have essentially blocked that recruiter from ever reaching back out to you.

Instead, respond with this simple message:

“Hey ______,

Thank you so much for reaching out about the opportunity with *insert company or industry*. I really do appreciate it but I am happy in my current role. I’ll be sure to let you know if or when I decide to look for other opportunities.

Rich, ______”

This keeps the relationship open and you now have someone you can go to if things ever get bad. I was a finance major in college and I get these requests on a monthly basis even though I work at a church.

I never plan to switch careers, but if I ever did I have a list of around 40-50 recruiters I can reach back out if needed.

6. Build Your Own Business

I almost didn’t include this one because it is so obvious, but this is just about the only guaranteed way to be truly resilient in your career. One of my good blogging friends wrote a massive guide that will help you start your own business! It absolutely should be required reading for every hopeful entrepreneur!

7. Work For A Smaller Company

Fun fact: Back in 2008, around 27% of firms with less than 100 employees had to make job cuts while 45% of firms with 500 or more workers did the same. (source)

Work at a smaller company and become less susceptible to job loss.

Money

Now, for the $$$$. This is an area that most personal finance bloggers have covered at length so I’ll be brief and just link out to awesome content that you should go read.

1. Emergency Funds

The whole purpose of an emergency fund is to give you a buffer when life decides to smack you in the face! You just never know what kind of emergency you might run into. Check out my Ultimate Guide to Start and Build an Emergency Fund to get started!

2. Live On One Income

If you’re in a dual income household, then the BEST thing you can do to insulate yourselves financially is to only live on one of your incomes. This gives you an incredible amount of protection against financial worry and job loss.

3. Reduce Expenses

This is an area that I love to write about! Spending less money isn’t sexy, but it is one of the easiest ways to make your finances more bulletproof. The less money you spend, the less you need. Duh.

If you don’t have a lot of room to increase your income, then you’ve got to reduce your expenses.

Download my massive list of 150 proven ways to save money to help you do exactly that.

4. Automate Your Finances

The last way to make your money a bit more shock-proof is to simply take YOU out of the equation. The less your financial plan requires your time, energy, financial discipline, and ability to remember, the better.

Things you can automate:

- Debt payoff

- Retirement savings

- Credit card payments

- Bills

- Emergency fund savings

*Bonus* If you want to train up your kids to be financially resilient, then you absolutely need to start teaching them at a young age. The key is to teach them the importance of delayed gratification early on.

My buddy Matt wrote an incredibly detailed guide on the marshmellow test and you absolutely need to check it out.

5. Side Hustle

If you can find a way to make some extra cash on the side, then you’ll be much more financially resilient. A side hustle can help you pay off debt, boost your emergency fund, and become financially independent faster.

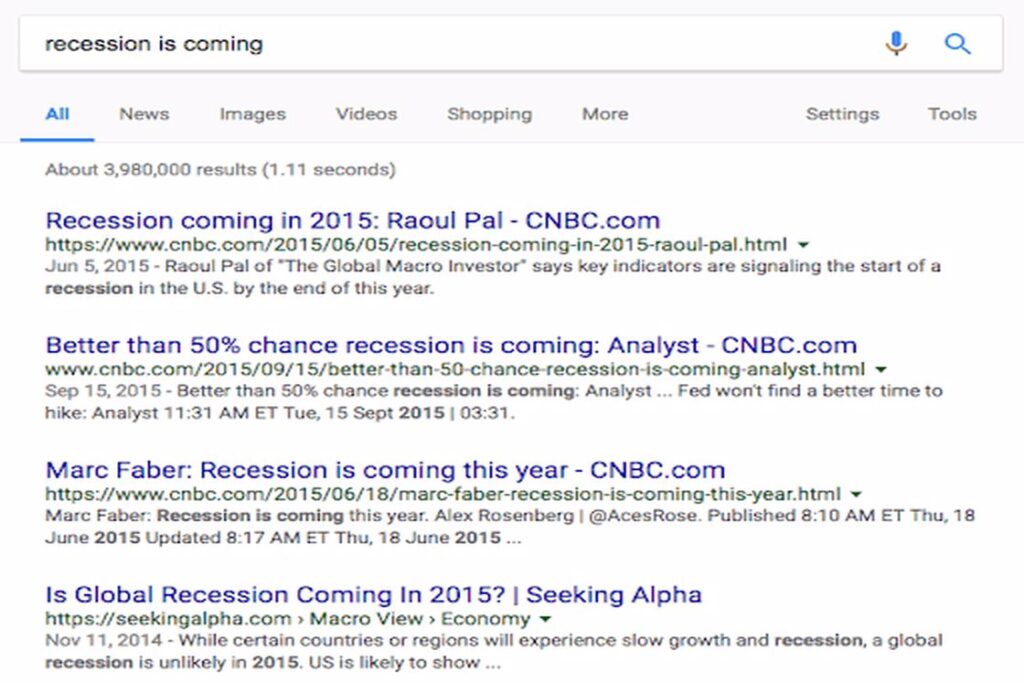

Over the past few years I have watched dozens of videos and read hundreds of articles by financial experts doling out their latest advice on investing and the state of the stock market. For the most part the advice has been the same: SELL.

I’ve even had close friends and family tell me that there is no question that the market is about to crash and that I need to sell all my stock, hold cash, and wait for the market to bottom out before re-investing.

How Do You Prepare Yourself for a Recession

These days, I can’t listen to or read anything about the financial state of my country without hearing this message blasted across any medium.

Look at the dates on those articles. People have been trying to predict the recession for a few years now.

I’ve ignored their advice.

Eventually one of them will be right. Maybe it will be the student loan crisis, the auto loan crisis, the sheer amount of consumer debt, or the beginning of another housing crisis. It could be any of these or a black swan event I cannot predict.

