Emergencies, down payments, and unexpected market trends – there have been many times I’ve wished I had more money in the bank.

Unfortunately, around 21% of Americans aren’t saving any money at all, according to a report published by CNBC. Not only does this compromise financial goals, but it also leads to unwanted stress.

Luckily a solid saving strategy, a bit of monthly budgeting and the right mindset are all it takes to save money for your future needs.

So, whether you want to save for an emergency fund, a relaxing vacation, or a big purchase, this guide will help you get there by teaching you how to start saving roughly $5,000 in 3 months.

This may sound far-fetched, but as with most goals in life, you can do what you put your mind to – and saving money is no exception. What’s more, I’ve also provided a chart near the end to help track your progress and stay motivated!

So, let’s dive right in and talk about how to save $5,000 in 3 months or less.

Contents

Save $5,000 in 3 Months With This Chart

Saving 5,000 US dollars within 3 months means separating $420 from your income weekly for 12 weeks.

That’s a significant amount of money, but with a clear plan and consistent effort, it can be achieved. One way to help visualize your progress and stay on track is by using a savings chart.

A savings chart can be as simple as a piece of paper or a spreadsheet that you use to track your progress toward your goal.

This can let you see your progress and make adjustments as needed to stay on track and reach your goal. It also helps to visually see how much money is left to save, which can help you make more informed decisions about your spending.

Here is an example of a savings chart for someone trying to save $5,000 in 3 months:

| Week | Deposited Amount | Savings | Left To Save |

|---|---|---|---|

| 1 | $420 | $420 | $4,580 |

| 2 | $420 | $840 | $4,160 |

| 3 | $420 | $1,260 | $3,740 |

| 4 | $420 | $1,680 | $3,320 |

| 5 | $420 | $2,100 | $2,900 |

| 6 | $420 | $2,520 | $2,480 |

| 7 | $420 | $2,940 | $2,060 |

| 8 | $420 | $3,360 | $1,640 |

| 9 | $420 | $3,780 | $1,220 |

| 10 | $420 | $4,200 | $800 |

| 11 | $420 | $4,620 | $380 |

| 12 | $420 | $5,040 | -$40 |

While you can add the precise figure of $417 weekly to hit the target amount of $5,004, saving $3 extra every week will net you an extra $40 at the end of the journey, something you can use at the end of the cycle to pay for a celebration meal of reaching your financial goal.

How to Save $5,000 in 3 Months: Actionable Tips that Work

I know that saving $5,000 in 3 months may sound like a daunting undertaking when you feel like you’re already strapped for cash.

That’s why to make this goal realistic and achievable, I’ve broken it into smaller, more easily digestible pieces. Consider them as mini objectives that’ll direct you to achieve your main goal – saving $5,000 every 3 months.

Not to mention that reaching mini milestones will boost your confidence to keep saving more money until you reach your final objective.

Create a Budget & Stick to It

Despite the countless perks of budgeting, research has shown that less than half of Americans actually create and plan out a budget. But if you’re on a mission to save $5,000 in 3 months, you certainly wouldn’t want to be a part of that crowd.

The key is to keep track of the money coming in and going out. In other words, how much you earn and what you spend are a few things to consider.

You can keep an eye on your budget by creating a budget planner, or by following budget techniques such as zero-sum budgeting or the 50-30-20 budget tip. Alternatively, you can download a budgeting app to monitor your spending habits.

Whichever tracking method you choose, make sure to use it to analyze your spending regularly and seek ways to minimize your living expenses. Go through your bank and credit card statements to see where your money goes. Consider:

- Curbing impulse purchases

- Pausing subscription services that you don’t need

- Keeping online shopping habits in check by setting a monthly spending limit

- Cooking food at home more often

- Using public transport if your monthly fuel costs are too high

Even though sticking to a budget may seem like a taxing ordeal – never lose sight of why you’re doing it in the first place. To keep you from spending wastefully and directing your cash flow where necessary.

Not only will this give you greater control over your money but it’ll also help you build a stronger financial future, which means more peace of mind and less distress for you and your family in the long run!

Boost Your Earnings

The fastest way to save $5,000 in 3 months is to earn more. But how can you do so if you have a job that doesn’t pay enough to meet your financial goals? Well, by creating new income channels of course.

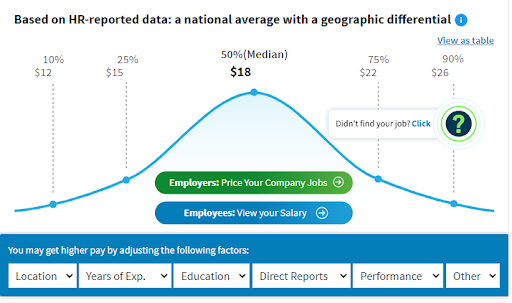

Use your full-time job to pay monthly bills and take a side hustle to generate more money. That’s right; a reliable side gig like driving uber after work can easily let you earn around $18/hr in the U.S. according to Salary.com.

