Have you ever stumbled across your favorite early retirement blogger and had your mind blown? One blog post, and you’re off to the races. Chasing the dream. You start off just wanting to cut back and make some adjustments.

Before you know it, nothing matters except reaching the Holy Grail… Financial Independence. You’ve set Financial Independence on the altar, willing to sacrifice nearly everything to get there. Expensive coffee? No thanks. Eating out? Only idiots do that. The thought of buying Christmas gifts causes you to go on an internal rant about consumerism in American culture. You mock the crowds waiting in line for the newest iPhone.

Contents

There’s Only One Way to Become Financially Independent

Live like a monk. Avoid all social outings. Turn every purchase into a cost-benefit analysis and throw every single penny into VTSAX.

Save at least 50% of your income, pray the markets continue their bull run, and spend every Friday night tinkering with your spreadsheets, reviewing your strategy, and reading Early Retirement Now so that you can have the most optimal withdrawal rate strategy when you retire 10 years from now.

Sound familiar? I’ve heard it all. Heck, in many ways, I’m talking about myself.

Turning the Corner

I love the hardcore nature of the FIRE (Financial Independence Retire Early) community. I appreciate the intensity. I think it takes a certain personality to be willing to work hard and sacrifice luxuries, all for much-delayed satisfaction.

I’m part of nearly a dozen Facebook groups that are geared toward budgeting, saving, and financial independence. I love the community and have become immersed over this past year. One thing I’ve noticed over the past six months is this…

The hardcore nature of FIRE makes it hard to draw others in. For many, the intensity is a turn-off, and often, these people need the advice the most. My wife is one of those people. Those in the community want to help people manage their finances, learn how to budget, get out of debt, avoid making financial mistakes, and generally live a more fulfilling, more free life.

But too often, it comes across like this: “YOU’RE AN IDIOT! Why would you ever get a car loan?! Pay cash only!” This week she said, “Hey, I think I might leave the _________ Facebook group. They’re too intense for me. I mean, is it such a bad thing that I like luxuries and don’t want to give up everything I enjoy?”

I completely understood where she was coming from. Fortunately for people like her and thousands of others, there is a community of people ready to help. A community of people committed to helping each other along the journey to Financial Independence.

Meet ChooseFI: The Best Podcast Duo Spreading the FIRE

ChooseFI is a podcast and blog founded by Brad Barrett and Jonathan Mendonsa that is changing the lives of thousands of people, one episode at a time.

After launching at the beginning of 2017, the podcast has rapidly grown into one of the most listened to and the best podcast on personal finance in the country!

In 2017 they were voted by RockstarFinance bloggers as the best podcast covering Financial Independence, AND they were runner-ups for a new podcast of the year at FinCon. These are both huge wins for them!

I stumbled across ChooseFI about 6 months ago when the podcast had around 20 episodes and the Facebook group was just launched. Since then, Jonathan and Brad have delivered amazing episodes, and the community has grown.

Each of the four bloggers quoted below is actively involved in the ChooseFI Facebook group and has great things to say about the podcast and community!

Anissa Watkins, Blogger at Moetips

“The FI community has changed my way of thinking about how I manage my finances. I’ve reduced unnecessary costs in certain spending categories to allocate those funds toward retirement. When I post questions in the group for discussion, I get immediate responses and actionable steps! I love the community engagement and the comradery. The hosts provide valuable information every Monday and Friday and interview knowledgeable guests. I’m honored to be an admin for the Baltimore local group!”

What Makes Up the ChooseFI Community

Three major components make up the community of ChooseFI:

1. Podcast

The podcast airs every Monday and Friday. Monday introduces a new topic or idea, and Friday brings in the community’s feedback and ideas. With over 100 episodes, there is plenty of binge-worthy material!

They’ve interviewed some seriously amazing guests and some of the most well-known people in the Financial Independence community.

Favorite Episodes

- 009 | Travel Rewards

- 21 | The Pillars of FI

- 019 | JL Collins Index Fund Investing

- 019R | Index Investing

- 022 | The True Cost of Car Ownership

- 007 | Crushing the Grocery Bill

More Advanced Listening

- 017R | The Roth Conversion Ladder

- 034R | How to Determine your Risk Tolerance

- 035 | Sequence of Returns

- 035R | The 4% Rule Explained

With all of these awesome episodes and guests, there’s no wonder why they’re considered by many to be the best podcast in personal finance!

Fritz Gilbert, blogger at The Retirement Manifesto

“Jonathan and Brad are absolutely CRUSHING IT with this podcast! They’ve struck the perfect balance between “content” and “Community”, and their numbers speak for themselves. Check out those ratings, have you ever seen so many “5’s”? There’s a reason! Give them a listen, you won’t regret it!”

