Earning $18 an hour can seem like a decent wage, but have you ever wondered how much that adds up to annually? Knowing your annual salary can help you plan your financial future better, and we’re going to do exactly this.

First, we determine how much you would earn per year, and then we’d cover ways that you can spend effectively, and perhaps, even raise your income. Let’s dive in!

Contents

$18 an Hour Is How Much a Year?

Assuming you work 40 hours per week for 52 weeks, your annual salary would be $37,440. To get this figure, what I did was multiply your $18 hourly wage by 2,080 total annual hours worked (40 hours/week x 52 weeks/year). These figures represent your pre-tax income, so you would still have to factor in taxes and deductions when budgeting.

Now, for after-tax income, we first have to consider the applicable tax rate and deductions. Tax rates can vary based on factors such as filing status, location, and other personal circumstances.

However, as a general guideline, assuming a tax rate of around 20-30% (including federal, state, and local taxes), the annual income after taxes for an $18 per hour rate would be approximately $26,000 to $29,952.

And, don’t forget to take into consideration vacation and sick time. I remember when I got my first job (which paid a LOT less than $18/hour), and didn’t take into account a vacation I was taking. Lets just say that I came up quite a bit short financially at the end of that month!

$18 Per Hour Breakdown

$18 Per Hour Annual Salary

If you’re earning $18 per hour and working 40 hours per week for 52 weeks in a year, your annual salary comes out to be $37,440. This figure is pre-tax and assumes no overtime. This works out to an annual salary just above the median for US wage earners, as you would find on The Calculator Site.

How Much Is $18 per Month?

To determine your monthly pay at this same rate, just divide the annual pay figure that we arrived at earlier by 12. So, pre-tax income would be around $3,120. Keep in mind that we’re still working with the 40 hours per week assumption.

Also, you should note that some months have more work days than others.

For example, in August 2023, there are 23 work days. If you were working on an hourly basis at $18/hr, you would make $3,312 that month.

That’s a lot more than you would make in February 2023, where there were only 20 work days. If you were working on an hourly basis at $18/hr, you would make $2,880 that month (13% less than August).

My guess is that your landlord will still charge you the same amount for rent both month.

How Much Is $18 per Hour per Week?

If we break down the calculations further, you can see how much you’d earn in a week at an $18 hourly wage. With 40 hours of work per week, your weekly pay would be $720, again recall that this is pre-tax and excluding overtime. You can compare it with other income brackets such as $25 an hour or even $34 an hour and see what can you do to level up.

How Much Is $18 per Hour Bi-weekly?

If you receive your paychecks every two weeks, you can calculate your bi-weekly earnings at the $18 per hour rate by multiplying your weekly pay by two. In this case, your bi-weekly pay would amount to $1,440.

How Much Is $18 per Hour per Day?

To find out how much you’d earn per day at an $18 hourly wage, simply multiply your hourly rate by the number of hours worked per day. If you work a standard 8-hour day, your daily pre-tax earnings would be $144.

How Much Is $18 per Hour Part-Time?

Part-time employment typically involves working fewer hours per week than a standard full-time position. Assuming you work 20 hours per week instead of 40, your annual part-time salary at $18 per hour would be $18,720. In this case, your monthly and weekly earnings would be $1,560 and $360, respectively.

Paid Time off Earning 18 Dollars an Hour

When I earn $18 an hour, my annual income comes to $37,440, assuming I work a full-time schedule of 40 hours per week for 52 weeks. Now, let’s explore how paid time off (PTO) affects my income.

In most cases, employers provide PTO to full-time employees, which may include vacation days, sick days, and personal days that are paid. If, for example, my employer grants me two weeks of PTO, that means I’m being paid for 50 weeks of work, amounting to 2,000 hours (40 hours x 50 weeks).

In this scenario, my annual income would be $36,000 (2,000 hours x $18). It’s important to note that PTO policies vary by employer, so I’ll need to factor that into my financial planning.

$18 an Hour Budget

If you’re trying to budget with an $18 an hour wage, you have to consider both gross and net income. For a full-time job at 40 hours a week, the gross income would be around $37,440 a year before taxes. However, the amount you actually take home, or your net income, will be different due to deductions like taxes and benefits, like we’ve highlighted already.