This extra money can let you earn thousands of dollars extra per month, all of which can potentially go straight into your savings account. Saving $5,000 in 3 months suddenly feels a lot more feasible, doesn’t it?

Here are some of my favorite side hustles if you’re looking for something to pursue in your free time.

Freelancing

Freelancing has skyrocketed in popularity in recent years and for obvious reasons. The ability to choose your workload and decide your own income sounds enticing to all.

In fact, around 60 million Americans turned to the freelancing route the previous year. And this number is only predicted to rise in the coming years.

Here are a few ideas to draw inspiration from.

- If you’re a wordsmith with grips over grammar and fantastic research skills, freelance content writing can be your go-to side hustle. You can earn as much as $40 per hour by selling what you’re good at.

- Whether you have a knack for playing an instrument or know a certain subject, someone out there needs your coaching. Become a tutor and charge as much as $50 per hour.

- The graphic designing industry has seen tremendous growth in the past few years, according to a report published by IBISWorld. This means accelerating demand for skilled designers and high-paying opportunities. And you do not necessarily need to be an expert to break into the field, either. With tools like Canva at your fingertips, anyone can get started dipping their toes into the world of graphic design.

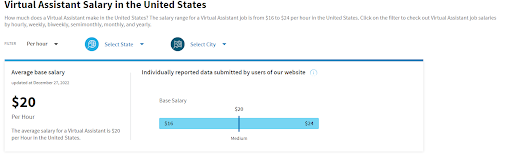

Becoming a virtual assistant is yet another lucrative side hustle that can let you earn around $20 per hour from the comfort of your home. It’s a roller coaster ride and hardly gets monotonous. One day you might find yourself editing a blog post, and the next day scheduling trips for a client, sounds exciting doesn’t it?

Driving

Another way to generate more money that goes directly into your savings account is to start driving for Lyft, Uber, or any other rideshare service.

A functional car, a clean driving record, and a smartphone are all you need to get started. The driving services give you flexible hours to make extra money any hour of the day and night.

Negotiate a Raise

Go this route if your job keeps you busy to the point that you can’t take up a side hustle.

Remember, while it’s completely natural to feel anxious when asking for a raise, it shouldn’t keep you from requesting what you deserve as a diligent employee. Here are a few tips to keep in mind.

- Conduct thorough research on average salary statistics for your role. For instance, data highlights the average annual salary of Marketing Managers is $153,440. If you’re a marketing manager, are you being paid a similar figure? If not, back your raise request with the latest data to sound reasonable.

- Talk about your past accomplishments and how they contributed to the company’s growth. Just make sure you maintain a polite and professional tone.

- Psychologically speaking, the more confident you appear when asking for a raise, the higher the chance of getting one. After all, research has repeatedly highlighted the correlation between confidence and success.

Top Tip: Looking for a complete guide with actionable steps on how to ask for a raise or negotiate your salary? Consider reading my post about the topic here.

Sell Stuff You Don’t Need Online

Let’s face it, everyone owns stuff that they don’t use. How about wrapping those items in fancy packaging and selling them on platforms like eBay, Etsy, or Poshmark?

The items you no longer use can benefit others, and they’d be willing to pay the price for second-hand products. Although clothing is usually the most popular option, some other items to sell include the following:

- Kitchen items

- Books

- Furniture

- Gardening equipment

- Used but fully functional electronics

Save Money on Groceries

According to the Bureau of Labor Statistics, Americans spend around $5,259 on food/groceries annually.

A little smart work, however, can help bring this number down by a significant amount if you’re serious about saving cash.

To cut unnecessary spending on food and meet your savings goals, consider:

- Shopping at a discount grocery store that offers prices lower than traditional stores without compromising product quality.

- The unprecedented post-pandemic times and the looming threat of a recession have encouraged more consumers to purchase bulk items. Be a part of the crowd and reduce your grocery bill by buying bulk items when products go on sale.

- Don’t forget to use coupons to reduce costs on your regular purchases.

- If you’re in service or a retired veteran, consider shopping at these stores that offer exclusive discounts for military personnel and their families.

Remember, I’m not saying to completely stop buying groceries. The key is not to restrict buying items but to pick low-priced alternatives and keep an eye on sales!

Turn to a Financial Coach

The importance of mentorship in life is undeniable. If you struggle to save extra money, a little help might be all that you need to kickstart your savings.

That’s where having a financial coach can come in real handy – they let you sort out what’s standing in the way of achieving your savings goal.

They can help you sit with:

- Your bank account statement

- Other financial accounts to iron out the gray areas of your spending habits

- Find realistic ways to save more money.

I know not everyone’s good with money, and that’s why having someone there to guide you to make the right financial decisions and cultivate better money habits can be so useful.