The hole in their logic is that it is next to impossible to predict any of the following

- When the market will peak

- When the market will crash

- When the market will hit its low

- When the market will start to rise again

Sure some indicators point to a recession, but there are also indicators that show this is the strongest the US economy has been in years.

I’ve learned to simply tune out the noise and can do this without worry.

In fact, I have zero concern for myself if the market were to tank this month, this year, or in 5 years.

To take it even further… A stock market recession in my 20’s while my wife and I are earning a dual income without kids would be the greatest thing for my retirement and savings. I would be able to take advantage of market lows for a couple of years, maximize my investments, and then watch them grow and compound for years on end.

That being said, I don’t wish for a recession like some of my colleagues in the finance blogging world.

Recessions and depressions are nothing to celebrate or find joy in. Millions near retirement will wonder what they will do. Millions will lose their jobs. A financial catastrophe is one of the leading causes of suicide.

None of that is worthy of celebration.

But those of me who are invested in the stock market must face a stark reality.

A Recession is Coming

Eventually those who claim the market is about to crash will be right. The market will eventually crash and there is almost no way to prevent it or avoid it. However, the best advice you can get is to ignore the noise, be excellent at your job, save money, and make no attempt to time the market.

But what can you do to prepare for the next recession? What should you be doing?

The best time to start preparing for the next recession is now. There are a number of steps you can take such as beefing up your emergency fund, creating multiple income streams, and excelling at your current job.

Why You Need A Recession Proof Budget

For many people, 2008-2010 were some of the worst years of their lives as they saw their employment disappear nearly overnight. Millions of people across the country of every age, gender, and industry saw their jobs disappear nearly overnight.

In fact, in the two years starting September of 2008, the US economy saw nearly seven million jobs lost. Certain industries were certainly hit harder than others, and while I was confident in my current job, I wanted to take a few steps to prepare just in case.

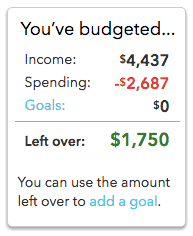

My wife and I have been using Mint as my primary budgeting software. It has been instrumental in helping me set up, stick to, and ultimately execute a monthly budget. The budget I follow each month is pretty lean. I live a simple life. My goal is to save and give as much as I am able to while preventing my lifestyle from inflating with my income more than it needs to.

A few weeks ago I asked myself a tough question, “If I lost my job tomorrow, how much more could I cut? What are the areas of fat in my budget? Where can I find more savings? Is it worth it to cut even more than I have?”

Essentially, I wanted to drill down and find the bare minimum amount of money I need each month to get by. How little could I live on and still break even each month?

When you set your mind on reaching financial independence, you make the necessary sacrifices to reign in your spending. But the truth is, even with already-lean budgets, have areas I could cut but choose not to.

- My wife and I love to eat out.

- I have a gym membership and spend too much on overpriced coffee.

- She likes to renovate furniture and buy gifts for friends.

These things come at a cost, not only in dollars but in time spent working.

For me, they are worth it.

But what if I lost my job tomorrow? I would cut these small luxuries.

How to Make a Recession-Proof Budget

One of my balanced financial goals is to put myself in a position that is as “Recession-Proof” as possible. I want to have security in my job, security in my investments, and security in my ability to save.

One aspect of this is understanding exactly how much I need each month to get by–the absolute bare minimum.

I created a Recession proof budget, otherwise known as a “Slash and Burn” budget. Essentially, I went through my budget item by item and asked myself, “If worst came to worst and I lost my job, could I get by without this? How frugal could I live if life brought me to my knees?”

Do you know that number?

Knowing this number has given me an extra layer of financial peace.

My monthly expenses all together come out to $2,687

The “Cut-List”

Below is a list of everything that I have decided I could sacrifice in order to be at my almost bare minimum budget. This would allow me to keep paying for wifi and books for Seminary. After going through this exercise I may decide that some of these areas are not worth the price I pay for convenience or pleasure.

- Monthly allowance $100

- Gym membership $78

- Gifts $40

- House Additions $50

- Dollar Shave Club $2 average monthly —add note about pre-tax income below image above

- Food $100

- Costco $5 average monthly

- Eating out $100

- Dry cleaning $10

- Laundry $25 – I use a laundry facility but could drive to friends/family

- Christmas $50 – I set this aside each month

- Missionary Support $50

- Website $10 average monthly

After going through my budget and making the above, imaginary budget cuts, I calculated that I could lower my monthly spending by $620 to a bare minimum of $2,067 to get by each month, which includes a $328 car payment! A year from now when the loan is paid off, my minimum will go down to $1,739.

With this number in mind, I am extremely confident in my long-term financial security. Plus, with my side-hustle, I have an extra $800-1,000 coming in each month not included in my income on Mint.

As I mentally prepare for a possible eventual recession I have an extra level of financial safety because I know exactly how much I need each month to get by without dipping into my savings. I know how much I can get by if things get desperate.

I also have a goal to work towards… How can I create multiple streams of income outside of my current job that can cover my monthly expenses?

Final Thoughts

It’s impossible to predict the future. If you’re being honest, you really have no idea what tomorrow will hold for, but there are steps you can take today to position yourself as best as possible.

If you’ve never gone through the process of actually making a budget, then I highly recommend checking out either of my budgeting guides: Creating a Zero Based Budget or the 50/30/20 Budgeting Rule. Follow the steps and get yourself on track and on a budget. After you have a better idea of what your current spending looks like, take the time to follow the simple steps above to create your own recession proof budget.

This is one of the simplest and most powerful levers you can pull for yourself and for your family to earn more, save more, and give more.