2. Facebook Group

About 6 months after launching the podcast, Brad and Jonathan felt the need to form a place for their listeners and the greater FI population to come together to grow, share ideas, and ask for personalized advice.

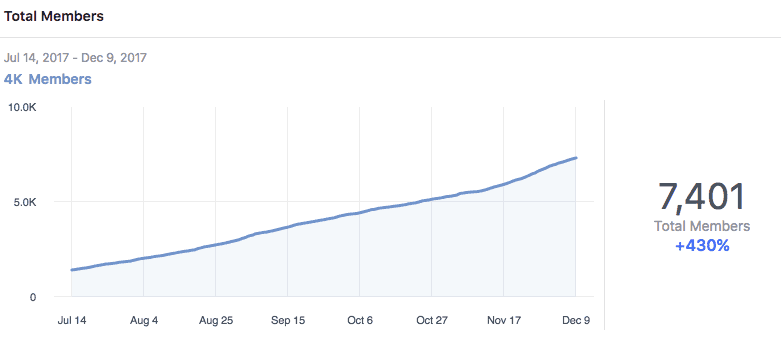

What began less than two years ago has become one of the hottest and fastest-growing communities within the early retirement space.

Undoubtedly, it can be tough to bring up finances with friends and family. Fortunately, the ChooseFI Facebook group is a place where you can ask questions about becoming debt-free, optimizing your investments, cutting costs, or even sharing tips on how to budget with a spouse or partner.

About two weeks ago, they launched over 70 local Facebook groups designed to foster real-life relationships with those in the FIRE community and to share tips and hacks for local areas.

Join a Local group today!

Robert Farrington, Founder of The College Investor

“I love the engagement of the community on Facebook. It’s awesome to see a question and then like 10 responses almost immediately. While I don’t always agree with everything, it’s great to see such a strong community.”

3. ChooseFI Vault

What happens when you get 7,000+ FI-seeking people together?

Every day people begin to share the advice, strategies, and ideas that are helping them reach financial independence. I’ve seen people share everything from their favorite recipes to complex budget templates and net worth trackers.

A few months back, Brad and Jonathan realized that they were sitting on a goldmine of advice and found a way to organize it all.

They launched the ChooseFI Vault. A simple folder in Google drive where people could submit their own DIY resources and guides to help others.

In the Vault, you can find:

- Net Worth Templates

- Bank of Budget-Friendly Recipes

- Budget Templates

- Private Mortgage Insurance Removal Calculator

- Loan Amortization Table

To get access, go here: https://www.choosefi.com/vault/

What Sets ChooseFI Apart

1. Community Focused

Truly what sets them apart is that this whole podcast and community isn’t even about them.

They obsessively focus on making everything they do about the community they are trying to foster and build. They aren’t trying to promote their own name or become “larger than life,” and they never take on any kind of celebrity status.

Even as the podcast has grown to be one of the most listened to in the country, they have stayed down-to-earth. Two guys being passionate about helping others reach financial independence. If anything, they’ve become more humble during the exponential growth of the podcast.

How refreshing does that sound? In an online community of bloggers and podcasters who all seem to be projecting themselves as the experts, the two guys changing the community have found a different approach–“help thousands of people reach their financial goals.”

2. Flexible Approach to Financial Independence

Because of their humility and eagerness to learn, they are much more open to different approaches. They realize that personal finance is exactly that–personal.

“I am not dogmatic here about any single approach to Financial Independence but want to foster conversation that allows to reach the goal of financial independence faster. The path this community chooses to follow to reach FI will be incredibly diverse but the conversation is guaranteed to be fascinating.

The only dogma is that you Take Action.”

Airmen, Anonymous Blogger at Military Dollar

“The great thing about Brad and Jonathan is they’ve been able to capture the imagination of thousands of people with a message that, to many people, seems “nuts” (even though it’s not!). I’m in my mid-thirties and have been walking this path mostly by myself for over a decade because even though I found plenty of other FIRE people online, they were either much older than me or too hardcore. It’s great to see the FIRE spreading and the community building!”

The Fire is Spreading: Join the Movement Today

Suppose you’re looking for an awesome group of people to learn from and grow with. Join the ChooseFI community today. Don’t just dip your toes in the water. Jump on in.

Here are 3 quick ways to do that:

- Join the Main Group

- Join a Local Group

- Listen to the Best Podcast out there!

Lastly, would you do me a huge favor?

Click one of the share buttons to the left so that others like you can find a community where they can learn, ask questions, and be part of a group of like-minded people. OR send it to someone you know who wants help with their finances.

Become part of the movement today.