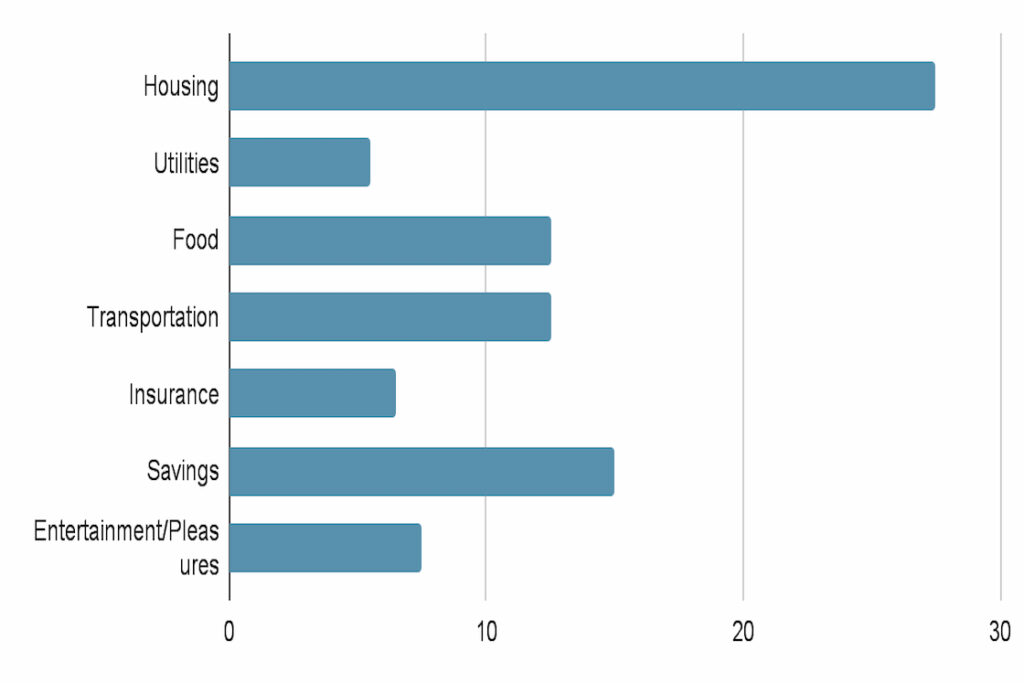

To create a sample budget, I’ll start with calculating the net income by estimating around 20-25% in deductions. This will result in approximately $28,080 to $29,850 annually, or $2,340 to $2,488 monthly. Now, let’s break down some basic expenses. Depending on your lifestyle and location, these figures could vary:

- Housing: 25-30% of net income

- Utilities: 4-7% of net income

- Food: 10-15% of net income

- Transportation: 10-15% of net income

- Insurance: 5-8% of net income

- Savings: 10-20% of net income

- Entertainment/Pleasures: 5-10% of net income

Living on $18 an hour can be manageable in areas with low cost of living, but you might need to make some adjustments in your lifestyle. My tips for thriving on this income include reducing discretionary spending, finding ways to save on essential expenses, and focusing on increasing your savings for a cushion in case of emergencies. Remember, the key to successful budgeting is tracking your expenses and maintaining a balance between needs and wants.

How to Live on $18 per Hour

Create a Budget

To live on $18 per hour, you should definitely create a budget. With a pre-tax income of about $37,440 per year, I would account for all my expenses like rent, utilities, groceries, and transportation.

Planning my spending ahead helps me get a better understanding of how much money I have left over for savings and leisure activities.

I prepare my budget several days in advance of the coming month. I also review my previous months budget (and resulting spend) a few days after the month ends. How else will I know if I’m sticking to the budget?

Housing

Finding affordable housing is key when trying to live on $18 per hour. I would consider renting an apartment with roommates to reduce the cost of living or look for affordable housing options in less expensive neighborhoods. It’s important to ensure that housing costs do not consume a significant portion of my monthly income.

Save on Groceries

I would make an effort to save on groceries while living on $18 per hour. This could include shopping at discount stores, using coupons, or buying in bulk. Planning meals ahead of time and avoiding eating out are also effective ways to save money on food expenses, and prioritize my nutrition.

Prioritize Debt Repayment

Living on $18 per hour, I would prioritize repaying any existing debts in order to improve my financial situation. This could mean allocating a portion of my budget towards extra debt payments and working towards becoming debt-free sooner. Eliminating debt will allow me to save money on interest payments and work towards other financial goals.

Develop a Side Hustle

To supplement my current income, I would explore the possibility of developing a side hustle. This can help increase my overall earnings and provide additional financial security, especially during economic uncertainties. By finding freelance work, turning my hobbies into a source of income, or launching a small business, I can create additional revenue streams that complement my hourly wage.

I build websites on the side, monetizing them with ads and affiliate offers. I love this side hustle, because I can do it from anywhere and anytime. No boss to report to, just me and my computer at night after the kids go to bed.

5 Ways to Increase Your Hourly Wage

As a finance expert, I can tell you that increasing your hourly rate like aiming for $39 an hour is key to making more money. Here are five strategies that I recommend:

- Improve your skills: Invest in yourself through continued education, certifications, and training relevant to your field. This not only increases your value to employers but also sets you apart from the competition.

- Negotiate your salary: Don’t be afraid to ask for higher wages during a job offer or performance review. Do your research and present a data-driven case for the increase you deserve. Who knows your skills might be worth $32 an hour.

- Network: Connect with professionals in your field, attend industry events, and participate in online forums. Building relationships can open doors to better job opportunities with higher pay.

- Job hop strategically: Stay alert for job openings and evaluate if they offer better pay and long-term potential. Changing jobs can lead to significant pay increases.

- Explore alternative work arrangements: Consider picking up freelance work or pursuing multiple part-time jobs that pay a higher hourly rate.

By focusing on these strategies and effectively implementing them, you can significantly increase your hourly rate up to $23 an hour, for example, and ultimately, your annual income. Remember, a successful career in any field requires perseverance, dedication, and adaptability.

Jobs That Pay $18 an Hour

As a finance expert, I’ve come across various occupations that offer an hourly wage of around $18. These jobs can provide a stable income for those who are interested in earning a decent salary. To put it into perspective, if you work full time at this rate, you can make approximately $37,440 per year before taxes.

Here are some jobs that typically pay around $18 an hour:

- Administrative Assistant

- Dental Assistant

- Customer Service Representative

- Warehouse Worker

- Sales Associate

Keep in mind that these are just a few examples; there might be other opportunities in various sectors that offer similar compensation. Additionally, factors such as experience, location, and company size can also influence the hourly wage for these positions. In any case, it’s essential to focus on building your skills and gaining relevant experience to increase your earning potential.

Conclusion

In summary, earning $18 an hour amounts to a pre-tax annual salary of $37,440, assuming a 40-hour workweek and 52 weeks of work per year. After accounting for taxes, your take-home pay may be around $28,080 per year, based on a 25% to 30% tax rate.

As a finance expert, I’d like to say that managing your finances is crucial, regardless of your hourly wage. Being frugal and wise with your spending choices will make it feasible to live on an $18 an hour wage, particularly if there are no dependents involved. To ensure financial stability, I recommend focusing on budgeting, saving, and investing in order to maximize the benefits of your income.