Top Tip: An experienced financial coach may share actionable tips you never thought possible and may help you save more than you’ve ever been able to. They practically pay for themselves and then some within the first few months!

Automate Your Savings

Another killer hack to save $5,000 in 3 months is to pay yourself first. The phrase is pretty popular in the personal finance literature, and investors swear by it. The concept entails putting your money in savings before spending it on your needs.

For instance, if you receive a paycheck of $2,500 and seek to save $700 from each, consider transferring $700 to your savings account soon after receiving your wage.

Though it can be challenging, it is an excellent way to gain greater financial freedom. Here are two reliable methods to go about it.

- Use direct deposit to split your paycheck. This means a portion of your money directly goes into your savings.

- Use a recurring automated transfer to send your funds in savings near payday.

Use the Envelope Method

It’s no secret that many people struggle with controlling their impulse purchases. If you’re in the same boat, here’s an easy trick that can help put an end to this bad practice.

Dave Ramsey, a popular financial advisor, introduced the envelope technique as an easy method for people to track how much cash they have in reserve for each budget category.

As the name implies, this method involves using envelopes to categorize your monthly expenses and save extra cash. You can put money inside and label each envelope for different categories.

The caveat is that once the money for a specific category is used up, you cannot use money from a different envelope.

This simple yet effective method can help you visually see and track how much money is left in each category, which can help you make more informed decisions about your spending.

So for example, say you take home $4,500 monthly. Your envelope categories will look something like:

- Rent: $1,400

- Utility bills: $200

- Grocery budget: $350

- Debt: $400

- Car insurance: $200

- Spending money: $250

- Savings: $1,700

Set Up a Separate Savings Account

Avoid mingling your regular bank accounts with your savings. In the worst-case scenario, you may end up spending your savings.

Luckily, you can easily automate monthly transfers to a separate account for saving money. This way, a chunk of your earnings directly goes into savings without you ‘accidentally’ spending it on online shopping before realizing it.

Top Tip: Here’s how to create an automatic savings plan to help you get on top of your finances.

Monthly Planning to Save $5,000 In 3 Months

To start saving $5,000 in 3 months, you’d practically need to save around $1,700 monthly to hit your 3-month savings goal.

Generally, for most people, a monthly goal is an excellent place to start when setting significant financial goals. That’s mainly because a month is a natural timeline for most.

Saving $1,700 every month will give you $5,100 after 3 months. Alternatively, you can make it $1,667, to be more precise.

However, it’s always good to transfer a bit of extra cash, especially because cutting a few dollars here from your monthly expenses won’t hurt that much but will end up adding an extra few hundred dollars every year toward your goal.

Bi-Weekly Planning to Save $5,000 In 3 Months

Considering the 12 weeks in a 3-month timeline, I get 6 bi-weeks. If you prefer saving bi-weekly, you would need to separate $835 every 2 weeks from your earnings.

If you’re paid to work a job that pays you bi-weekly, even better. This will let you compare your bi-weekly money-saving goals with your wage.

It also helps you determine how much more you must earn per paycheck or cut from your grocery bill and other expenses.

Weekly Planning to Save $5,000 In 3 Months

Conversely, you can also do a weekly savings schedule to help reach your $5,000 in 3 months. This means putting approximately $420 into your savings every 7 days.

The biggest perk of weekly savings is that it allows you to see progress more frequently and make adjustments to your spending and saving habits as needed.

It also helps to break down the larger goal of saving $5,000 into smaller, more manageable chunks.

However, because it’s such a short timeline, some people usually find it more difficult to stick to their weekly plan if unexpected expenses arise.

Wrapping Up

- Just like saving money in 6 months, saving $5,000 in 3 months may sound daunting, but it is achievable with the right mindset, strategy, and budgeting.

- Keeping track of your spending and seeking ways to minimize expenses is crucial in saving money.

- Creating a budget and sticking to it can help you have a better control over your money flow.

- Boosting your income through side hustles or freelancing is a great way to increase your savings.

- Setting mini objectives and tracking your progress can help you stay motivated and reach your final goal.

Saving money can be a challenging task, especially when statistics show that 21% of Americans aren’t saving any money at all. However, with the right mindset, strategy, and budgeting, saving $5,000 in 3 months is a realistic and achievable goal.

Saving money is not only about cutting expenses – but also about finding ways to increase your income. By creating new income channels, you can increase your earning potential and make saving $5,000 in 3 months a lot more feasible.

Reaching mini milestones and tracking your progress can also help you stay motivated and reach your final goal. With this guide and the provided chart, you have the tools to reach your savings goals and build a stronger financial future for yourself and your family.

Remember – you can do what you put your mind to, and saving money is no exception. So, let’s start saving today to achieve everyone’s future financial goals.

Best of luck!

Next: Read my in-depth guide on Is $40k salary good?