PF, great post to a couple of great guys. It’s exciting to see how the ChooseFI “platform” has EXPLODED. They’ve clearly hit a nerve, and they’re creating a true phenomenon! This is the most exciting growth story I’ve witnessed in my 2 1/2 years of blogging, and for good reason.

Great podcast, great community. Thanks for giving them the shoutout they so rightly deserve!

Fritz! Thank you for contributing and commenting.There’s no question Brad and Jonathan are on a wild growth path. Can’t imagine to see where they end up a year from now.

I was fortunate enough to stumble upon the Choose FI podcast earlier this year. I was smitten from the first episode and knew they had a magical formula.

Two thumbs up here! Looking forward to more informative and entertaining episodes in 2018!

Thanks for commenting MMMM! They are killing it with their podcast. I’m glad you’re a fan! PS. Tried to find y’all today on Pinterest and didn’t have any luck. You on there?

I found ChooseFI pretty early and have been enjoying it ever since. The Facebook group is getting overwhelming but we had our first local meetup last weekend. What an awesome experience to be around people who had no idea others like them existed. I haven’t been willing to disclose the blog yet, but look forward to. Awkward but slightly liberating to talk Money in person!

I get where you’re coming from. Honestly, I think one of their biggest challenges this next year will be maintaining the value of the Facebook group as they continue to grow. Most of the groups I’m a part of that have grown past the 5k mark tend to regress at a certain point.

You nailed it with this post. It’s spot on. ChooseFI is the must listen Personal Finance podcast. I found it around the same time as you. Have listened to every episode and really just can’t get enough. Every time I hear these guys I get smarter. Thanks for sharing.

Appreciate the comments Jason! I’m still catching up on some of the recent episodes. You have a favorite?

Hey! Great job on the shoutout to our favorite podcast. This podcast is a life changer in many many ways. I Wish more people were open to the concepts.

Your writing is great too!

Appreciate the kind words Claudia! Glad you love the podcast. Are you in the Facebook group?

Great post! ChooseFI sounds very intriguing and I will have to give the podcasts a listen.

Hi Melanie, you absolutely should! Especially if you are into saving money and trying to make sure you’re making the best investment decisions possible. Thankfully, the hosts do a great job keeping it fun and entertaining.

I love this! Sounds like a really interesting podcast, I am super into listening to I will definitely have to check this one out!

Great! Thanks for commenting Charlie. I’d love to hear what you think once you get around to listening. I linked a bunch of my favorite episodes in the post.

This is new to me and I’d love more about and to connect with a community like this! Thanks for sharing all of the information and I’ll be checking into it myself!

Absolutely! The community is very engaging!

That really seems interesting, I will have to check those podcasts out! 🙂

Yes ! You will absolutely love it! Very informative and insightful. Im learning a lot about retirement and investing..

The podcast sounds Good, I think I might give it a try. I’ve always been concerned with saving and I feel like I’m doing a good job, but I could always find ways of improving.

This community will definitely help you reach your goals!

Great post, I’m not really a podcast listener if i’m honest but It was a great post to read 😊

This sounds like an awesome podcast. Need to check it out asap

Very interesting post. I will be sure to look up the podcast to see how I can refine my budgeting strategy

can’t say I’ve heard about this podcast series but I am so tuning in. At 25 I am a lot more aware of the importance of saving for retirement and having financial independence. Great post!

Great info. Thanks for sharing!!

sounds like a podcast i should be checking out! thanks for the info

Definitely! Come back and let me know when you do! Also, thanks for sharing on Twitter!

financial independence is really something I think many of us seek. I know for me thats a very large part of why I am trying to recreate my own brand. You mentioned a lot of useful things and the podcasts sound very interesting. I saved them for later!

I will definitely listen to the FI Podcast, lots of information I agree with.

Thanks for commenting Lois! Glad you found it helpful.

I am definitely a long way from retirement but it is never too early to get your finances in check! I just recently started my blog, about 4 months ago, and other than that my boyfriend is the income for the household. Would love to check out this podcast though!

It is definitely never too early! Best time to start planning is today. And the earlier you start, the shorter your path to retirement will be. I’ll be checking out your blog for sure. Let me know when you start listening to their podcast!

Looks like an interesting podcast. Will definitely give it a listen.

Do it! Once you get through a few episodes, come back and let me know which was your favorite!

What a very informative post. I not a real podcast listener but this one sounds really good. Going to have to check it out. Thanks so much for sharing.!

I love ChooseFI… such a great podcast and community!

Found the the ChooseFI podcast on episode 1 and always enjoyed their topics. Great guys.

This podcast seems really helpful. I am glad I found your website and got to know about ChooseFi!

– http://www.allshethings.com